Key Insights

- US President Donald Trump continues to foray deeper and deeper into the AI and crypto space.

- Trump is doing so with the launch of his crypto venture, World Liberty Financial.

- Before his inauguration and even after, this platform continues to buy massive amounts of cryptocurrency.

- WLFI is now one of the top holders of staked Ethereum.

- Industry leaders predict an incoming era of better crypto regulation for the United States, under Donald Trump.

The foray of Donald Trump into the world of crypto has made headlines for the past two weeks, especially with World Liberty Financial (WLFI), his defi platform

This platform has rapidly ascended through the crypto ranks with massive investments in staked Ethereum and other cryptocurrencies so far, and here are the latest updates.

WLFI Joins the Elite 0.1% of stETH Holders

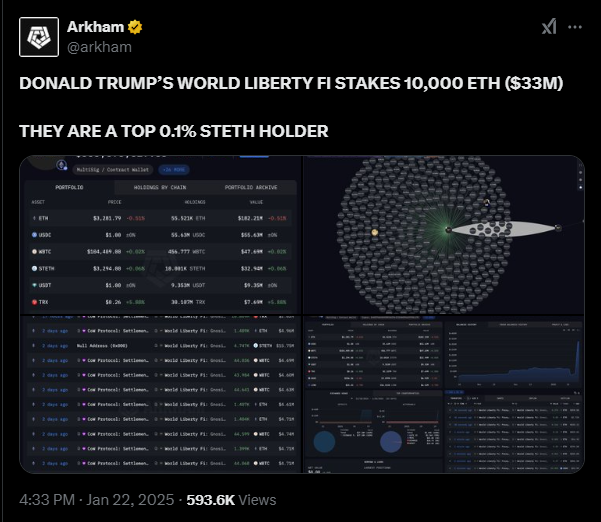

According to recent data from Arkham, WLFI has become a top 0.1% holder of staked Ethereum.

The blockchain analytics platform noted that this happened after WLFI amassed $33 million worth of the asset, showing its commitment to Ethereum as the leading smart contract platform.

However, stETH isn’t the only asset in the WLFI portfolio. Data from Arkham further shows that the platform holds around $182 million in ETH, $55.6 million in USDC, $48 million in Wrapped Bitcoin (WBTC), $6.9 million in Aave (AAVE) and $6.2 million in Chainlink (LINK).

Celebrating with Crypto

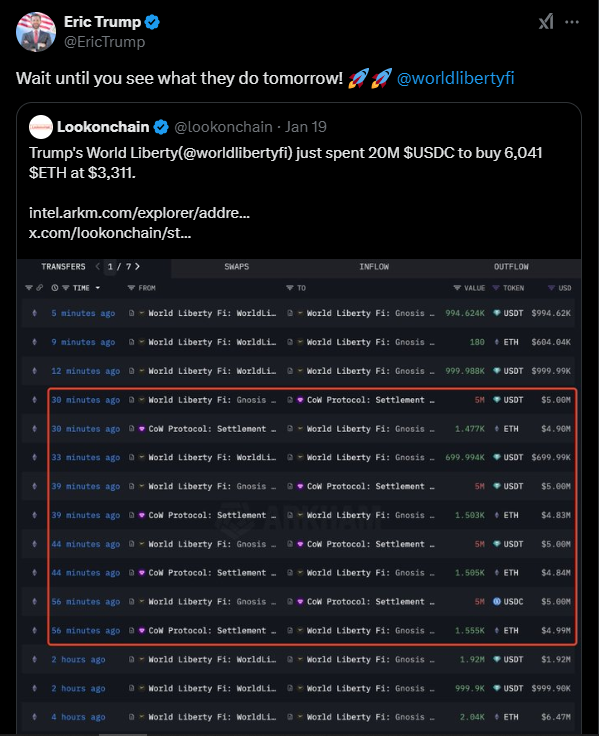

WLFI also made moves on 20 January, the day of Donald Trump’s inauguration as the president of the United States.

The platform purchased an additional $47 million worth of ETH and WBTC to commemorate the occasion.

Said celebration also extended towards buying extra $4.7 million each in AAVE, LINK, Justin Sun’s Tron (TRX), and $ENA stablecoin.

The launch of the $TRUMP memecoin also added more fuel to the fire.

This token, which was deployed on the Solana network on 17 January, quickly became one of the best performing memecoins within 48 hours of launch.

At its peak, it had ammassed billions of dollars in market cap with a price of $73 before dropping below $40.

The memecoin’s launch also caused a surge in new Solana wallets.

Even though Trump himself expressed limited knowledge about the project, he acknowledged that it was a huge success.

Soon after the $TRUMP launch, first lady Melania Trump also launched her own memecoin ($MELANIA), which drew in 500,000 users and billions of dollars in market cap.

Trump’s Broader Vision Of Cryptocurrency and Beyond

While the WLFI crypto purchases dominated headlines, the Trump administration also had further impact on the crypto sector.

For example, industry leaders like Coinbase CEO Brian Armstrong now predict that the administration could push for more sensible regulations for Stablecoins and other assets.

Meanwhile, the CEO of the Bank of America, Brian Moynihan noted that there has been an increased interest in crypto payments among financial institutions.

Trump also announced the launch of a $500 billion AI infrastructure initiative called Stargate in addition to his crypto ventures.

The project is aimed at constructing advanced AI data centers across the United States, which will be funded by private equity players like OpenAI and Oracle, among others.

The project now has around $100 billion earmarked for immediate investment and is set to create jobs while improving the US’ competitiveness in the AI space.