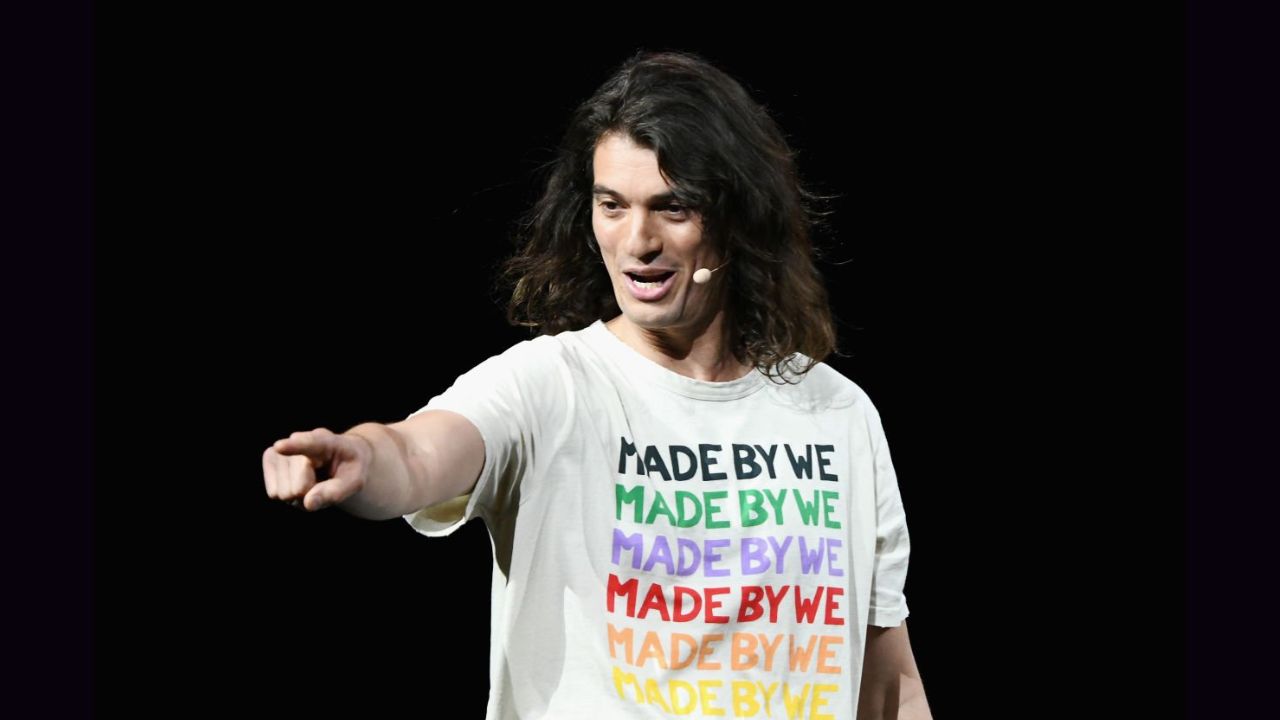

Adam Neumann has “submitted an unsolicited bid over $500 million to acquire WeWork out of bankruptcy,” according to a source familiar with the situation speaking to CNBC.

“Neumann’s financing was not immediately clear,” although CNBC’s sources indicated that Dan Loeb’s Third Point was not involved in the offer. Neumann’s counsel had previously suggested that Loeb’s investment firm was supporting his bid, but Third Point contradicted this in a prior statement.

The uncertainty surrounding Neumann’s financing, along with his past performance at the company, could affect WeWork’s willingness to consider his offer.

Neumann, along with his family office Nazare and his Andreessen Horowitz-backed real estate venture Flow, filed a notice of appearance in WeWork’s bankruptcy docket on Monday.

“A coalition of half a dozen financing partners…submitted a potential bid for substantially more” than $500 million, stated a spokesperson for Flow. However, Flow did not comment on the $900 million bid potential.

This bid follows recent reports of Neumann’s renewed interest in reclaiming the company he was ousted from five years ago. WeWork filed for bankruptcy in 2023 after facing years of challenges and has been collaborating with bankruptcy advisors to restructure its operations.

“As we’ve said previously, WeWork is an extraordinary company…and it’s no surprise we receive expressions of interest from third parties on a regular basis,” said a WeWork spokesperson in a statement on Monday.

The bid, initially reported by The Wall Street Journal, may complicate WeWork’s bankruptcy proceedings, as the company seeks to terminate numerous leases to free itself from longer-term commitments in less profitable markets, a move some lessors have opposed.