Key Insights:

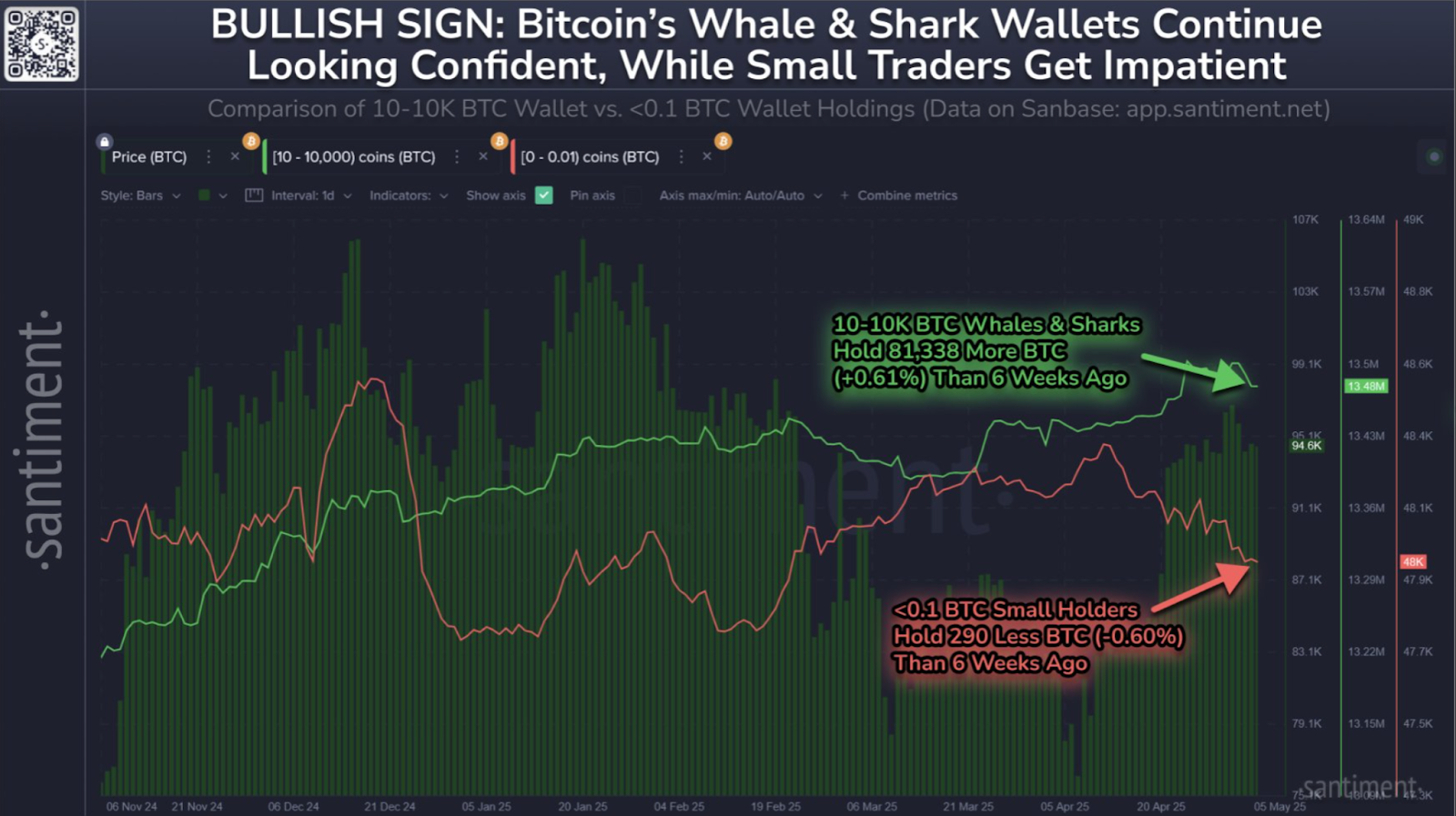

- Whales and sharks increased BTC holdings by 81,338 coins over the past 6 weeks.

- Retail wallets sold 290 BTC as Bitcoin approached the short-term holder cost basis.

