Key Insights:

- Avalanche (AVAX) may decline if it doesn’t stay above the $23 mark. Losing this level could trigger downside momentum.

- Whale participation in AVAX has soared by 153%, while daily active addresses have increased by 17%, indicating a potential pullback.

- Exchanges have recorded an outflow of $13.33 million worth of AVAX over the past seven days.

AVAX price prediction suggests the asset is on the verge of a crash. The token has failed to hold the key support level of $23. The cryptocurrency market has been correcting in recent days.

As a result, Avalanche’s value has declined significantly, opening the path for considerable downside momentum.

Whale Transaction Drops by 82%

Following the major breakdown, whale and institutional participation have plummeted, as reported by the on-chain analytics tool IntoTheBlock. According to recent data, the enormous transaction volume (typically linked to whales) has dropped by 82% over the past 24 hours.

This indicates that whales are avoiding participation in the asset during its downside momentum. These recent developments hit the AVAX price harder, recording a 6% decline over the past 24 hours. Meanwhile, the asset was trading near $22.50.

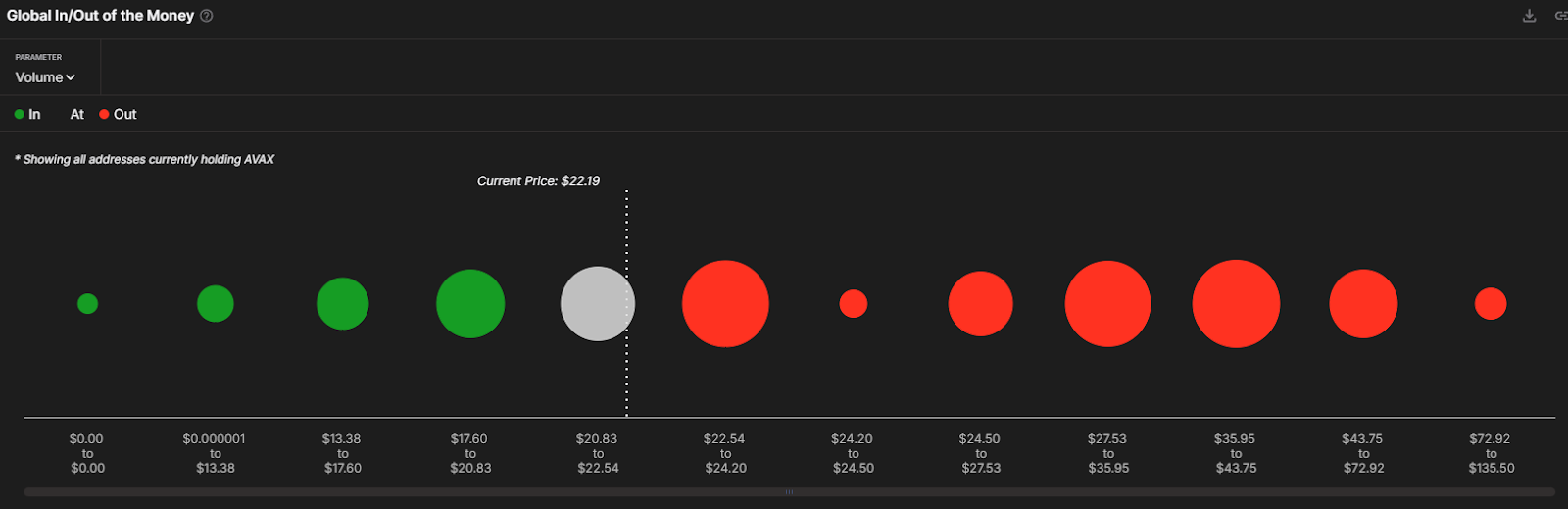

AVAX price might slow down or stop at $20.83, based on data from IntoTheBlock. This level was where 773.74K wallets bought 16.03 million AVAX tokens.

AVAX Price Prediction and Key Levels

According to the TradingView chart, AVAX price prediction has turned bearish and is poised for downside momentum. This bearish confirmation could be confirmed once AVAX closes its daily candle below the $22.50 level.

If the token successfully closes a candle below this level, it could drop over 25%. It could reach the $16 level soon. The price has been moving within a descending channel for a long time.

The sentiment remains unchanged on the weekly time frame. The price is now approaching the lower boundary of the pattern. It continues to follow the established trend.

The downside of the asset began after the AVAX price hit the 200 EMA on the daily time frame. Now, the price is moving below it, indicating that it is in a downtrend.

Meanwhile, AVAX’s RSI was neutral and stood at 50. This indicates that the asset is neither overbought nor oversold. However, given the bearish market sentiment, there is more probability that AVAX could face downward pressure in the coming sessions.

