Key Insights:

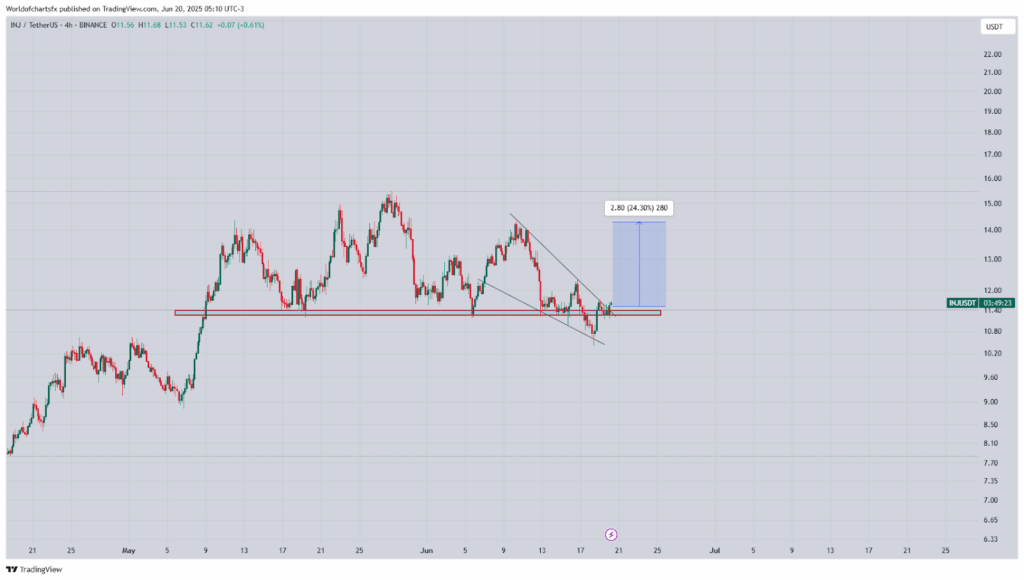

- $INJ has cleared primary resistance levels, signaling a potential 24-30% price rise in the short term.

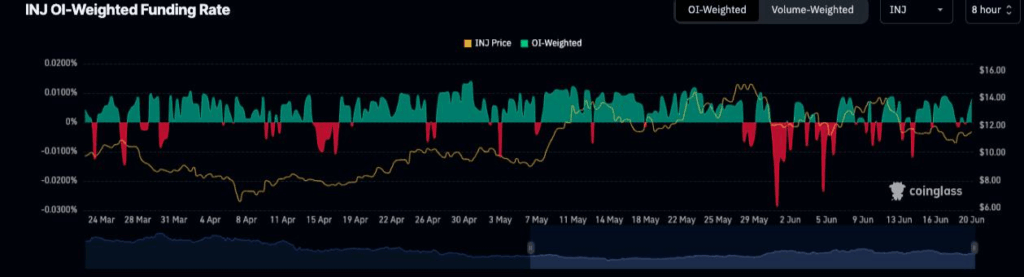

- Injective crypto funding rates show a favourable market.

- Technical indicators suggest that INJ has strong breakout potential.

Injective crypto ($INJ) has demonstrated active resilience compared to other altcoins. Recently, $INJ broke a number of resistance barriers, which indicates that a recovery could be experienced in the short term. Based on recent analysis, the price of $INJ has been trading within a consolidation pattern. Still, many of the resistance edges have already been taken, and the traders anticipate a bullish burst of 30-35%.

Injective Crypto Beats Important Resistance Levels

Based on the chart above, $INJ appears to be on its way up as it managed to break the primary resistance levels. This could precondition the new positive price movement. Technically, it is a good sign that a 24-30% price rise is expected, and this might push it back to its following vital targets.

The breakout chart analysis indicates that resistance levels are likely at $13.50 and $15.00. The latest trend has revealed that injection is reclaiming a bullish trend, even though the broader crypto market has experienced such erratic trends.

Looking at Open Interest (OI)-Weighted Funding Rate of Injective (INJ), we see that favorable funding rates characterize the period. These are identified with green, meaning traders are long biased. However, the dramatic negative spikes, particularly in late May and early and mid-June, indicate additional short positioning as prices go down. INJ price reached over 14 dollars in late May before falling under 12. This is in tandem with an increase in negative funding. This indicates the reversal of sentiment since traders anticipate more declines.

Injective Crypto Shows Consolidation with Potential for Breakout

The price of Injective crypto ranges between the upper and the lower Bollinger Band. This implies that the market is volatile. The price is close to the lower band, which is within the region of 10.70. This shows possible assistance.

This implies that the price may move back or consolidate in its present range. Also, one indicator of decreased volatility is the shrinking of the bands, which frequently precedes a dramatic price movement. The bands may break up or break down, leading to a more intense directional move, either up or down.

The Relative Strength Index (RSI), on the other hand, is at 50.29, which is quite neutral. In the last few days, the RSI traded between 45 and 55, indicating uncertainty in the market. This impartiality means that the market is in a consolidation stage, with neither bullish nor bearish momentum.

Once the RSI starts to trend upwards, it might indicate an increase in buy pressure and, hence, a push towards upward price action. On the other hand, when the RSI falls below 45. There will be more downward momentum, and prices may retest lower.

The Moving Average Convergence Divergence (MACD) is presently in a negative divergence state, where the MACD line presents -0.058 against the signal line. This is an indication that there has been increased selling pressure. However, the histogram is beginning to appear in the shift towards positive mode, and this shows that the downward trend might be on its way to decline. A possible crossover of the MACD above the signal line may be a bullish clue. This will be an indication that the buying force is slowly gaining momentum, and the price can begin to move upwards.