Key Insights:

- Avalanche (AAVE) surges to $264.75 after Senate stablecoin vote clears 60-vote threshold.

- Over $24B locked in Aave protocol as DeFi activity increases across Ethereum.

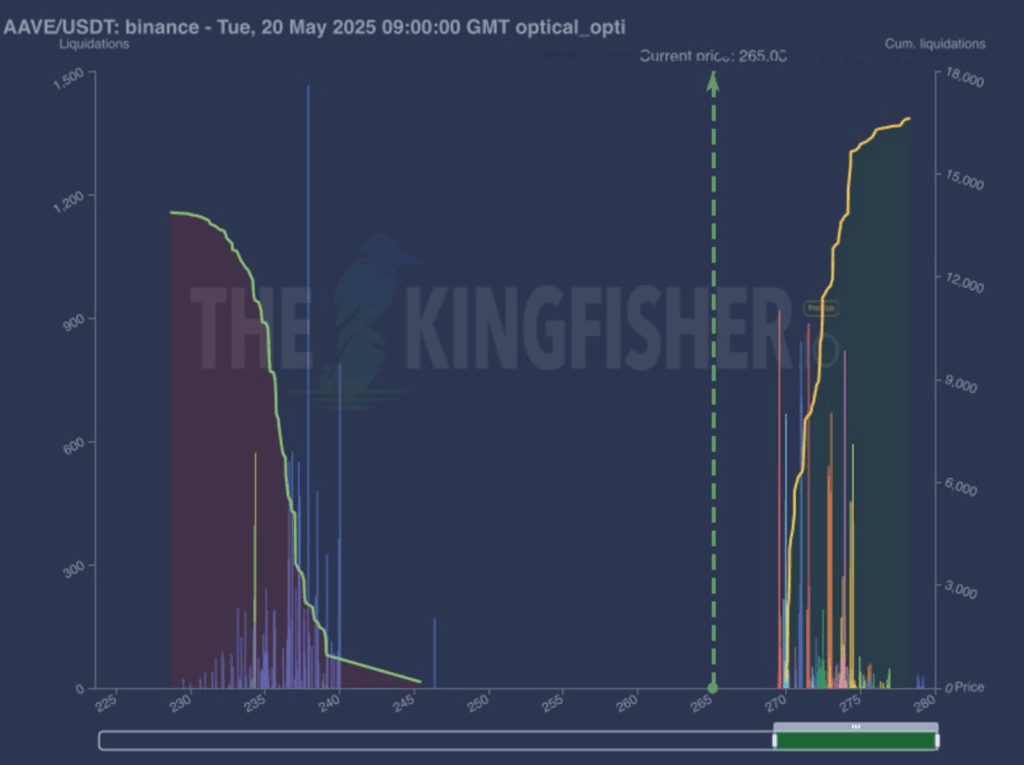

- Liquidation zones show short positions may trigger another price move above $270.

AAVE price surged over 20% in a single day, hitting $264.70. This jump followed the U.S. Senate’s approval of the closure vote on the GENIUS stablecoin bill. This vote paves the way for debate and a final vote, providing more clarity on crypto regulation.

Meanwhile, Avalanche’s platform saw total value locked (TVL) increase 50% to over $24 billion. The rally of the token was further aided by this increase, over $1 million in daily protocol fees, and strong technical signals.

Stablecoin Legislation Triggers Investor Reaction

On May 20, 2025, the price of the AAVE governance token for the Aave decentralized lending platform increased by 20.3%. The price increase came after the U.S. Senate passed the closure vote for the GENIUS stablecoin bill.

That closure vote cleared a key procedural block and sent the bill to debate before a final Senate vote. It follows earlier resistance in the Senate earlier this month. But on May 8, lawmakers fell short of the 60 votes needed to advance the measure because of bipartisan concerns.

But they reversed course after revisions to address consumer protection and national security. Lawmakers such as Ruben Gallego and Mark Warner, who had voted against the bill before, voted for it this time.

The legislation would set regulatory standards for stablecoin issuers in the U.S. Aave supports decentralized stablecoin lending and borrowing, and clearer regulations benefit its long-term utility and adoption. Investors welcomed the improved regulatory clarity.

Technical Levels and Liquidation Data Point to More Volatility

Liquidation mechanics and technical trends also supported AAVE’s recent spike, according to on-chain data and trading signals.

The Kingfisher also showed strong long liquidations between $230 and $240, peaking at $238. After the price broke through, this zone may now act as a support level.

Liquidation clusters for short positions get denser above $265, especially in the $270 to $280 range. Many traders are betting against the token above current levels.

Hence, if AAVE breaks past $270, forced liquidations could trigger a price spike due to short covering. This is often the case when there is a large concentration of short positions near resistance.

Technical charts support this outlook. Analyst JavonTM1 analysis notes $628.5 as the next technical target. That’s more than 137% above current levels.

The chart also shows a long-term breakout of a downtrend that began in 2021, with higher lows consistently made since mid-2023.

The ascending structure that AAVE/USD is forming is usually a bullish setup. The current price action has a strong upward momentum with little pullbacks. This indicates that buying interest is strong in the short term.

Growth in DeFi Usage Drives Aave’s On-Chain Strength

AAVE price performance also reflects an increase in the usage of decentralized finance across Ethereum and related networks. The total value locked (TVL) in Aave has hit $24 billion, according to DefiLlama.

That’s 50% higher than its 2025 low. While Ethereum still dominates, other networks such as Arbitrum, Polygon, and Avalanche have also grown steadily.

The rise in TVL suggests more and more users are depositing crypto assets into Aave to earn interest or borrow funds.

In addition, the platform has amassed over $1 million in daily protocol fees and over $10 billion in active loans. These metrics indicate that trust and demand for decentralized lending are growing.

Market cap data also supports this trend. At the time of writing, Aave’s market cap is $4.0B, and its 24-hour trading volume is over $730m.

About 15.1 million out of a maximum supply of 16 million tokens are in circulation. This means that most tokens are already in circulation, which could reduce the risk of future inflation.

As Aave is adopted increasingly, and volume increases, it benefits from a growing decentralized finance ecosystem. Additionally, the stablecoin bill has created positive sentiment, boosting investor confidence in protocols aligned with regulatory frameworks.

While the stablecoin discussion continues in both chambers of Congress, Aave and other platforms will likely remain in the spotlight.

A similar version of the bill is being worked on by the House of Representatives, with final approval possible later this year. This would result from a more defined legal framework for platforms like Aave to operate in the U.S. market.