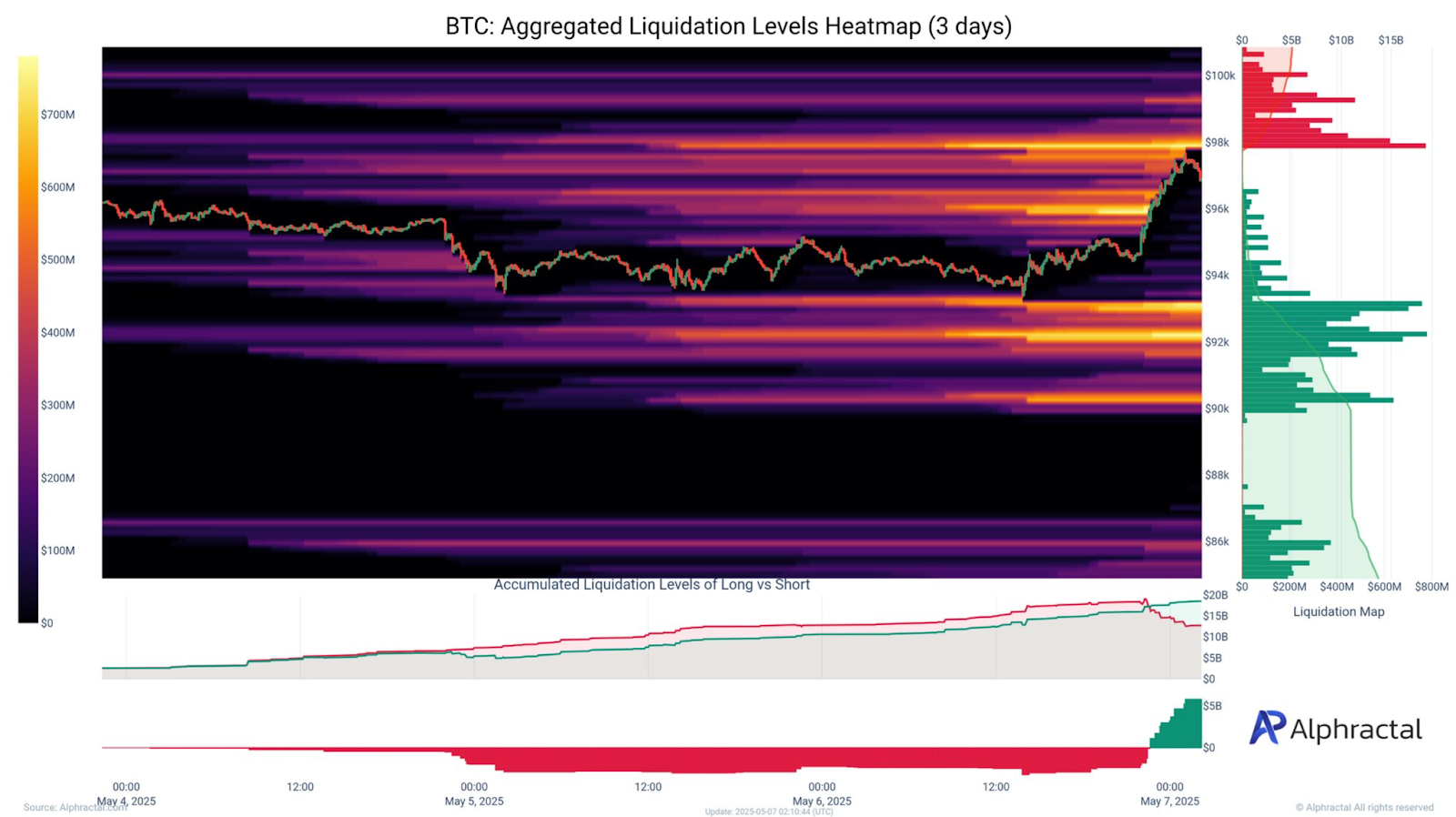

- Price is holding near $93,400, a key support level tied to recent liquidation clusters.

Large holders are accumulating over 81,000 BTC as retail wallets continue to sell. At the same time, the price is defending the $93.4K level, which lines up with the short-term holder realized price and key liquidation zones, an important area to keep an eye on.

Large Holders Accumulate While Small Wallets Exit

In the last six weeks, wallets with between 10 and 10,000 BTC have accumulated 81,338 BTC. According to data from Santiment, this is a 0.61% increase in holdings.

Because of their size and their behavior in volatile times, these wallets are often seen as key players in the market.

Meanwhile, wallets with less than 0.1 BTC have cut their balances by 290 BTC, or 0.60%. Usually, this group lags the market and reacts emotionally. It may be that they are impatient or fearful after recent price swings.

Large and small holders can diverge to give a broader market sentiment. It tends to indicate a longer-term confidence amongst experienced participants when larger wallets accumulate and smaller ones sell. Historically, this has been the case when Bitcoin consolidates before a price expansion.

