Key Insights:

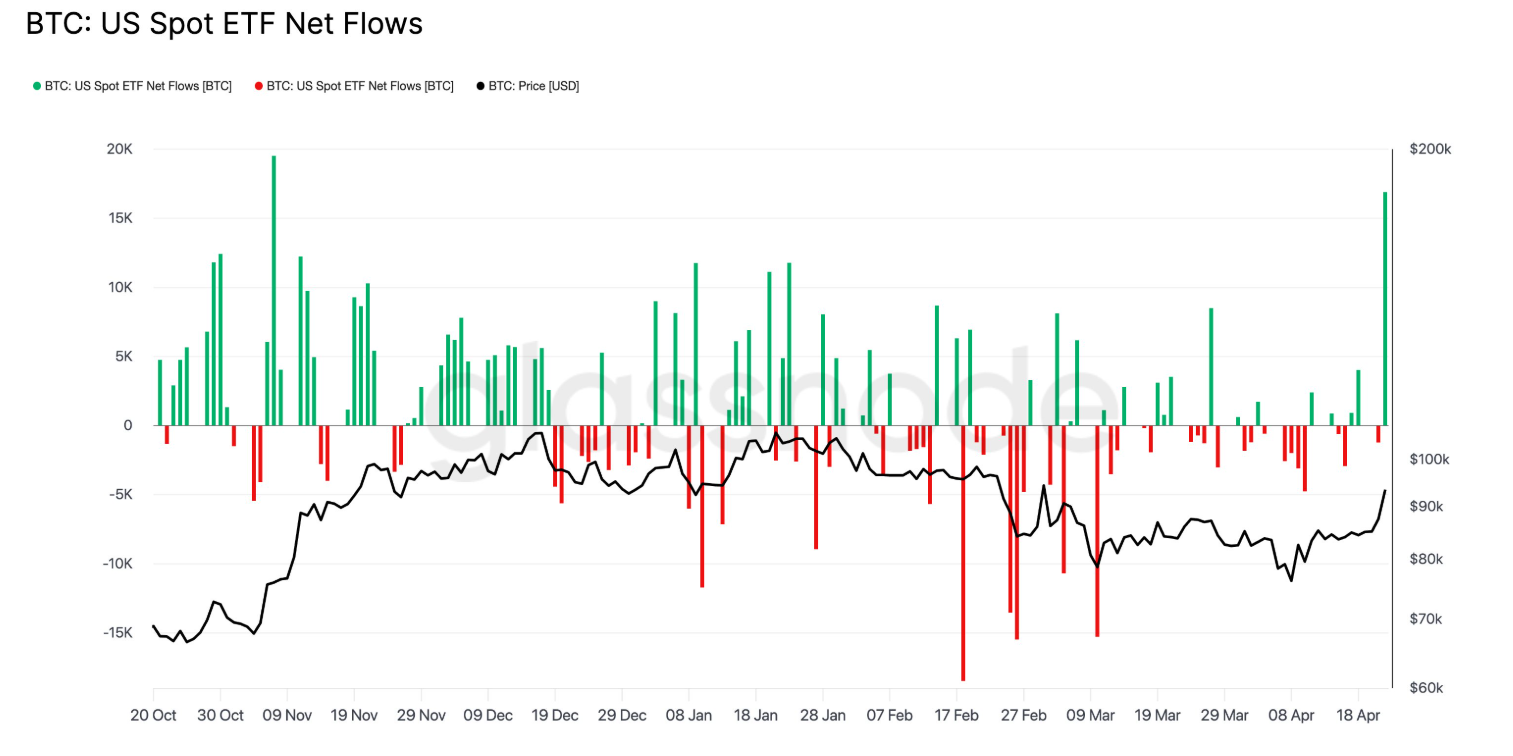

- Bitcoin ETFs added 11,898 BTC on April 23, marking the highest inflow since November 2024.

