During the previous year, worries among stock investors centered on the apprehension that technology companies with a disruptive impact would not perform as well, given the context of higher interest rates and a weaker macroeconomic environment.

Nevertheless, this uncertainty presented a unique opportunity for investors to enter various segments of the innovative tech ecosystem, especially in software and semiconductors.

In 2023, there was a surge in excitement surrounding generative artificial intelligence (AI), which dominated U.S. equity-market sentiment and wealth creation.

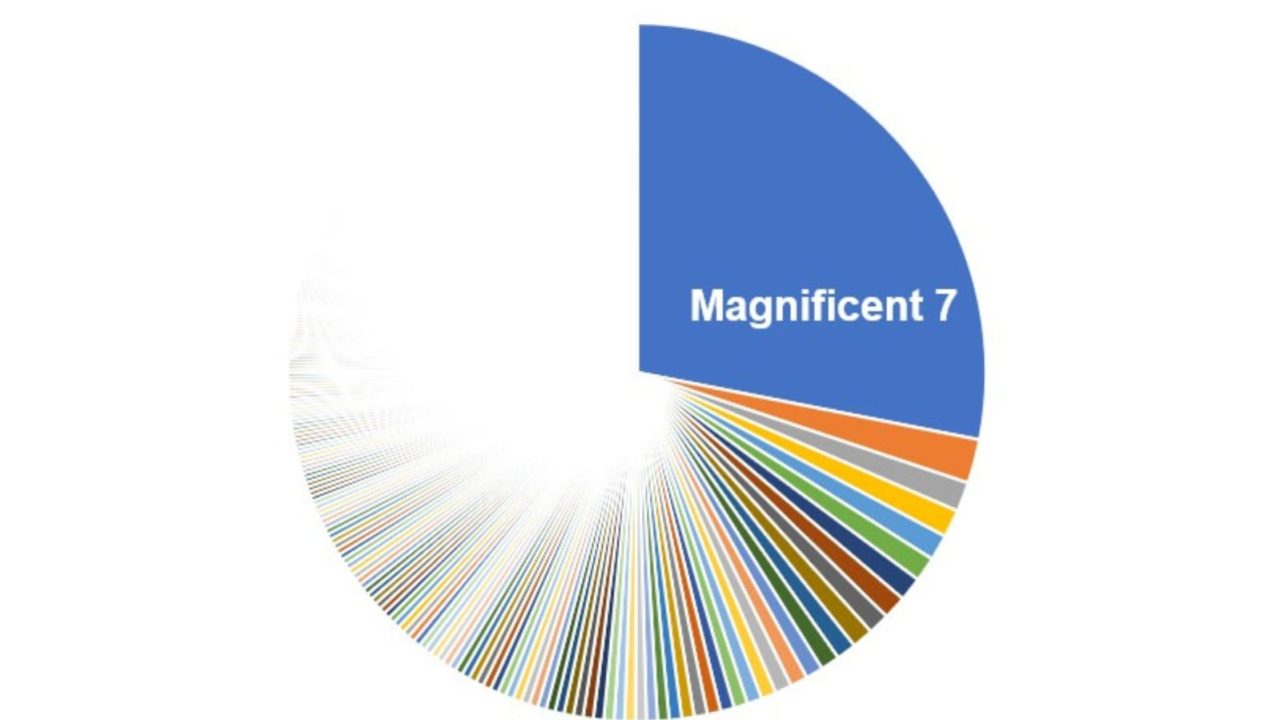

The standout performers referred to as the “Magnificent Seven” tech stocks—Apple, Microsoft, Alphabet, Amazon.com, Nvidia, Meta Platforms, and Tesla—experienced significant increases in their share prices, contributing to an impressive 70% of the absolute performance of the Nasdaq Composite Index.

These increases were not only remarkable but also warranted, as the earnings per share for these companies increased by at least 50%.

On the contrary, smaller tech stocks encountered obstacles, as evidenced by the MSCI ACWI Global Small Cap Tech index registering a 5% decrease over the previous two years.

This downturn was linked to a less robust spending environment and the strain on valuations due to increased interest rates.

The growth path of the tech sector fell behind its usual trajectory, with global information technology (IT) expenditure expanding below its historical norms, reaching 2.9% in 2022 and 3.5% in 2023.

The multiples for smaller tech stocks faced additional pressure as the 10-year U.S. Treasury bond rate surged from 1.6% at the start of 2022 to 3.9% by the conclusion of 2023.

However, as 2024 progresses, the growth rate for global IT spending is projected to more than double.

With the Federal Reserve nearing the conclusion of its cycle of interest rate hikes, the strain on multiples is anticipated to alleviate, suggesting a potential change in market leadership.

Amidst this shifting landscape, investors are counseled to expand their attention beyond the Magnificent Seven.

Especially appealing valuations are discernible in the software sector, where the variance between the swiftest- and slowest-growing companies remains minimal.

This offers superb opportunities for investors to delve into the most transformative segments of the market at favorable prices.

Pipelines are emerging across various industries and applications, spanning next-generation data storage, cybersecurity, and software development tools.

Driven by a strengthening spending environment and a more favorable rate backdrop, the beneficiaries of AI are expected to extend beyond the Magnificent Seven.

Innovation is advancing swiftly, with companies unveiling new solutions, products, and applications poised to propel growth.

Goldman Sachs Asset Management highlights various investment opportunities for companies positioned to partake in a shift in tech leadership.

Stocks such as AMD, Micron Technology, MercadoLibre, and HubSpot are singled out as potential beneficiaries of these growth trends in 2024.

Considering the industry’s escalating disruption and the potential for wealth creation opportunities, investors must contemplate dedicated allocations to tech.