Key Insights:

- SUI price surges over 20%, breaking out of its descending channel near $3.75.

- Network accounts rise to 180M, with a 38.56% increase in just 30 days.

- Short liquidation levels cluster around $3.95, adding pressure for another upward move.

SUI has soared more than 20% to trade close to $3.91 after breaking out of its downtrend, while account activity on the network has shot past 180 million.

Meanwhile, liquidation data reveals increasing short pressure around current levels to back the momentum building toward a $5 target.

SUI Breaks Channel With 20% Move and Eyes $5

SUI has broken out sharply from its falling channel, up over 20% and trading around $3.91 at the time of writing. The 4-hour chart shows a clear breakout above the upper trendline of the falling channel that has been constraining price action since late April.

This breakout has created a bullish impulse where the next target price is $5. The move followed repeated support tests around $3.25, then rising buying pressure.

If price remains above the breakout level, the measured move projection indicates a rally of approximately 27%, consistent with the $5 psychological level.

The price structure now has early indications of a bullish reversal. However, follow-through volume and holding above key short-term levels will be crucial for momentum to continue.

User Growth Accelerates With 180M Active Accounts

On-chain data reveals a significant increase in user growth across the SUI network. As at May 8, the number of accounts totalled 180,360,507.

In the last 30 days, SUI has added over 50 million accounts, a 38.56% increase, as reported by Torero_Romero.

This drastic rise signifies wider usage of the network and more usage. SUI accounts are only counted once a transaction is complete, so the numbers are active wallets, not idle sign-ups.

The steady increase of active accounts indicates that more people are using applications based on the SUI blockchain.

Network activity and price movement are commonly associated with account growth. Greater numbers of users can translate into greater transaction volumes and liquidity, which tends to be good for asset value. This is consistent with the recent price breakout and may provide more support to the current rally.

TVL Shows Renewed Growth Across SUI Ecosystem

Furthermore, SUI’s TVL has also been increasing again after a recent dip. The most recent data from DeFiLlama indicates that TVL is again over $1.8 Billion, after briefly dipping below $1.5 Billion in early April. This rise contributes to the bullish view of the SUI ecosystem.

TVL indicates how much capital is being locked in smart contracts in the network. Greater TVL often implies more lending, trading or staking activities.

The gradual recovery of SUI from its March dip indicates increasing confidence among users and builders. It also indicates that funds are coming back to the network after short-term exits.

TVL has doubled in the last year, and the recent spike has coincided with the spike in wallet activity and price movement.

These trends combined point to increasing demand from traders and DeFi users who are creating long-term positions.

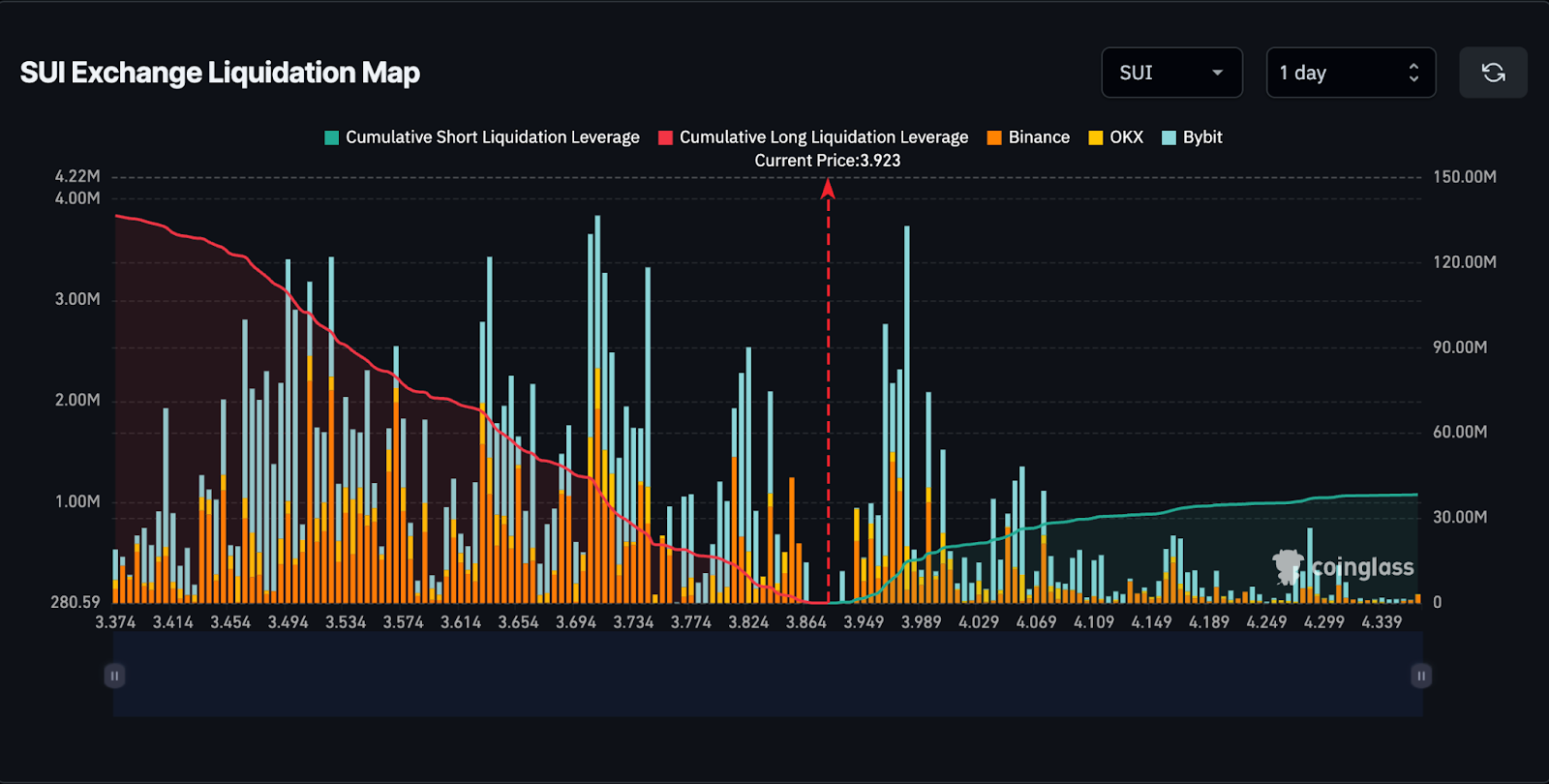

Liquidation Map Points to Short Squeeze Risk

On the other side, the SUI Exchange Liquidation Map data shows a cluster of short liquidations in the $3.95–$3.99 range. At the time of reporting, the price was in a high-risk area for shorts. If the price continues to rise, it could cause forced buybacks as short positions are closed.

The map displays liquidation leverage at major exchanges including Binance, OKX and Bybit. Blue bars indicate short liquidations, and their volume rises sharply above $3.90. A continuation above $4.00 may prolong liquidations and give additional impetus to another price leg.

At the same time, long liquidations are still low, which indicates a lack of downside pressure from over-leveraged longs.

With the shorts under pressure and new users coming to the network, the setup is in favour of the bullish case. These mechanics can help push SUI closer to the $5 target because liquidation events tend to add buying momentum.