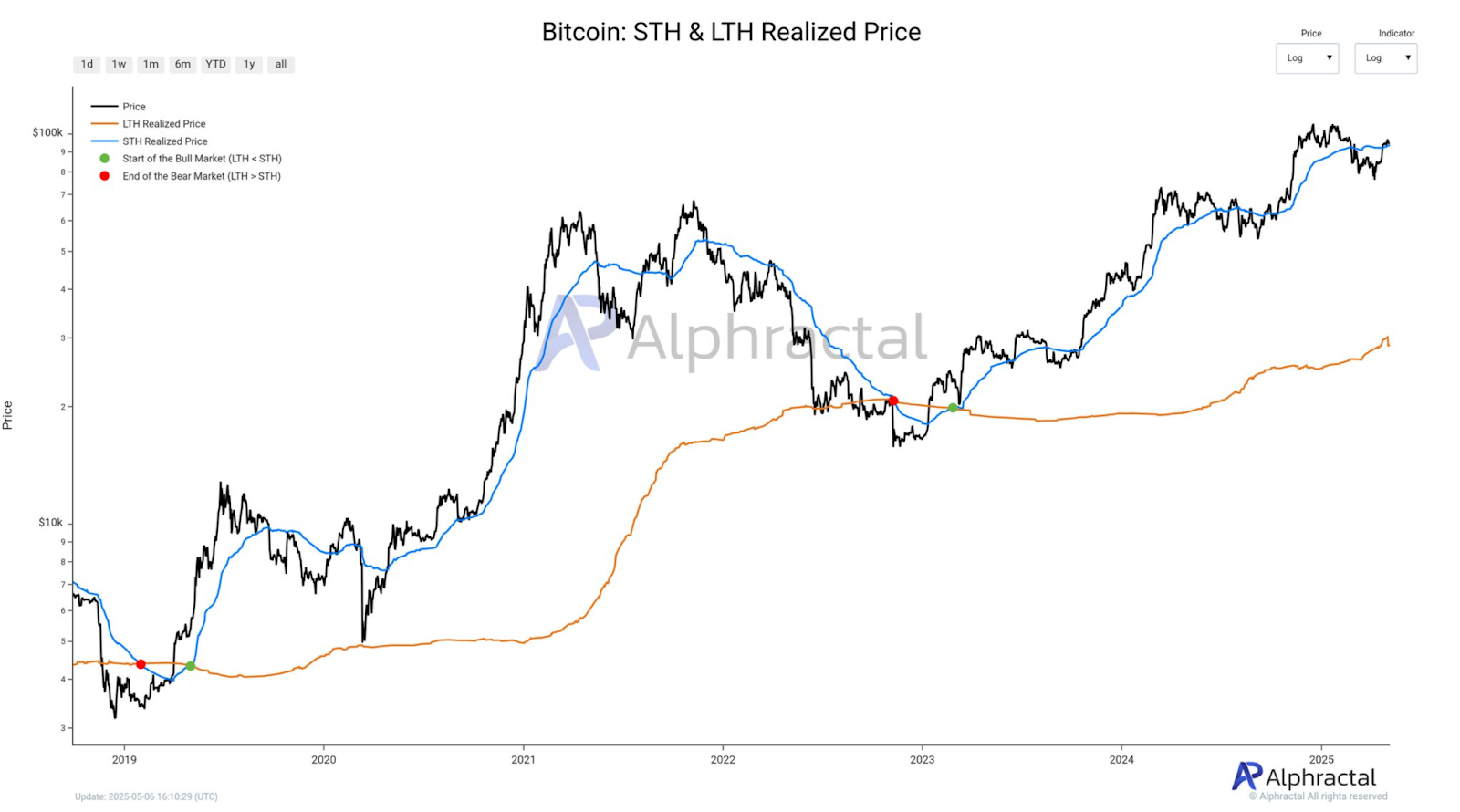

Realized Price Marks Key Support Around $93,400

At the time of writing, Bitcoin is just above the realized price of short-term holders (STH) at around $93,400. This metric is the average price of coins held by wallets that bought them in the last 155 days.

The recent price rise has returned many short-term holders to profit, according to Alphractal. As a result of this, this group has increased selling pressure. That could create more selling if the price falls below their realized cost basis.

But for now, the $93,400 zone is acting as strong support. In recent sessions, Bitcoin has bounced from this level multiple times, indicating that STHs may be attempting to defend their gains.

If this support holds, it could prevent a deeper pullback and help stabilize price action in the short term.

Moreover, looking at Bitcoin’s 3-day liquidation heatmap, we see that $93,000 has become a base of support.

A lot of selling and long liquidations have been absorbed here. Bitcoin has been able to stay within this zone despite pressure, with liquidation levels clustered heavily around $93K to $95K.

The map also displays strong liquidation bands above $96,000 and around $100,000. A breakout here could force liquidations of short positions in these areas. If Bitcoin starts to rise and enters these levels, it can lead to very fast price moves.

On the flip side, there are fewer liquidation levels below $93,000, so a drop below support could lead to new volatility.

Bitcoin Dominance Strengthens, Reflecting Market Rotation

Bitcoin dominance is still on the rise, reaching 65.11%, as it has been since early 2023. Dominance is the percentage of the total crypto market value that Bitcoin has.

Generally, a rising trend in this metric indicates that capital is leaving altcoins and returning to Bitcoin.

The current phase is very much in favour of Bitcoin, according to the OCM Dominance Trend model. The green trend line is always sloping upwards, and recent values are well above the long-term moving average.

Historically, this behaviour occurs during periods when Bitcoin outperforms the rest of the crypto market.

Furthermore, on the BTC/USDT monthly chart, we see a repeating pattern across past market cycles. Every major bull market has been about 48 monthly candles, or about four years. This has been the pattern of the 2013, 2017 and 2021 peaks.

In the current cycle, Bitcoin is in the 18th bar of what could be another 48-month structure. If this pattern holds, Bitcoin may still be in the middle of a longer-term trend.

The market also hasn’t yet reached the levels of speculative activity seen in past tops, and volume remains lower than in past peaks. Looking at historical data, price peaks have often been accompanied by spikes in volume and retail participation, which we don’t see yet.