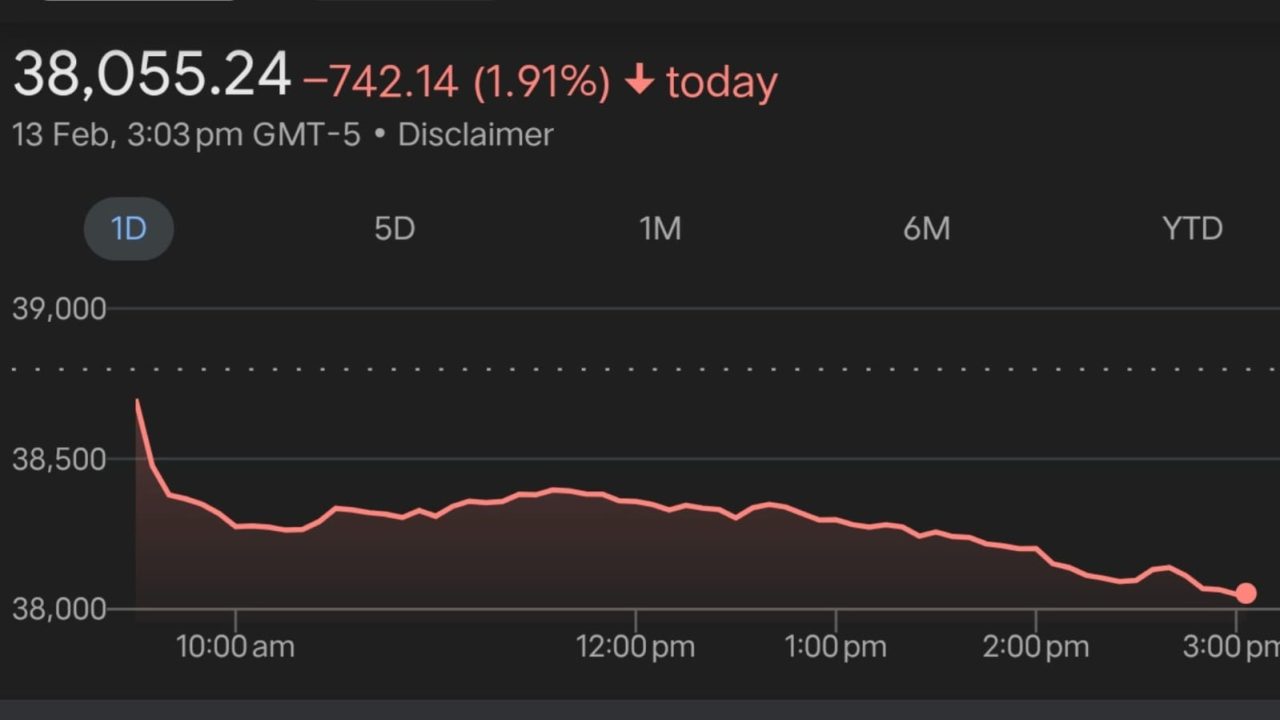

Stocks experienced a decline on Tuesday following inflation data for January that surpassed expectations, causing Treasury yields to surge and casting doubt on the Federal Reserve’s ability to implement multiple rate cuts throughout the year, a crucial component of the bullish scenario for the equity market.

The Dow Jones Industrial Average witnessed a loss of 516 points, equivalent to 1.3%, marking its most significant decline since March 2023, when it dropped by 1.63%.

Simultaneously, the S&P 500 decreased by 1.4%, and the Nasdaq Composite fell by 1.7%.

The consumer price index (CPI) for January rose by 0.3% compared to December. On an annual basis, CPI increased by 3.1%.

Economists surveyed by Dow Jones had anticipated a month-over-month CPI increase of 0.2% in January and a year-over-year rise of 2.9%.

Core prices, excluding volatile food and energy components, increased by 0.4% month over month and 3.9% from a year ago. Predictions had pointed to a 0.3% rise in core CPI for January and a 3.7% increase from the previous year.

“This may well serve as a convenient pretext to temper some of the exuberance from the high-flying market that has enjoyed universal gains thus far this year,” remarked Art Hogan, chief market strategist at B. Riley Financial.

“The CPI figures reported today, slightly hotter than anticipated, serve as tangible evidence that we’re not on a straightforward trajectory, but rather, we’re moving in a direction that leads downward.”

Following the CPI data release, the 2-year Treasury yield surged above 4.6%, while the 10-year yield exceeded 4.27%.

Tech giants such as Microsoft and Amazon, which had propelled the market to record highs amid declining rates, spearheaded the losses in Tuesday’s trading session. Microsoft experienced a decline of 1.4%, and Amazon dropped by 1.4%.

In corporate developments, JetBlue Airways saw a surge of 12% following activist investor Carl Icahn’s disclosure of a nearly 10% stake in the airline.

On the other hand, toymaker Hasbro experienced a 6% decline after falling short of analyst expectations for the fourth quarter. Meanwhile, shares of Avis Budget Group declined by 20% due to disappointing fourth-quarter revenue.