Key Insights:

- Whales offloaded 1.32B DOGE in 48hrs, sparking market shake-up.

- DOGE tests a rising trendline at $0.13 near the key 61.8% Fib level.

- Wyckoff Spring is in play as DOGE mirrors the accumulation structure.

Dogecoin (DOGE) has come under pressure with broader market pullback as President Trump announced fresh U.S. tariffs. In the past week, Dogecoin price has fallen by over 12%.

After reaching a local high of $0.48, the price has corrected by 70% to the current value of $0.1452. Nevertheless, the token prepared for a possible recovery phase even with this correction.

Whale Sell-Off Contributes to DOGE Price Decline

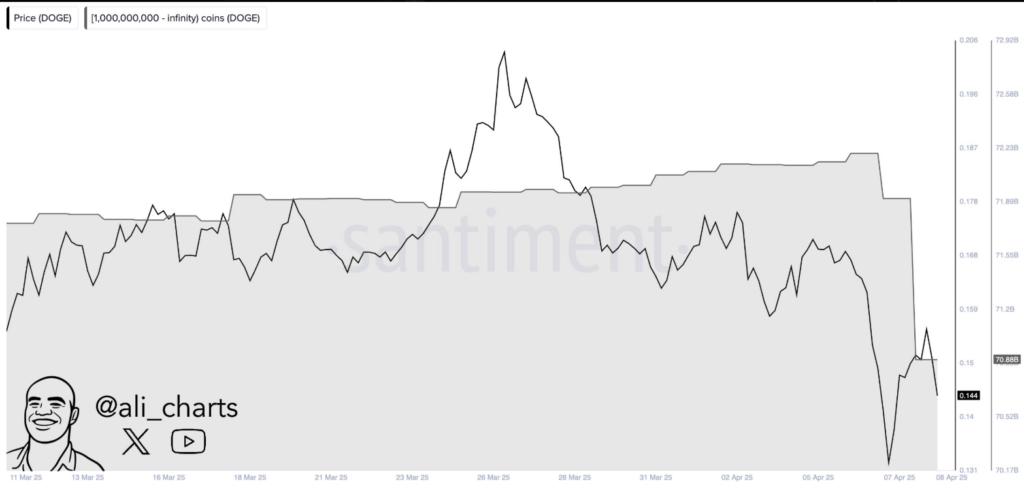

Data from Santiment showed that major DOGE holders, known as whales, have sold over 1.32 billion DOGE in 48 hours. These are those wallets that hold over 1 billion tokens each.

According to the data, their holdings dropped from approximately 72.9 billion DOGE to around 70.88 billion DOGE. This suggested selling pressure.

When this sell-off occurred, DOGE fell from around $0.18 to a low near $0.131. This move implied that these large holders contributed to the downward trend in early April.

When demand from buyers doesn’t match the volume sold, such selling activity can weigh heavily on price. Meanwhile, the overall whale wallet behavior has consistently reduced from late March until the start of April.

The current wallet holdings have returned to levels observed earlier. These are similar to the levels seen before the March rally began.

Key Support Found at Fibonacci and Trendline Confluence

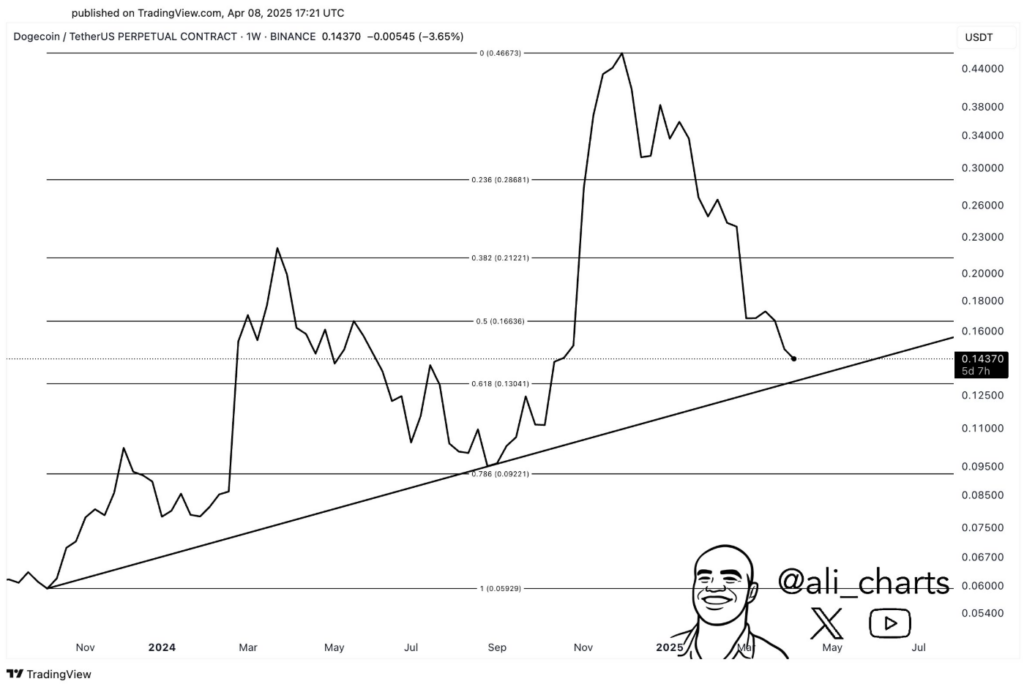

Meanwhile, according to technical analysis, Dogecoin may be close to a strong support zone. Analyst ali_charts showed that since October 2023, DOGE has respected an ascending trendline.