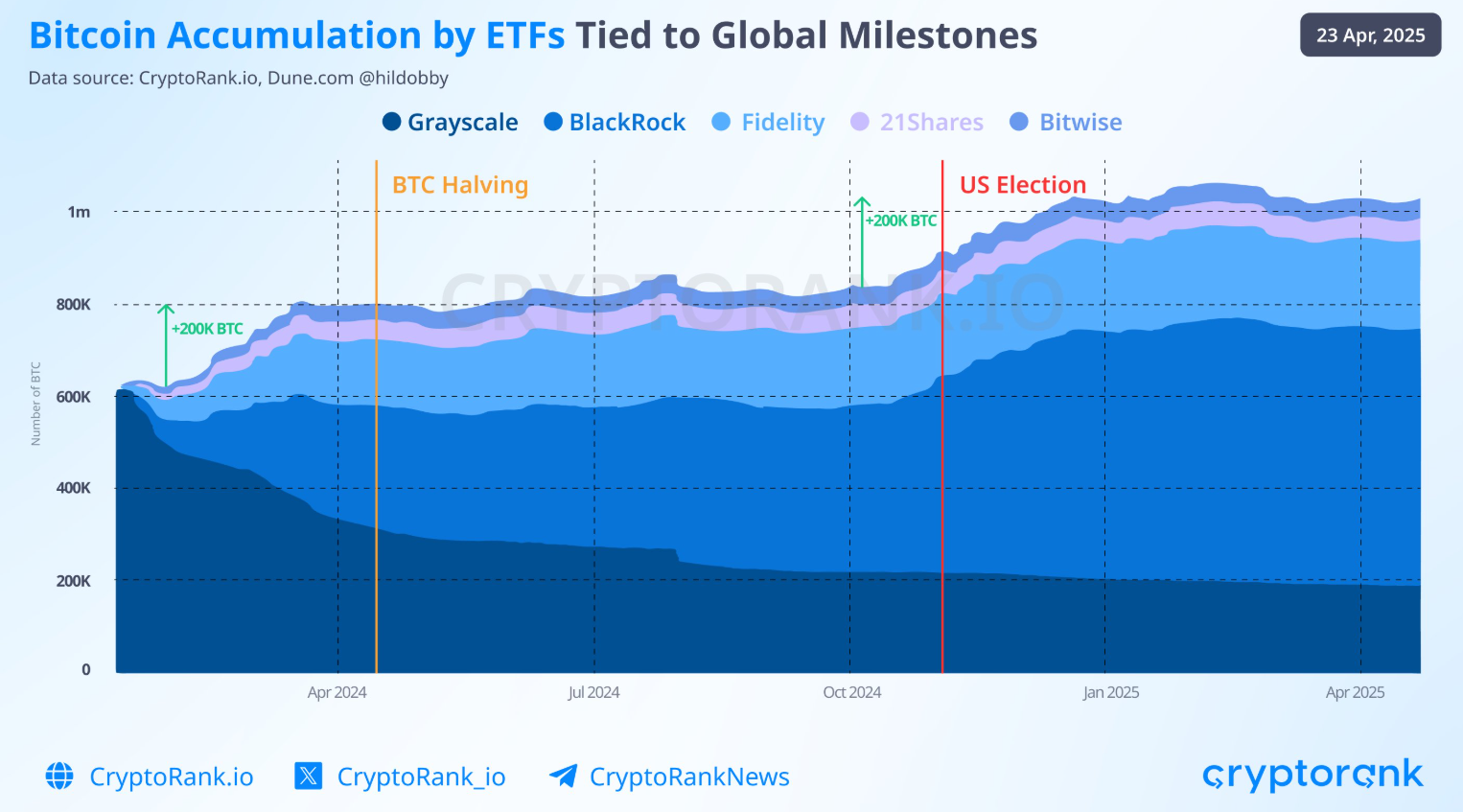

- Institutional holdings exceed 900K BTC after accumulation during key global events.

