Key Insights:

- A whale investor lost $23.5 million on a 5x leveraged short position on $HYPE, the native token of the Hyperliquid protocol.

- The whale opened the short position at $20.40 and added $30.5 million in USDC, but $HYPE rallied to $35.86.

- The loss likely triggered the surge in $HYPE trading volume and wallet interactions.

- This incident shows the risks of high-leverage trading in crypto markets, and the importance of risk management.

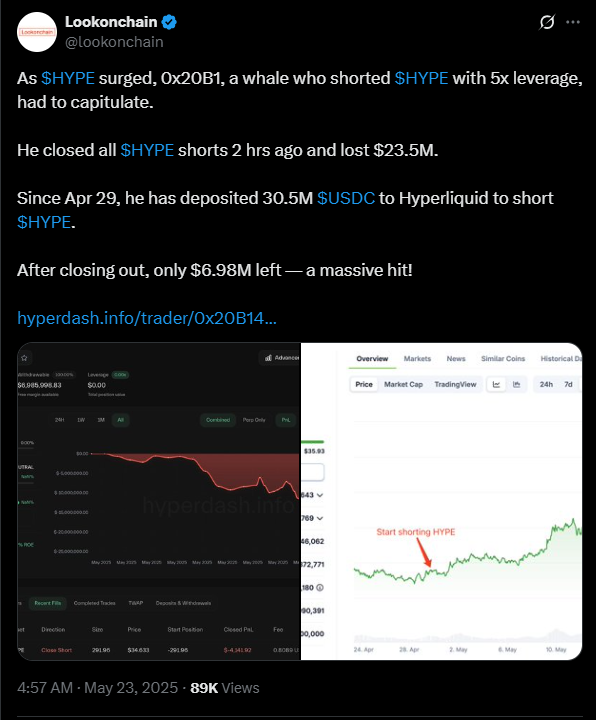

The crypto market just witnessed another spectacular loss. On 23 May, a whale with the wallet address “0x20b1…” closed a massive 5x leveraged short position on $HYPE, the native token of the Hyperliquid protocol. This closure did not end in a victory. Instead, it resulted in a massive $23.5 million loss.

This single trade set off alarm bells across the DeFi space, reminding everyone that this is not just a case of a trader losing it all. It shows just how quickly high-leverage bets can go wrong.

How the Trade Played Out

The story started on 29 April, whale 0x20B1 started pouring capital into Hyperliquid to short $HYPE.

Over the following 23 days, the trader added a staggering $30.5 million in USDC to the account, and was clearly confident that the price of $HYPE would drop.

Instead, the market turned against them. When May 8 came, the whale opened a short position at $20.40 using 5x leverage according to LookOnChain.

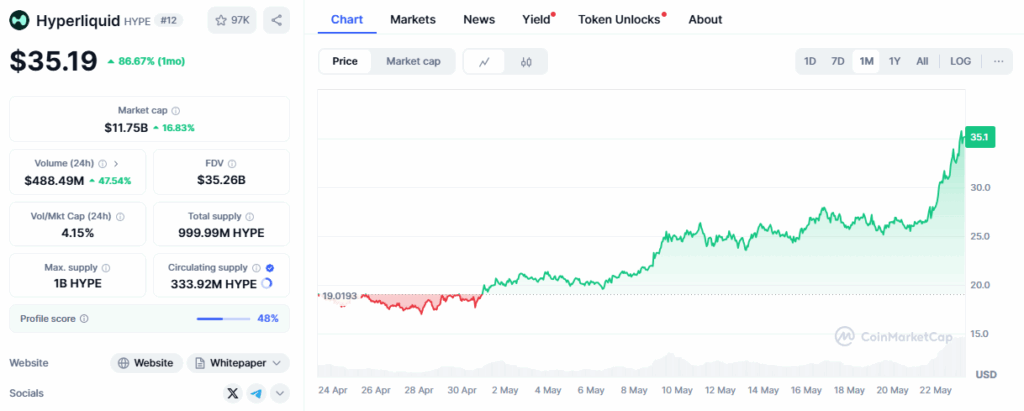

Essentially, they were betting with over $150 million worth of exposure. However, $HYPE didn’t fall as they expected. It rallied, hard. And by 23 May, its price surged to $35.86. At that point, the whale’s unrealized losses ballooned to $18.8 million.

Two hours before Lookonchain published their on-chain report, the whale finally capitulated. They closed the position and were able to salvage just $6.98 million of the original $30.5 million.

Market Reactions and On-Chain Insights

On-chain analytics platforms like Lookonchain and CoinMarketCap documented the ripple effects of this whale’s moves in real-time.

For example, $HYPE trading volume spiked to $482.25 million in a 55.76% increase. The token’s price change over the past 90 days also stood at 44.21%, which is almost enough to rival Ethereum’s price increase.

According to market observers, the liquidation came alongside a surge in unique wallet interactions, with over 10,000 addresses engaged with $HYPE in just 24 hours. This shows that investors were indeed interested in this cryptocurrency, with their trades likely fueled by FOMO.

This isn’t the first time that a whale has lost big on a major trade, and it likely won’t be the last.

In fact, early May saw one whale lose $3.32 million via an Ethereum trade on Hyperliquid. Another whale lost $4 million earlier than this in March. All of these case studies show that risk management in the crypto space (and any other financial market) is not optional.

What’s Next for $HYPE and the DeFi Market?

With the whale out of the picture, bullish sentiment around $HYPE may continue in the short term.

This liquidation continues to fuel the bullish momentum, and traders are now expecting a continuation of the upward price swings.

From a technical standpoint, traders are watching for a break above the $35.4 price level. However, considering the overbought condition of the asset, this break seems unlikely, and a rejection might be in the cards.

Still, if $HYPE breaks and holds above that level, the rally may have legs after all. On a much wider scale, this whale’s liquidation shows just how one whale’s liquidation can affect how traders approach crypto.