UBS remains engaged in a thorough examination of potential misstatements in Credit Suisse’s financial reports, with ongoing discussions with regulators to address the issue.

Concerns persist regarding the risk of undetected material errors that could lead to significant misstatements in Credit Suisse’s financial results, now consolidated with UBS’s following the acquisition.

Remediation Efforts and Regulatory Dialogue

In response to identified material weaknesses in Credit Suisse‘s internal controls, UBS has undertaken a comprehensive review of processes and systems, implementing remediation measures.

However, the review process is ongoing, with UBS committed to adopting further controls and procedures following discussions with regulators.

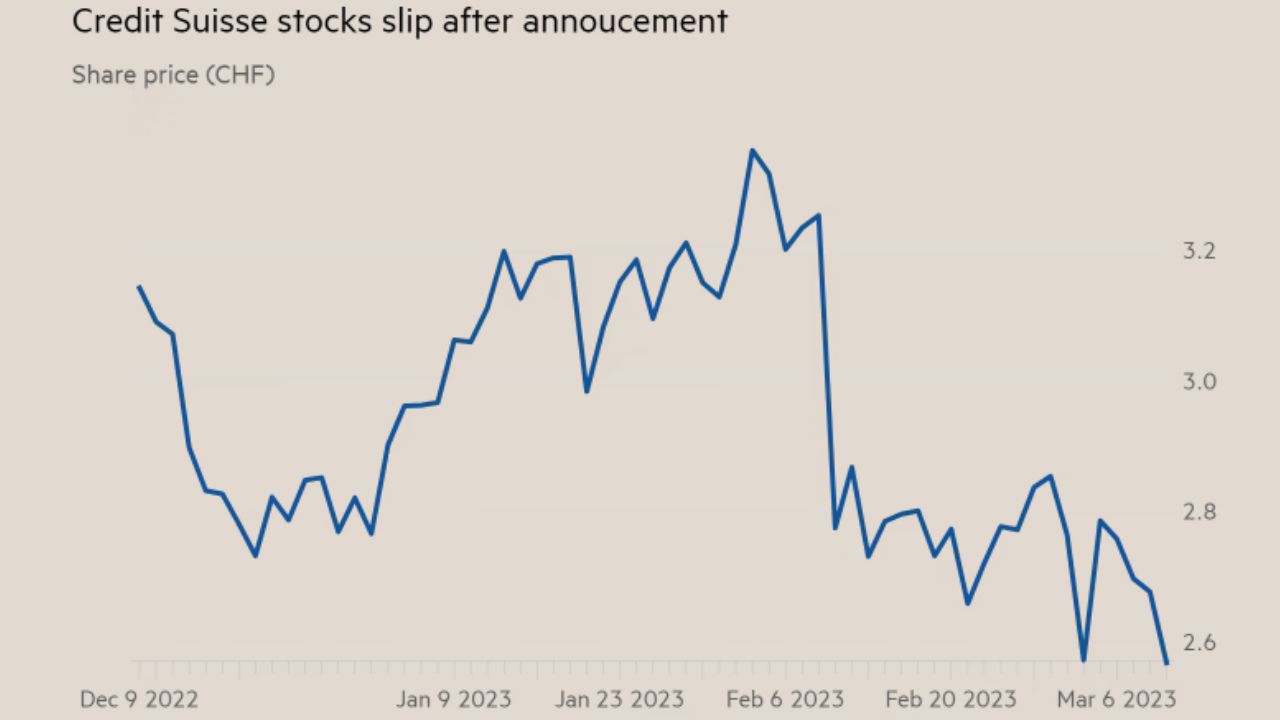

Credit Suisse’s reporting deficiencies have been a subject of scrutiny, with previous engagements between the bank and U.S. authorities highlighting concerns over valuation issues and internal control deficiencies.

Despite efforts to address these issues, challenges persisted, leading to Credit Suisse’s collapse and subsequent integration into UBS’s operations.