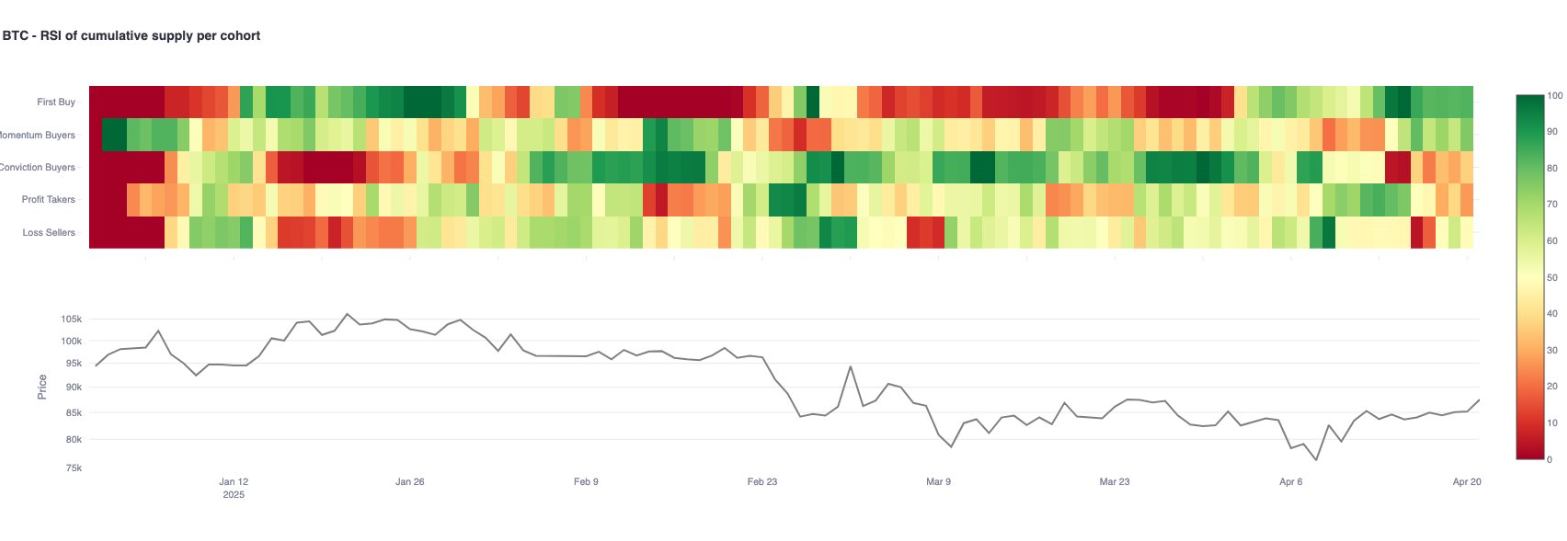

- Retail buyers show increased activity, with RSI for “First Buy” cohort peaking at 100.

Institutions and retail buyers are returning to the market, and Bitcoin ETFs are seeing renewed interest. On April 23, 11,898 BTC in ETF inflows were recorded, the highest level since November 2018.

However, retail activity is increasing, and exchange balances are still falling, which indicates changing trends.

Bitcoin ETF Inflows Reach Highest Since November

Glassnode data shows that on April 23, 2025, US spot Bitcoin exchange-traded funds (ETFs) saw a net inflow of 11,898 BTC. This is the largest single-day inflow since November 11, 2024, after months of relatively flat flows where institutions have been absent.

Bitcoin ETF flows have increased throughout the past five months, with many days of negative net movement. During this time, positive inflows above 10,000 BTC were rare.

The April 23 figure is significant as it implies institutional buyers are more confident and may be reallocated into crypto assets. Inflows are represented by green bars and outflows by red bars. The black line tracks Bitcoin’s price in USD.

Red bars dominated during March and early April, many days reaching outflows of 2,000 to 8,000 BTC. However, the green bar for April 23 shows a sudden shift in sentiment.

ETF Holdings Increase Around Key Events

CryptoRank also provides another dataset on the ETF holdings by top providers. This includes Grayscale, BlackRock, Fidelity, 21Shares, and Bitwise since early 2024.

Their combined holdings surged by over 400,000 BTC in two major phases. This increase followed the ETF approvals and the U.S. presidential election in November 2024.

From April to October 2024, total holdings surged by 200,000 BTC. Following the election results, an additional 200,000 BTC was accumulated.

The data also shows that institutions increase their positions after significant geopolitical events. Public firms have significantly increased their Bitcoin holdings, exceeding 900,000 BTC as of April 2025. This accumulation trend continues, reflecting strong institutional interest in BTC.

The behaviour is that institutions react to significant events but are wary in between. Recent inflows may have surged due to rising expectations of policy changes. These include possible interest rate adjustments and expanded ETF access in other countries.

