Key Insights:

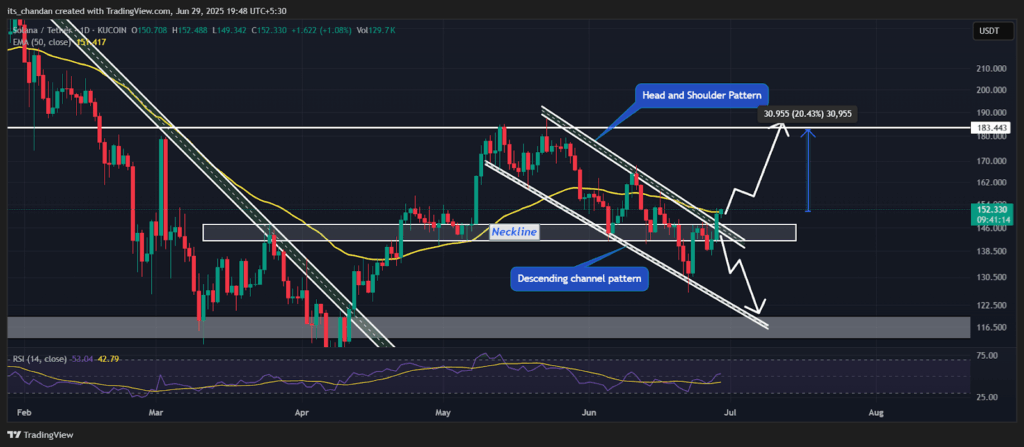

- Solana (SOL) has broken out of two major bearish patterns, a head and shoulders and a descending channel, hinting trend reversal.

- If SOL holds above $150, a 20% rally toward $182 is possible.

The latest Solana news is that SOL, the native token, has finally broken out of two distinct bearish patterns and now appears to be shifting from a bearish trend to a bullish one.

According to the daily chart, since April 2025, SOL has formed bearish patterns such as a head and shoulders and a descending channel.

Latest Solana News: SOL Ends Its Bearish Trend

With a 5% upside move, SOL has broken out of its prolonged descending channel pattern and completed its head and shoulders pattern.

Current Price Momentum

As a result, the asset is now trading near $149 and has been garnering significant attention from traders and investors. Data from CoinMarketCap reveals that during this period, the asset recorded a 10% increase in trading volume compared to the previous day.

This jump in trading volume, along with the rise in asset price, suggests that the upside momentum is strong and may be sustained for a longer period.

Solana Price Action and Key Technical Levels

According to expert technical analysis, Solana (SOL) appears bullish and is poised for significant upside momentum, having broken out of the descending channel pattern.

As per the daily chart, the SOL price has been hovering within this channel since the beginning of May 2025. This breakout stands out as a major development for token holders, as it has now opened the path for a substantial upside rally.

Solana Price Prediction

Based on recent price action and historical momentum, the SOL price has successfully closed a daily candle above the channel pattern. If the price continues to hold above the $150 level, there is a strong possibility that it could soar by 20%, potentially reaching the $182 level in the coming days.

On the other hand, if the ongoing sentiment shifts and the price begins to fall, there is a strong possibility that $148 will act as a strong support level for the asset, and the price may continue to consolidate near this level.

With this breakout, the SOL price has now moved above the 50-day Exponential Moving Average (EMA) on the daily timeframe, indicating that the asset is in an uptrend and may continue this rally in the coming days.

Meanwhile, the SOL Relative Strength Index (RSI) has soared to 52, indicating a shift toward bullish momentum and suggesting that buying pressure is gradually increasing.

Experts and Analyst Bullish View

Given the current market sentiment, experts and analysts have been making bold predictions. On X (formerly Twitter), several optimistic posts have surfaced, with some suggesting that SOL could reach $388, while others have shared a positive outlook regarding a potential Solana ETF.

On June 29, 2025, a crypto expert shared a post on X, noting, “SOL looks ready to start its climb to $388.” He further added, “Noting you can do to stop it.” This post on X gained massive attention from the crypto enthusiasts and spread like wildfire.

Another major Solana news update revolves around its potential ETF approval. In a recent post on X, a crypto user shared,

“SOL has been in an uptrend for almost two years. It also hit a new all-time high (ATH) in 2025 and now looks set for another rally. There’s almost a certainty of Solana staking ETF approval in July, and this will definitely unlock a lot of institutional capital for Solana. I’m not expecting a new ATH, but rather a 20%–25% pump from the current level.”

The latest Solana news related to the ETF has been further supported by a crypto investor and OKX (a crypto exchange) partner. In a recent post, he made a bold prediction, stating, “SOL ETF approval is coming in a few weeks, and the chart looks like this. It’s time to send Solana higher.”