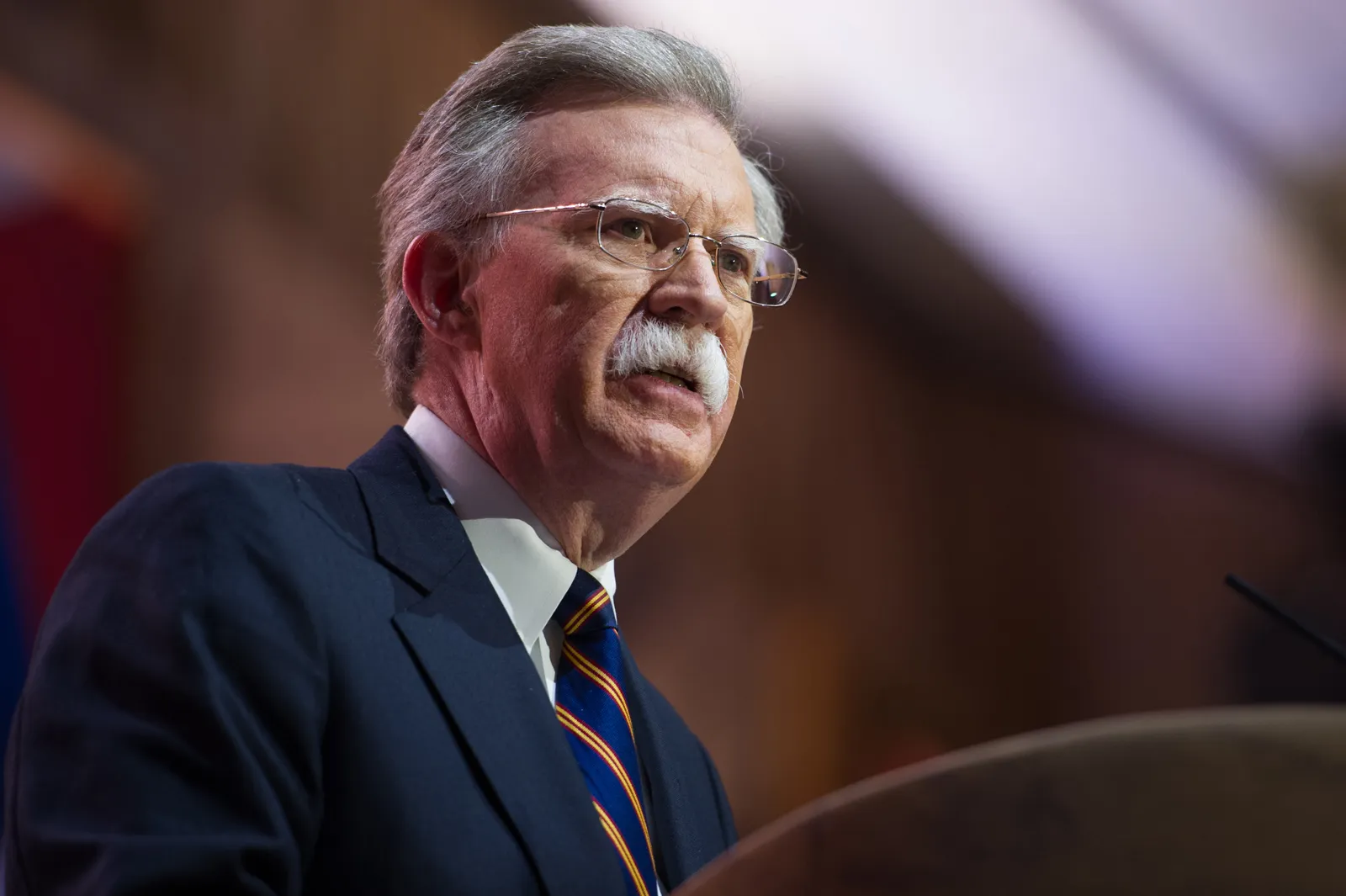

Former national security adviser John Bolton recently shared his voting plans for the upcoming presidential election. He stated that he will write in former Vice President Dick Cheney for president, marking the second time he’s done so.

During an interview with CNN’s Kaitlan Collins on “The Source,” Bolton admitted his support for Cheney in the 2020 election and reiterated his intention to do so again this November. He explained that he sees Cheney as a principled conservative who would do a better job than both President Biden and former President Trump.

Cheney, who is 83 years old, served as vice president under former President George W. Bush and represented Wyoming in Congress before that.

Bolton also expressed admiration for Cheney’s daughter, former Rep. Liz Cheney, who has been critical of Trump, particularly after the January 6, 2021, attack on the Capitol. When asked if he would support Liz Cheney for president, Bolton didn’t rule out the possibility but emphasized his current preference for her father.

Since leaving the Trump administration, Bolton has been vocal in his criticism of the former president. He has raised concerns about the potential consequences of another Trump term, including possible celebrations by the Russian government and the United States leaving NATO.