Mixed On-Chain Metrics

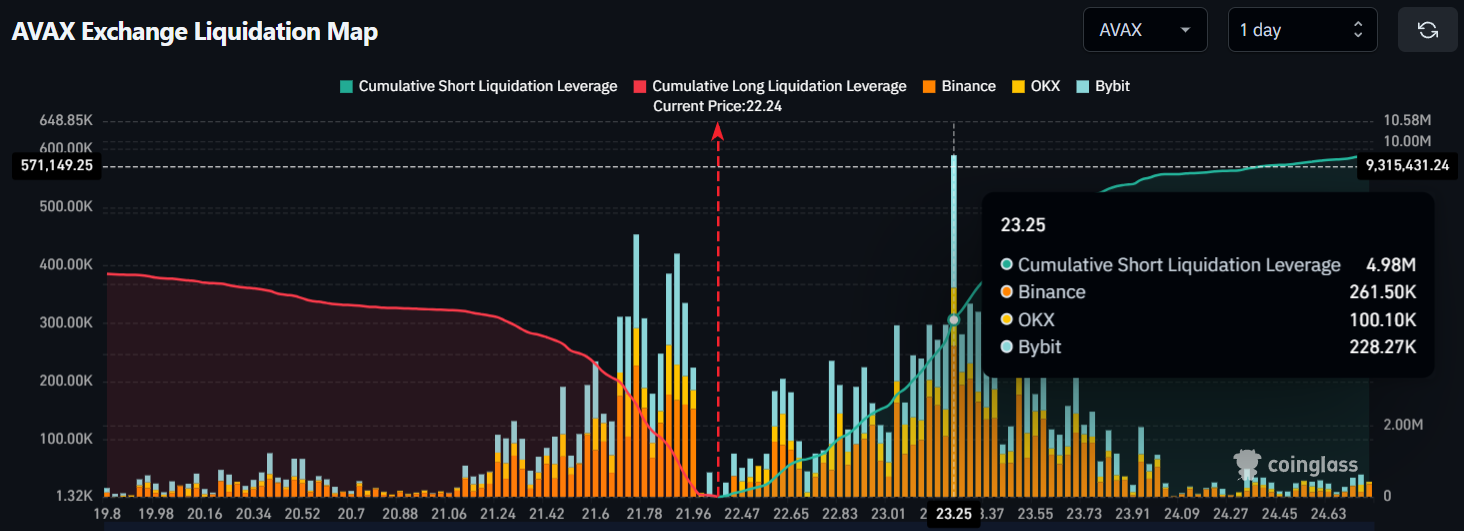

Some investors view the ongoing price dip as a buying opportunity and are accumulating assets. Meanwhile, traders use the bearish sentiment to place strong bets against the market.

The on-chain analytics firm Coinglass has reported these contrasting strategies. Overall, the market remains divided between accumulation and bearish speculation.

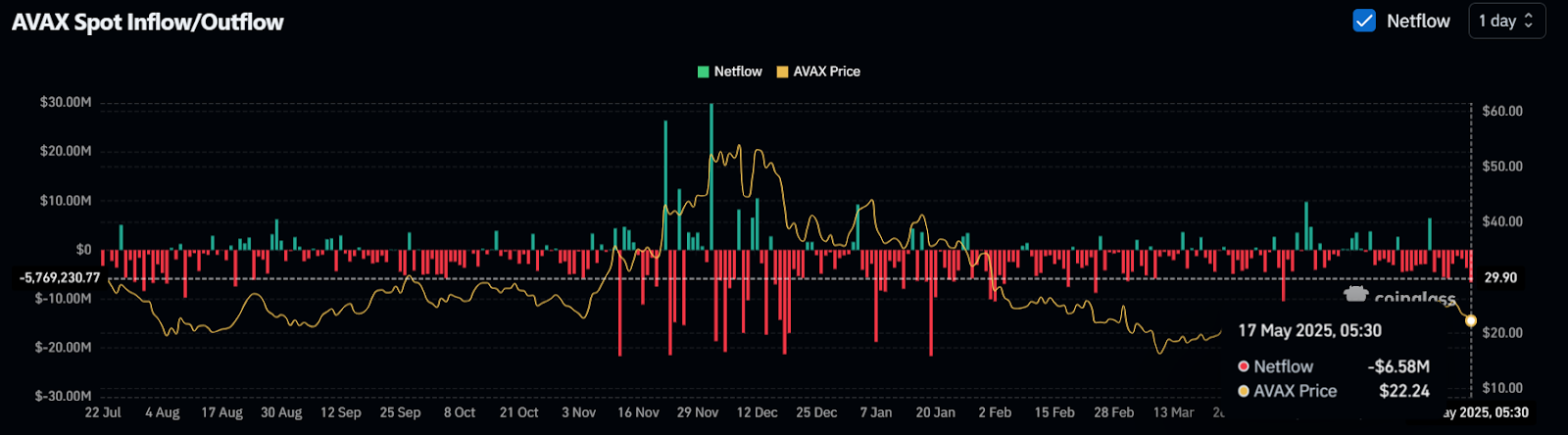

Data from the spot inflow/outflow reveals that exchanges have witnessed significant AVAX token movement. In the past 24 hours, they have recorded an outflow of $6.58 million worth of the asset.

This substantial outflow during the downside momentum indicates potential accumulation. This could lead to buying pressure and an upside rally.

On the other hand, traders have been strongly betting on the bearish side. The $21.75 level has seen traders build $2.61 million in long positions over the past 24 hours.

Meanwhile, the $23.25 level has attracted $4.98 million in short positions. These levels have drawn significant trading interest.

On-chain metrics and technical analysis suggest that bears have control over the asset. Their downward momentum may persist until the price hits a key support level.