Key Insights

- Bitcoin’s scarcity and other factors make it a superior store of value compared to Litecoin.

- Litecoin offers faster transactions, but Bitcoin’s Lightning Network closes that gap.

- Data on security, liquidity and performance shows that Bitcoin remains dominant over the long term.

Bitcoin and Litecoin often get compared as “digital gold” versus “digital silver.”

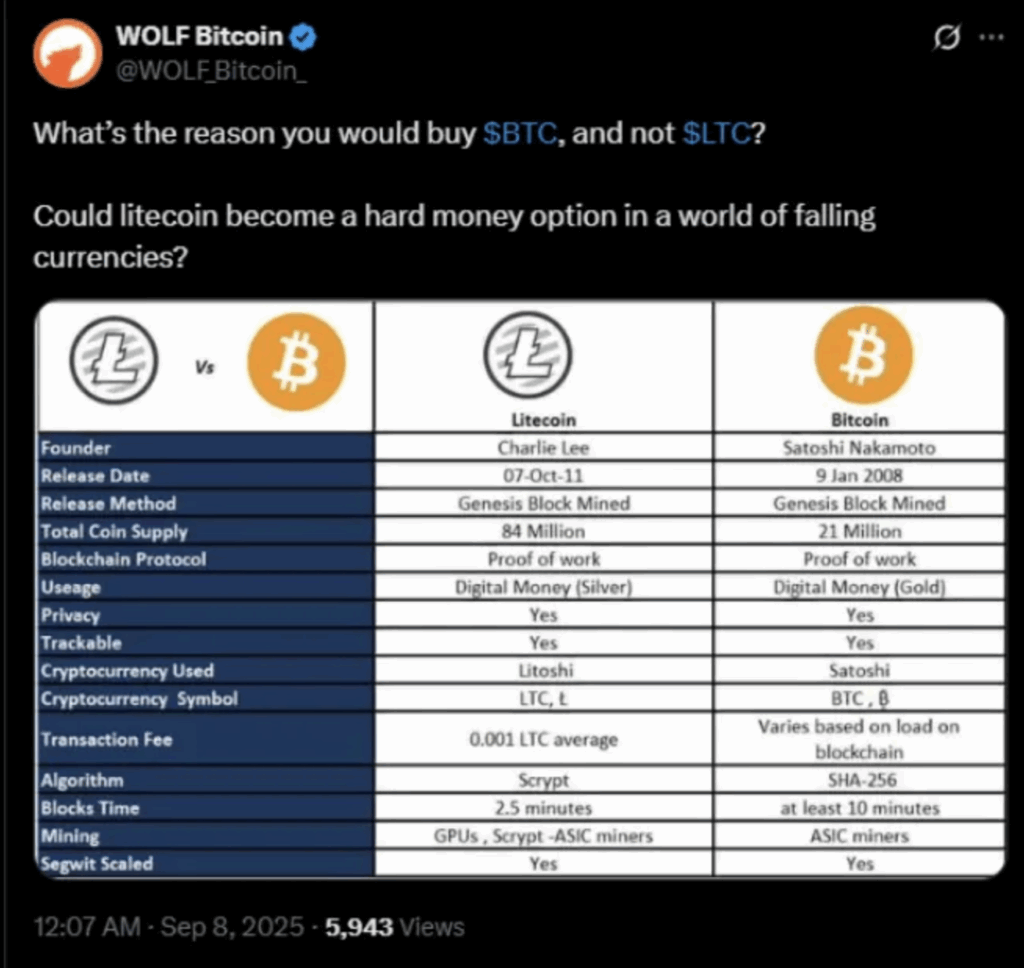

While Bitcoin launched in 2009 as the first decentralised form of money, Litecoin came two years later as a lighter version of the original (hence the name, “Litecoin”).

It was created by Charlie Lee and was meant to be faster and easier to mine.

Both share the Proof-of-Work foundation. However, over time, data has shown that Bitcoin holds a stronger position. Why exactly is Bitcoin more (or less) worth your attention than Litecoin?.

Technical Differences in Bitcoin vs Litecoin

Litecoin is a fork of Bitcoin’s source code. It is adjusted with changes to speed and supply, and these differences shaped how each currency functions today.

Faster Block Times

Litecoin processes blocks every 2.5 minutes compared to Bitcoin’s 10. This means that Litecoin has much quicker confirmations and higher throughput. It can handle about 56 transactions per second, while Bitcoin tends to manage around 3 – 7, depending on network congestion.

However, Bitcoin’s Lightning Network now allows relatively instant payments that have closed the gap with Litecoin, even in terms of cheapness.

Supply and Scarcity

Bitcoin has a fixed supply of 21 million coins, compared to Litecoin’s cap at 84 million. This fourfold increase makes Litecoin less scarce. Expectedly, this affects its value perception because Bitcoin’s tight supply is a major part of why it is considered digital gold.

Mining Algorithms

Bitcoin relies on SHA-256-based cryptography. What this means is that it demands expensive ASIC hardware to run. Comparatively, Litecoin uses Scrypt.

Scrypt, for context, was created for ordinary computers.

Data Shows Why Bitcoin Leads

Litecoin may look sharper and more efficient on paper. However, data on security, performance and adoption tells a different story.

Network Security and Hash Rate

Security in Proof-of-Work blockchains depends on hashrate. Bitcoin’s network runs at hundreds of exahashes per second, compared to Litecoin’s petahashes. This massive gap makes Bitcoin far more resistant to 51% attacks.

Market Dominance and Liquidity

Bitcoin’s market cap is more than $1.2 trillion. Litecoin’s price is only in the single-digit billions. Bitcoin also boasts trading volumes more than 100 times higher.

This unmatched liquidity allows investors to move large sums without affecting price. In other words, Bitcoin’s role as a store of value is stronger because of this.

The LTC/BTC Ratio Decline

The LTC/BTC ratio is one of the best ways to check Litecoin’s long-term performance against Bitcoin. This ratio has trended downwards over the last few years, which means that Bitcoin has been winning for years.

Litecoin tends to surge during altcoin speculation. However, the general trend shows strong investor preference for Bitcoin.

Adoption and Network Effects Strengthen Bitcoin

Network effects are another important area to look at.

First-Mover Advantage

Bitcoin was the first cryptocurrency and continues to be the most popular. Its transparent monetary policy and capped supply attract individuals, institutions, governments and even criminals.

Institutional Adoption

Bitcoin is now a major part of corporate treasuries and institutional products like ETFs. Major financial firms and investors even treat it as a macro asset and hedge against inflation. Litecoin, on the other hand, sees limited use among merchants and lacks the kind of large-scale institutional backing that Bitcoin possesses.

Network Effect Impact

The more adoption a blockchain has, the stronger the network. Bitcoin has expanded over the years and now has unbeatable liquidity that even Ethereum struggles to match. These factors give it a resilience that Litecoin cannot match.

Judging by history, these effects tend to compound over time (which means that it is almost guaranteed that Bitcoin stays on top).

Digital Gold Retains its Crown

Litecoin’s faster transactions once looked like a major advantage. However, with Bitcoin’s Lightning Network, that edge has faded. The real contest is not about speed but about store of value.

Bitcoin wins on every critical front, including scarcity, security, liquidity and adoption. The declining LTC/BTC ratio even shows this reality, that investors continue to move toward Bitcoin.

Litecoin may remain useful for smaller payments, but Bitcoin has already secured its role as digital gold.