The Xbox brand has undergone a transformative evolution, as evidenced by its latest campaign titled “This is an Xbox.”

Earlier today, the company released a 30-second ad showcasing its expanded vision. Set to Black Sheep’s 1991 hip-hop hit “The Choice is Yours,” the ad begins with a Series X console and the tagline “This is an Xbox.”

It then transitions to other devices such as a smart TV, smartphone, handheld PC, and laptop — all now defined as Xbox platforms.

This shift in branding aligns with the development of Xbox Cloud Gaming, which launched in 2019.

Coupled with Xbox games’ availability on PC for years, the ecosystem allows users to stream purchased games or titles from the Xbox Game Pass library across various devices, provided they have high-speed internet.

Fans React to the New Messaging

While the concept behind the campaign makes sense, it has stirred concerns among fans. Many worry Xbox may be abandoning its home console roots.

The anxiety stems from the lackluster sales performance of the current hardware generation. Reports from May indicate the PlayStation 5 has outsold Xbox Series X and S consoles by a nearly 5-to-1 ratio.

The concern has revived discussions about the “console wars,” a term that once described the fierce competition among gaming giants Nintendo, Sony, and Microsoft.

For some, the campaign seems like an indication that Xbox is shifting focus away from consoles in favor of cloud gaming. However, the reality is more nuanced.