This trendline is near the 61.8% Fibonacci retracement level, which is at $0.13041. The Fibonacci retracement measures how far the price could retrace from a recent move.

The support level on this level, around $0.13, has been a support level in previous corrections. Technical strength is added by the convergence of this level with the long-standing trendline.

At press time, DOGE was trading around $0.1437, just above this critical area. The token was expected to rebound to $0.168 and $0.212 levels.

These levels corresponded to 0.5 and 0.382 Fibonacci levels if it maintained its position. Once recovery began, these levels served as resistance points.

Wyckoff Accumulation Pattern Shows Early Reversal Signs

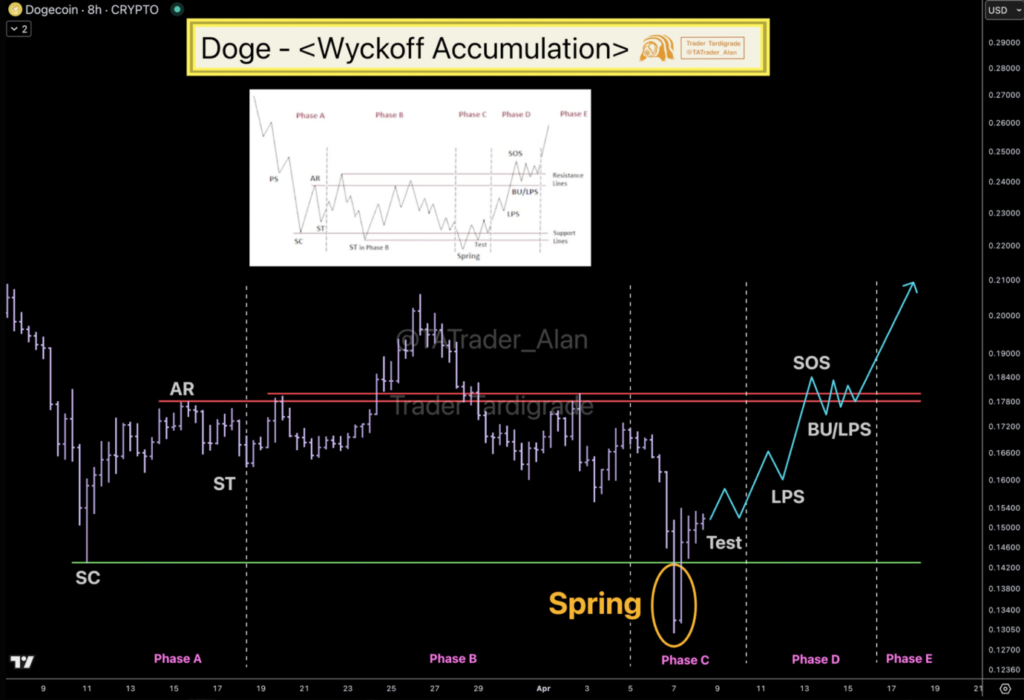

Additionally, TATrader_Alan separately analyzes Dogecoin’s current price behavior in a Wyckoff Accumulation pattern. This model describes five phases of a market bottoming before a new uptrend begins.

DOGE appears to have recently gone through the “Spring” phase. This phase was characterized by a false breakdown followed by a subsequent recovery. According to his analysis, the price moved into the early part of Phase D.

This part consists of “Last Point of Support” (LPS) and “Sign of Strength” (SOS), which meant buyers were taking over. If DOGE continues on this path, it may test resistance near $0.18 again. This may even rise higher to $0.21 in the coming weeks.

The pattern was not entirely well-defined. Specifically, Phase B showed slightly elevated prices, deviating from a typical Wyckoff setup. However, the structure was largely consistent with an accumulation phase.

Technical Indicators Show Bearish Momentum but Possible Rebound

Furthermore, technical indicators indicate that bearish momentum may be easing. On the 1-day chart, the MACD showed that the MACD line is at -0.00948, above the signal line at -0.01102.

This narrowing gap usually indicates a decrease in bearish momentum. A crossover could mean a change to a bullish movement.

Meanwhile, the RSI (Relative Strength Index) was at 40.75. This value was near the oversold threshold of 30, indicating that the selling pressure could be easing.

If the RSI goes above 50, it would indicate that buying strength is increasing. The daily chart of DOGE also had a green candle, suggesting a bounce from the $0.136 level. This was in line with the notion that buyers are entering near-key support.