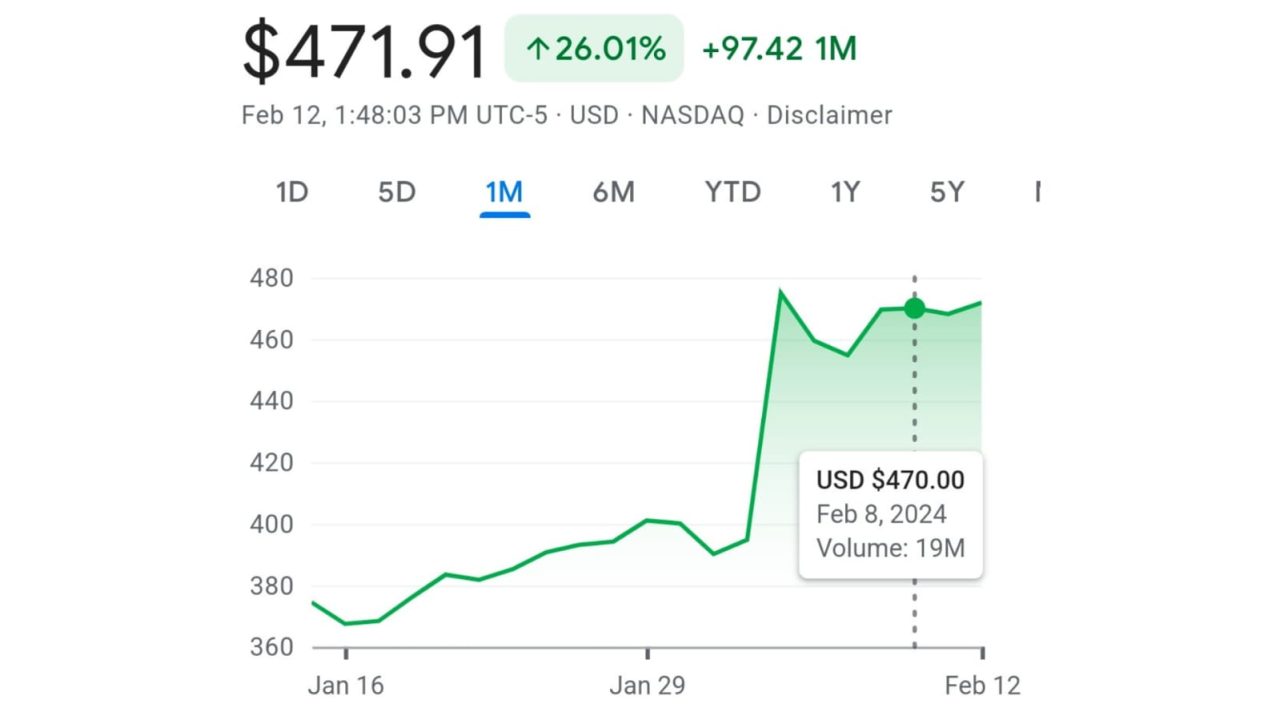

The stock of Facebook’s parent company, Meta, soared 26% on Thursday, marking its best daily gain in nearly a decade.

The stock’s performance was surpassed only once before. Back in July 2013, it took just one day for Meta’s shares to surge 30%.

According to Dow Jones Market Data, Thursday saw the stock add $100 billion, its largest one-day gain ever. Consequently, it re-entered the top 10 largest U.S. companies by market capitalization.

In the previous year, Meta experienced significant setbacks. It lost approximately $600 billion in market value due to intensified competition from TikTok and a downturn in digital advertising.

Meta’s fiscal fourth quarter didn’t fare well. Compared to the previous year, the company saw a 55% decrease in net profit. Nevertheless, the upcoming year holds more significance for investors.

On Wednesday, Meta highlighted early signs of improvement. The company anticipates that first-quarter revenue in 2023 will surpass sales from the same period in 2021 before Apple’s privacy measures were implemented, which impacted revenue.

Moreover, Meta announced plans to buy back an additional $40 billion in shares.

A broader rally in tech stocks, fueled by the Fed, may also be contributing to Meta’s surge. Amazon and Alphabet also saw their shares rise on Thursday.

Evercore ISI analyst Mark Mahaney raised questions about Meta’s substantial after-market gain. However, he ultimately concluded that Meta deserved it.

Citing “materially reduced expense projections” and a larger-than-anticipated share buyback, he raised his price target to $275 and reiterated his outperform rating.

Rosenblatt’s Barton Crockett upgraded the stock’s rating from hold to buy, establishing a $220 price target and stating that the valuation had become “enticing.”

Meanwhile, Guggenheim’s Michael Morris increased the price target to $210 while maintaining a buy rating.

Despite the dismissal of numerous Meta employees, Zuckerberg’s remarks garnered positive feedback from analysts.

A statement released on Wednesday revealed that the company’s management’s focus for 2023 is the ‘Year of Efficiency,’ emphasizing Meta’s dedication to evolving into a more resilient and agile organization.

Amid substantial investments in Meta’s Reality Labs vertical, 38-year-old Zuckerberg has spearheaded the company’s transition toward virtual reality.

However, this strategic shift has faced criticism from analysts and activist investors, such as Altimeter Capital’s Brad Gerstner, who view it as a diversion from the company’s core advertising business.