Key Insights:

- SOL has broken below its $140 support, confirming a bearish breakdown in Solana price prediction.

- Analysts highlight the $105–$115 range as a key demand zone where prior accumulation and support were observed.

- A rebound from $105 could trigger a bullish continuation, with $160 and $260 serving as intermediate resistance levels for Solana price prediction.

Solana price prediction has been the center of attraction as the market responded to consecutive bearish technical patterns. Additionally, Solana price extended decline in June attracted the attention of multiple analysts regarding critical support zones and a possible reversal setup.

Breakdown Below $140 Sparks Bearish Solana Price Prediction

According to analyst CryptosBatman’s Solana price prediction, the altcoin had recently fallen under a major horizontal support line of $140. A series of red candles in June accompanied this breakdown, indicating a strong selling momentum.

In addition, the analyst indicated that Solana price prediction was on the verge of testing a former demand region at around $105. This level provided support in March 2025, and it could potentially act to be a reactionary point to buyers.

More so, a projected V-shaped recovery path is illustrated in the chart. The path begins with a dip to $105 followed by a sharp reversal reclaiming the $140 level and targeting $160.

Further, the analyst outlined a potential bear trap scenario. If SOL price prediction surges past $160, a broader bullish structure could form, setting $260 to $295.83 as medium-term resistance levels.

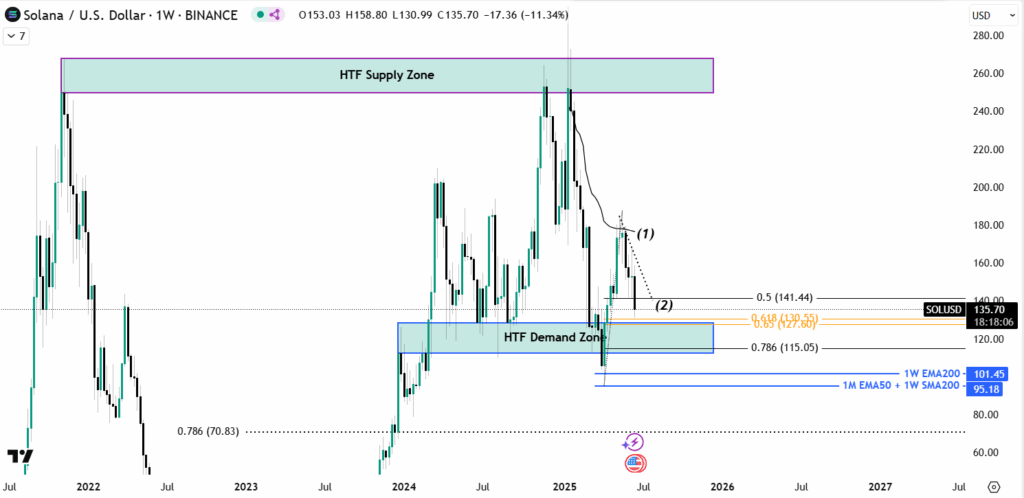

Solana Price Prediction Eyes HTF Demand Zone Between $115–$130

Furthermore, analyst CryptelligenceX showed that Solana price retraced from the anchored VWAP drawn from the all-time high (ATH). The rejection occurred near the $158–$160 resistance band, triggering a notable -11.34% candle close down to $135.70.

Meanwhile, the analyst has marked the high time frame (HTF) demand zone between the levels of $115 and $130. This base has been an accumulation range, and there are multiple confluences aligned.

Besides, multiple Fibonacci retracement levels cluster within this zone. The 0.618 level is at $130.55, while 0.65 lay slightly lower at $127.60, both residing inside the HTF demand region.

Additional downside support included the 0.786 level at $115.05. While, longer-term moving averages add to the structure: the 1W EMA200 at $101.45 and the 1M EMA50/1W SMA200 convergence at $95.18.

