Alibaba Group Holding Ltd. is significantly enhancing its stock-buyback initiative, indicating confidence in the business by infusing billions of additional dollars into the program.

The Chinese e-commerce giant announced on Wednesday its determination to augment the buyback program by $25 billion, leading to an expanded authorization of over $35 billion throughout the next three fiscal years.

In recent months, Alibaba has shown a stronger commitment to capital returns. Approximately three months ago, the company’s board greenlit an annual cash dividend of $1 per American depositary share.

This action mirrors the company’s dedication to delivering returns to shareholders and upholding financial stability.

Alibaba’s announcement of its reinforced buyback program coincided with the release of the company’s fiscal third-quarter results, which unveiled a slight deviation from the expected bottom-line figures.

During the quarter, Alibaba reported net income of 10.7 billion renminbi ($1.5 billion), translating to 5.65 renminbi per American depositary share.

This represented a decrease from the year-ago period when net income stood at 46.8 billion renminbi or 17.91 renminbi per ADS.

On an adjusted basis, Alibaba earned 18.97 renminbi per share, down from 19.26 renminbi per share in the prior year, slightly missing analysts’ projections of 19.12 renminbi.

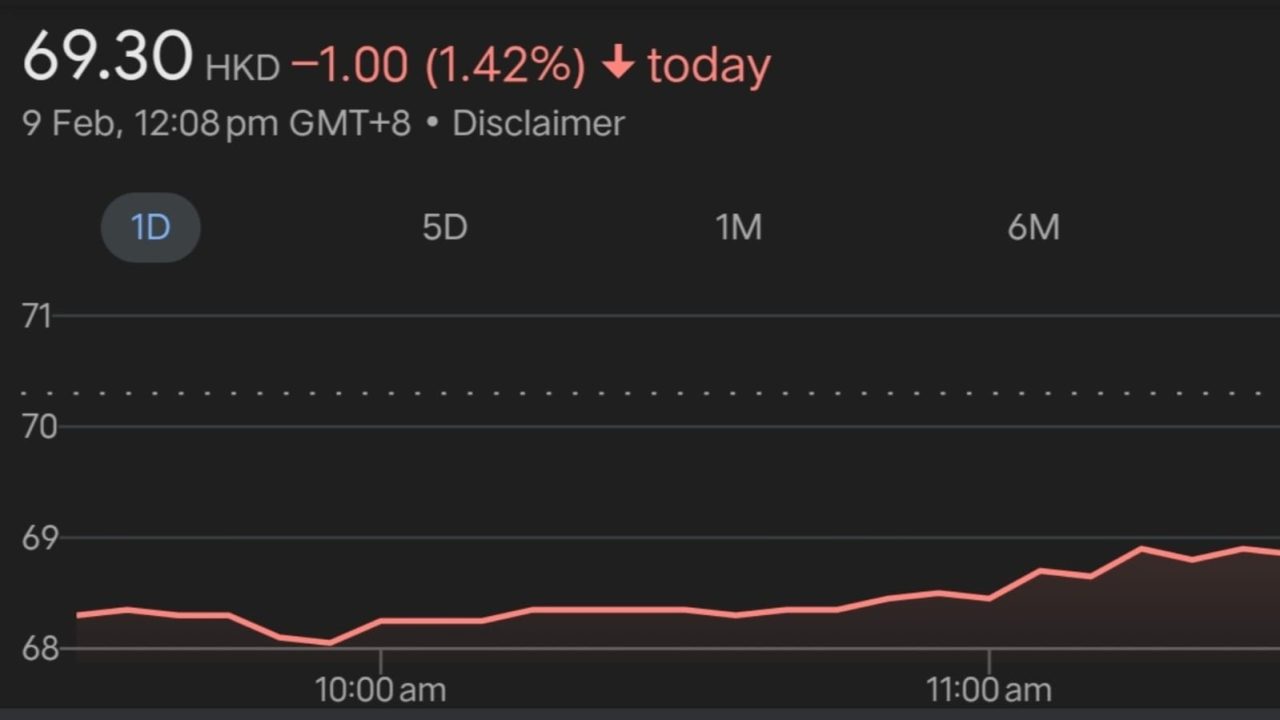

Despite the December quarter revenue reaching 260.3 billion renminbi, up from the previous year’s 247.8 billion renminbi, Alibaba’s stock dipped 3% in premarket trading on Wednesday.

Regarding segment performance, cloud revenue saw a 3% year-over-year increase, while revenue from the Taobao and Tmall e-commerce platforms rose by 2%.

Alibaba emphasized robust growth in order volume and the number of transacting buyers, although it noted a decline in average order value.

Within the cloud division, Alibaba stressed its ongoing initiatives to elevate revenue quality by minimizing income from low-margin project-based contracts.

Concurrently, the company noted impressive growth in revenue from public cloud products and services, which bolstered profits for the unit.

Alibaba’s choice to strengthen its stock-buyback program comes amid navigating the dynamic e-commerce and cloud industries.

The added investment in the buyback program serves as a strategic step to inspire investor confidence and underscores Alibaba’s positive outlook for the future.

Despite the slight bottom-line miss and the subsequent stock value decline, Alibaba’s steadfast dedication to shareholder value, showcased through dividend approvals and buyback enhancements, sets the stage for enduring long-term growth.

The evolution of revenue streams within specific segments, like cloud services, underscores Alibaba’s adaptability and strategic emphasis on maximizing profitability.

Investors are expected to closely track the progression of these strategic initiatives and their role in Alibaba’s sustained success in the global marketplace.