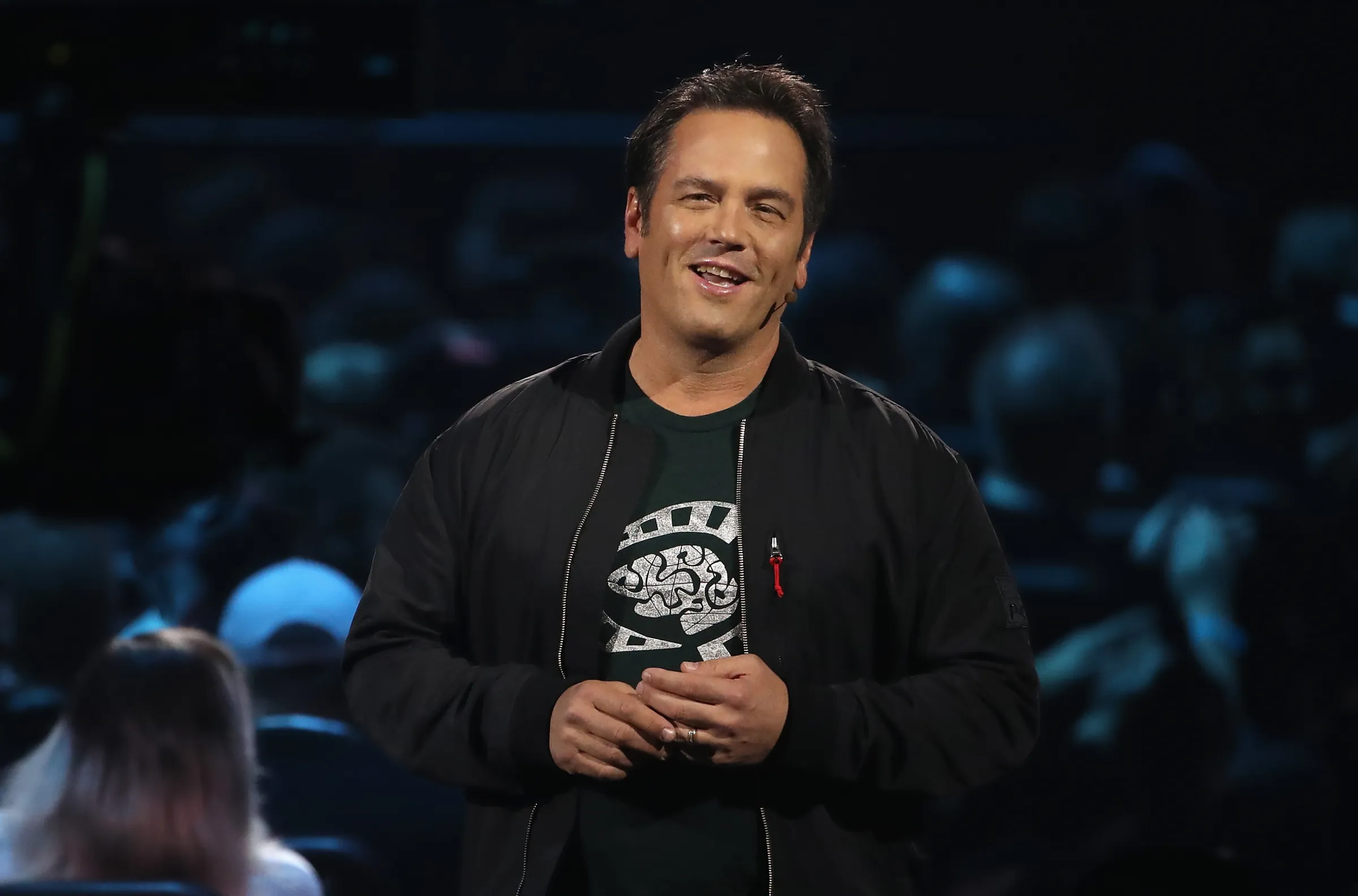

Phil Spencer on Xbox’s Future

In an interview, Xbox CEO Phil Spencer addressed these concerns and elaborated on the campaign’s intent.

He explained that the Xbox brand has evolved significantly since its inception. Originally a console—the “Direct X Box”—it has grown into an ecosystem emphasizing accessibility.

“Xbox isn’t just one device anymore. It’s on your smart TV, PC, phone, and we’re in the middle of that transition,” Spencer said.

He acknowledged that some fans might yearn for the simplicity of a single-platform gaming experience, but argued that today’s largest games transcend any one platform.

Having been with Microsoft since 1988 and part of the Xbox team since its 2001 launch, Spencer believes the brand’s core identity remains intact.

“The games, characters, and worlds should define Xbox, while platforms should enable players to enjoy those experiences wherever they choose,” he explained.

Expanding the Xbox Ecosystem

Microsoft’s acquisitions of ZeniMax Media in 2021 and Activision Blizzard in 2023 have significantly bolstered the Xbox library, bringing popular franchises such as The Elder Scrolls, Fallout, Doom, World of Warcraft, and Call of Duty under its umbrella.

Despite these major additions, Xbox has largely maintained cross-platform availability, launching many games on rival platforms like the PlayStation 5.

However, Xbox’s recent first-party offerings, including Redfall (2023), Starfield (2023), and Senua’s Saga: Hellblade II (2024), have faced mixed receptions.

While Starfield saw strong initial sales, its player base has since dwindled, even with the release of expansions like Shattered Space.

This, coupled with Xbox’s continued support for multi-platform releases, has fueled speculation about its future in the console market.

The Role of Consoles in a Changing Market

Spencer dismissed the idea that Xbox is abandoning consoles, stating, “We’ll definitely do more consoles in the future, and other devices.”

He noted, however, that the console market is not a growth sector. “Our biggest growth comes from PC and cloud gaming.

While we love our console customers, expanding Xbox means focusing on making games more available in more places.”

Among the “other devices” Spencer referenced is a potential handheld Xbox, aimed at capitalizing on the growing popularity of portable PCs like the Asus ROG Ally and Valve’s Steam Deck.

These devices, which often run Windows, integrate seamlessly with Xbox’s ecosystem, allowing players to transition effortlessly between their consoles and handhelds.

When asked about a mid-generation hardware refresh akin to Sony’s PlayStation 5 Pro, Spencer suggested it wasn’t a priority.

“We focus on hardware that creates unique value for players and developers. Incremental updates don’t necessarily offer a compelling new experience,” he said.

A Broader Vision for Xbox

For Spencer, the future of Xbox lies in expanding its definition beyond a single device.

Xbox Cloud Gaming exemplifies this mission, as the company aims to ensure the brand remains vibrant for decades to come.

“We’re redefining what it means to be an Xbox,” Spencer said. “Twenty years from now, Xbox needs to encompass multiple pieces of hardware and deliver a flexible, accessible gaming experience.”

This vision highlights Microsoft’s commitment to adapting its strategies while preserving the essence of what makes Xbox a leader in gaming.

As the industry evolves, Xbox aims to remain a pivotal part of the conversation, whether on a console, a PC, or a handheld device.