Japan’s Nikkei share average concluded higher on Friday, propelled by prominent chip-related companies, achieving a record fiscal-year advance in terms of points, buoyed by substantial foreign investment.

The index attained successive record peaks this month, following its breach of levels last observed on Feb. 22, 1989, during Japan’s economic bubble period.

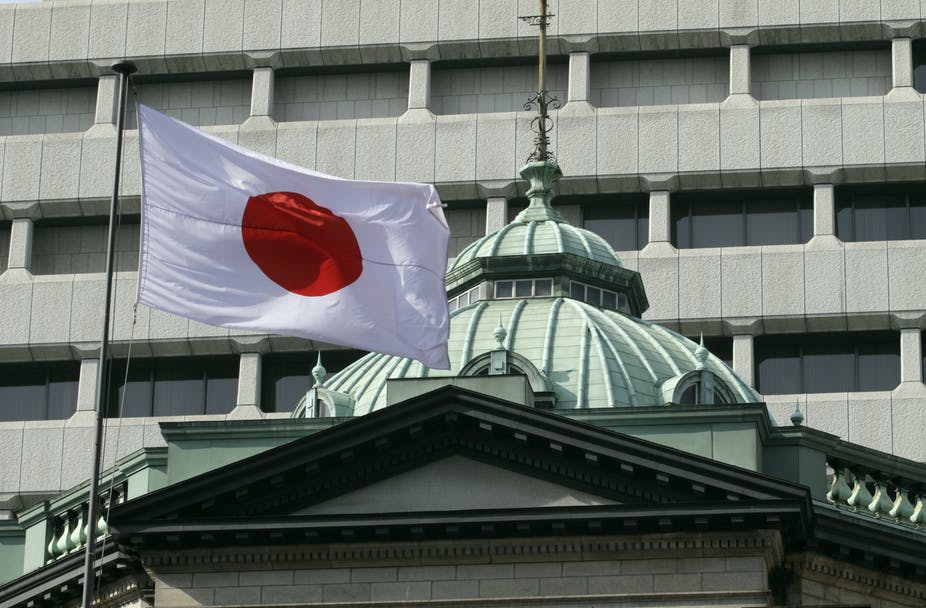

This surge was fueled by foreign investment driven by a depreciating yen and expectations of the Bank of Japan maintaining accommodative monetary policies.

The index surged by 12,328 points in the fiscal year ending on Friday, marking its most significant absolute gain to date.

It recorded a 44% increase over the year, the highest since the financial year ending March 2021.

On Friday, the Nikkei concluded 0.5% higher at 40,369.44, recovering from losses in the previous session.

Fumio Matsumoto, chief strategist at Okasan Securities, noted, “Investors remain cautious over a possible intervention in the currency market but prevalent they take the weak yen as a positive factor for domestic stocks.”

The yen experienced a significant decline to its lowest level against the dollar in 34 years this week, prompting local authorities to convene an emergency meeting, indicating Tokyo’s proximity to potential intervention in the market.

The Japanese yen remained unchanged at 151.40 per dollar at the latest reading. Chip-related stocks Tokyo Electron and Advantest (6857.T) witnessed gains of 0.79% and 1.85%, respectively.

In the property sector, there was a notable surge of 1.96%, contributing to a 16% increase for the month, the highest among all sectors.

This surge follows a government survey released this week, revealing the most rapid rise in land prices in the country in 33 years during 2023.

Fumio Matsumoto from Okasan Securities emphasized that the optimism surrounding the Bank of Japan’s cautious approach to interest rate hikes is bolstering stock prices. The broader Topix index rose by 0.61% to reach 2,768.62 points on Friday.