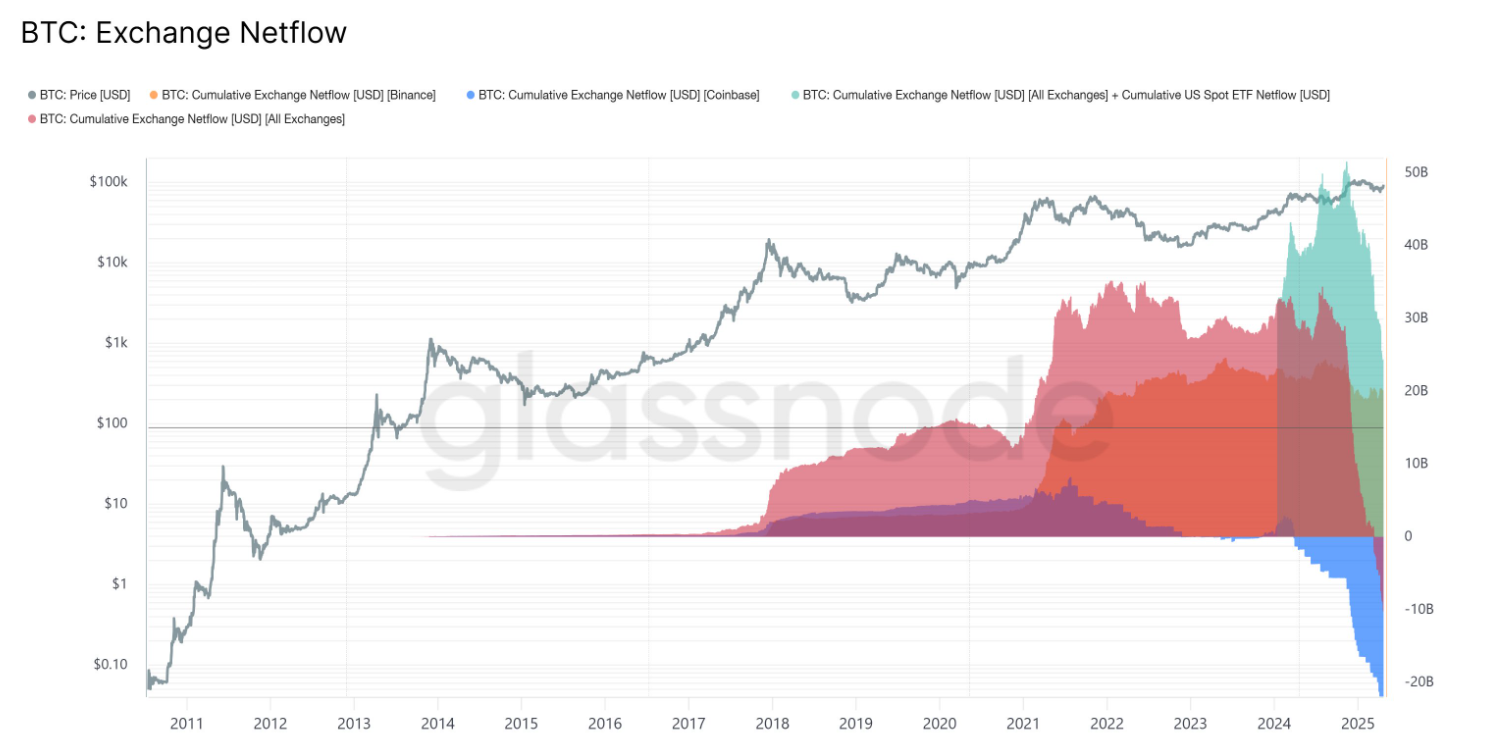

Exchange Netflows Continue Falling

Demand for ETFs is rising, but exchange data shows a severe drop in BTC balances on centralized platforms. The Glassnode chart below shows netflows across exchanges such as Binance and Coinbase. By early 2025, the cumulative exchange netflow fell below -$20 billion.

This drop indicates that users take their coins off exchanges, typically into cold storage or ETFs. Almost all major platforms saw a negative netflow trend from late 2023 to early 2025.

A new category, “Cumulative US Spot ETF Netflow,” shows a rising trend. This means that ETF growth makes up for exchange outflows.

The movements here are opposing and suggest a shift in investors’ preferences. More investors are leaning towards holding strategies for the long term, perhaps through regulated ETF products, rather than holding on exchanges.

Retail Buyers Show Renewed Activity

On the other hand, the RSI chart for supply cohorts shows that newer retail participants have been powerful in April. The RSI of the “First Buy” category has stayed above the 50 level for the whole month, hitting 100 last week.

This metric indicates the level of activity of various BTC holder groups. If RSI is high, it means that the buying behavior is strong.

New buyers were not the only ones who engaged at high levels in April; conviction and momentum buyers also did. It was even when the Bitcoin price was below recent highs.

Despite prices being near $90,000, the sustained buying activity from these groups suggests that retail investors are becoming more confident. Many of these participants are returning to the market for the first time or after having exited earlier.