Key Insights:

- It had been in shape as a bullish pattern and the support was considered strong between 0.19 and 0.22 as seen through the green horizontal area.

- The collaboration between PayPal and Protocol 22 would enhance the rate of adoption as the mainstream fintech will be linked with blockchain.

- The price of XLM was indicated by the liquidation map at the price of $0.2488 between concentration of long and short liquidations.

XLM crypto price had been clearly in shape as a bullish pennant pattern and the support was considered strong between $0.19 and $0.22 as seen through the green horizontal area.

The XLM crypto price action revered this level several times, indicating the accumulation.

XLM Price Action

The declining trendline was limiting XLM crypto price after November 2024, and an upward move across the trend would have confirmed the bullish mood, particularly in the region of 25 cents.

The EMA-200 seemed supportive and this means mid-term strength giving the price stability. In the event of the successful breakout, the following second resistance at 0.35 was to be targeted by XLM.

Another spike would have taken the price to the second horizontal target, the price of $0.44, as a measured move on the consolidation structure.

Had momentum been supported, then a potential bullish extension would have been achieved at $0.63+.

On the other hand, the inability to hold the support level of $0.19-$0.22 might have voided the setup which could have drawn the price back to the 0.17 bracket or even further.

Thus, $0.25 (breakout level), $0.35 (first target) and $0.44 (second target) acted as watch points. Rejection at the trend near 0.25 would yet have continued downwards.

Nonetheless, as long as the support held and we were about to confirm the pattern, XLM had built itself an ambitious mid-term bullish pin, with greater buyer power essential above the falling trendline.

Could XLM Move with Paypal and Protocol 22?

Stellar is readying to take a giant leap with PayPal’s PYUSD moves towards integrating in the Stellar, Denelle Dixon alluded to its position of creating bills throughout the globe easier and more efficient from the use of stablecoins.

This collaboration may enhance the rate of adoption as the mainstream fintech will be linked with blockchain.

The next major improvement planned by Stellar to its network, with Protocol 22, was to add the second generation of Smart Contracts.

This would enable faster, cheaper, and regulator-friendly activities, with quantum-resistant signature use to provide forward-compliant security.

Combined with a 5,000 TPS capacity, competing with Visa, Stellar would provide real-time use cases such as instant payroll in stablecoins and cross-border loans of small or medium businesses in less than three seconds.

In case of a surge in adoption, it is probable that improvements in enterprise partnerships and volume of transactions would follow on the coin, XLM.

On the other hand, failures to go through with PayPal or Protocol 22 could slow things down, or do poorly altogether.

However, the combination of novelty, scalability, and practical financial systems ushered Stellar into a central space in the world of finance.

Therefore, XLM is one of the most important tokens to follow in the digitized landscape of finance that is slowly emerging.

XLM Crypto Price on Liquidation Map

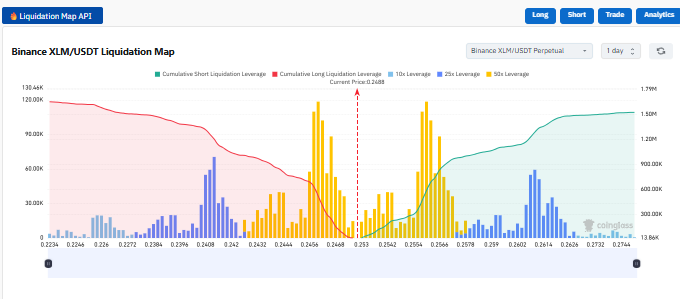

The XLM crypto price was also indicated by the liquidation map at $0.2488, between heavy concentration of long and short liquidations.

There were heavy long liquidations within the range of $0.2520 to $0.2564 and this indicates that liquidations above $0.2520 might be able to induce cascading liquidations across the long positions.

The negative was that with liquidations of shorts, strong support formed in $0.2440-$0.2380. Price reading higher than $0.2488 indicated a squeeze towards the $0.2564 mark.

However, breaking $0.2440 could push the price into a liquidity whirlpool at $0.2380. The high liquidation was at $0.2480 and $0.2550, and these levels are main decision points.

The run was in favor of a bullish breakout above $0.2520 level; with more targets near $0.2564.