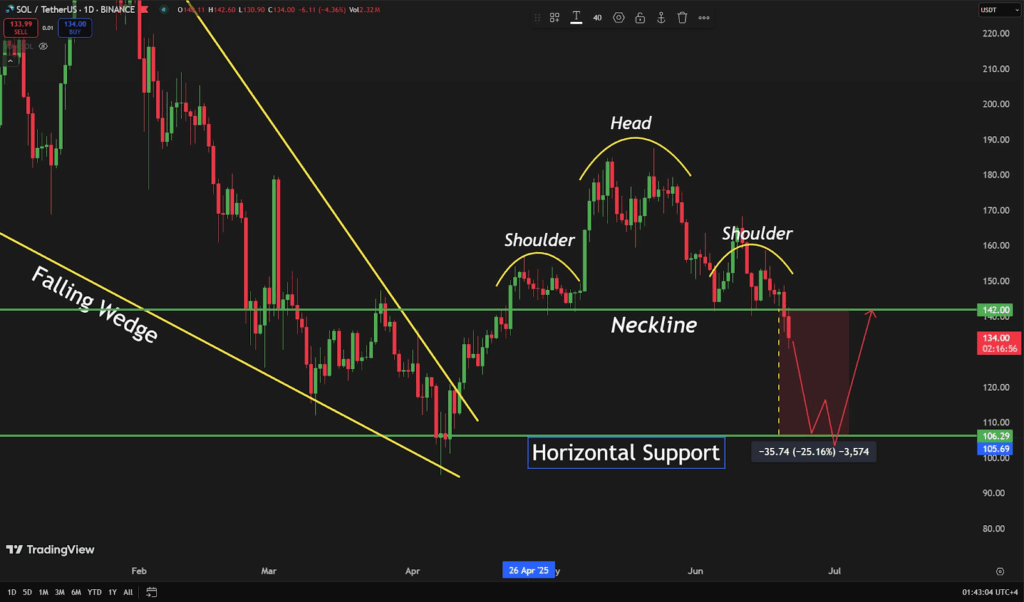

SOL Price Head and Shoulders Breakdown

Also, analyst TheMoonCarl outlined a clear Head and Shoulders Solana price prediction formation. The left shoulder formed near $160, while the head peaked above $190, and the right shoulder reached around $165.

On the other hand, the neckline is drawn at approximately $142. A decisive break and candle close below this level confirmed the bearish structure for Solana price prediction.

Post-breakdown, Solana price quickly declined to $134. The analyst projected a 25.16% downside move from the neckline to a bearish target near $106.30.

Conseque, a previously observed falling wedge breakout that led to the head has since lost momentum. Current Solana price prediction suggested weakening bullish follow-through, with focus now on the $106 area as a support test.

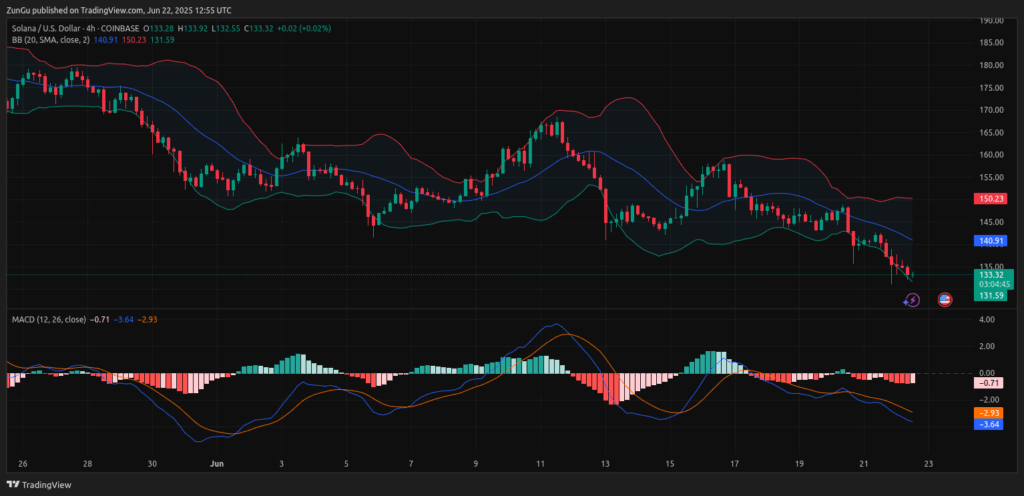

Bearish Indicators Confirm Short-Term Downtrend in Solana Price Prediction

Subsequently, on Solana price prediction, the asset has trended below the medium Bollinger Bands line. SOL price of $133.32 showed multiple rejections on the 20-period simple moving average (SMA), which is an indication of active downward pressure.

Additionally, the lower Bollinger Band that is in the vicinity of $131.59 has served as dynamic support. Comparatively, the high band of $150.23 was not put to the test, which indicated the absence of recent bullish pressure.

The MACD (12, 26) indicated ongoing bearish momentum. The MACD line is at -3.64, beneath the signal line at -2.93, with histogram bars still negative.

Although the bars in the histogram are becoming small, there is no established crossover or divergence. This continued to favour the sellers in the short run. Solana price prediction is tilted downside unless a renewed recovery is established beyond the mark of $140.