Key Insights:

- Cardano’s price stayed around $0.640 in April, showing signs of a possible major shift in momentum.

- Bitcoin has surged past the $90K mark.

- Arthur Hayes predicts that Bitcoin could rise to $100,000, which could lift altcoins like Cardano higher.

Cardano (ADA) price maintained stability throughout April, maintaining a level around $0.640, as major market changes are predicted.

The setup of Bitcoin and optimistic projections from eminent individuals indicate possible market gains in the near future.

The local breakout of Cardano alongside other altcoins appears possible when Bitcoin gains momentum throughout the short term.

Market participants show growing confidence in Bitcoin due to its formation of a bullish double-bottom pattern that indicates potential upward price trends.

Crossing the $90K mark has likely validated the upward trend continuation. A price crossing above this level creates potential for a powerful price surge throughout linked altcoin assets.

The Cardano technical setup currently indicates the altcoin is showing signs of a breakout event that follows several crucial market and fundamental indicator signals.

The projected rise in Bitcoin’s value to $100,000 could make Cardano reach $1 with a 55% growth rate. This scenario hinges on Bitcoin’s momentum, a primary driver of broader crypto activity.

Bitcoin Approaches Breakout Zone with Strong Market Signals

Bitcoin has formed a double-bottom pattern near $76,485, pointing to potential bullish momentum ahead.

The reliability of this chart pattern suggests that a breakout is possible when the price surpasses $88,415.

Now that BTC has surged past the $90K mark, it’s ascent to th psychological barrier of $100,000 is more likely.

Arthur Hayes has projected that Bitcoin could soon reach $100,000, which requires only a 13% increase from current levels.

The projected target is realistic since market indicators and investor sentiment continue to match.

Hayes’s prediction has received significant attention because it supports larger expectations about the growing demand for cryptocurrency.

Gold prices reaching all-time highs highlight Bitcoin’s emerging role as a digital alternative during economic uncertainty.

Spot Bitcoin ETFs have seen consistent inflows as market participants reposition away from traditional equities.

This flight to perceived safety has increased the growing demand for Bitcoin, reinforcing the bullish case.

ADA Holds Support and Eyes Breakout Move

Throughout most of April, Cardano maintained its price within a consolidation area spanning between $0.60 and $0.65.

ADA price rose after reaching its lowest point of $0.512 in the monthly cycle, thus demonstrating robust support in that area.

The consolidation phase suggests investors are accumulating ahead of a potentially large market shift because of rising market conditions.

Two downward trendlines that converge into one another shape a falling wedge pattern, which technical charts indicate is a bullish reversal indicator.

The Cardano price currently patterns itself as a small bullish pennant, which usually leads to extended rallies.

Market-favorable conditions will enable Cardano to execute a strong price movement according to current patterns.

The current price position of ADA sits under its 50-day exponential moving average while also remaining below its 200-day exponential moving average, indicating temporary market weakness.

The bullish pattern becomes valid for a move up to the $1 mark after a successful breach of resistance bars.

ADA’s pennant formation remains valid until it breaks through its lowest pennant boundary.

Futures Market Shows Continued ADA Demand

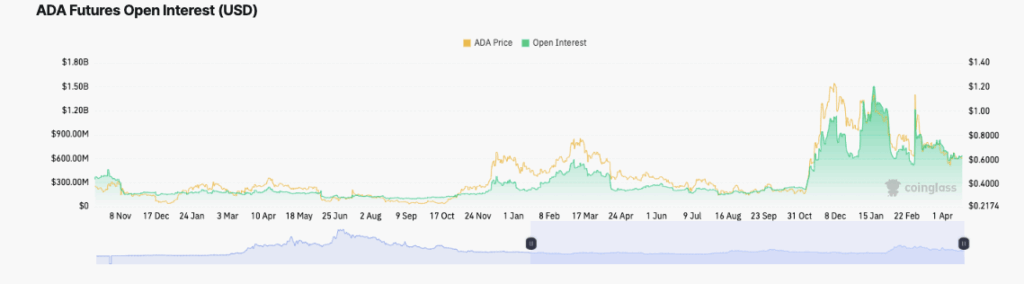

Open interest in Cardano futures exceeded $1 Billion during peaks in January and March, aligning with price gains.

This correlation between open interest and price action shows heightened trading activity when ADA gains bullish momentum.

The sustained interest in the future highlights strong participation in the Cardano market.

As of April, ADA’s futures open interest has stabilized above $600 million, reflecting consistent trader engagement.

At this point, open interest remains more than twice what it was in mid-2023, which indicates a new attitude regarding ADA.

The higher open interest points to a more active and liquid market despite price corrections.

Open interest measures all outstanding futures contracts and reflects ongoing speculation around price direction.

The price movement becomes more likely when continuous elevation of this indicator appears during periods of stability.