Key Insights:

- ETH accumulation jumped 22.54% from March 10 to May 3, totaling 19M ETH.

- Realized price dropped from $2,026 to $1,980, indicating strong buy-in at lower levels.

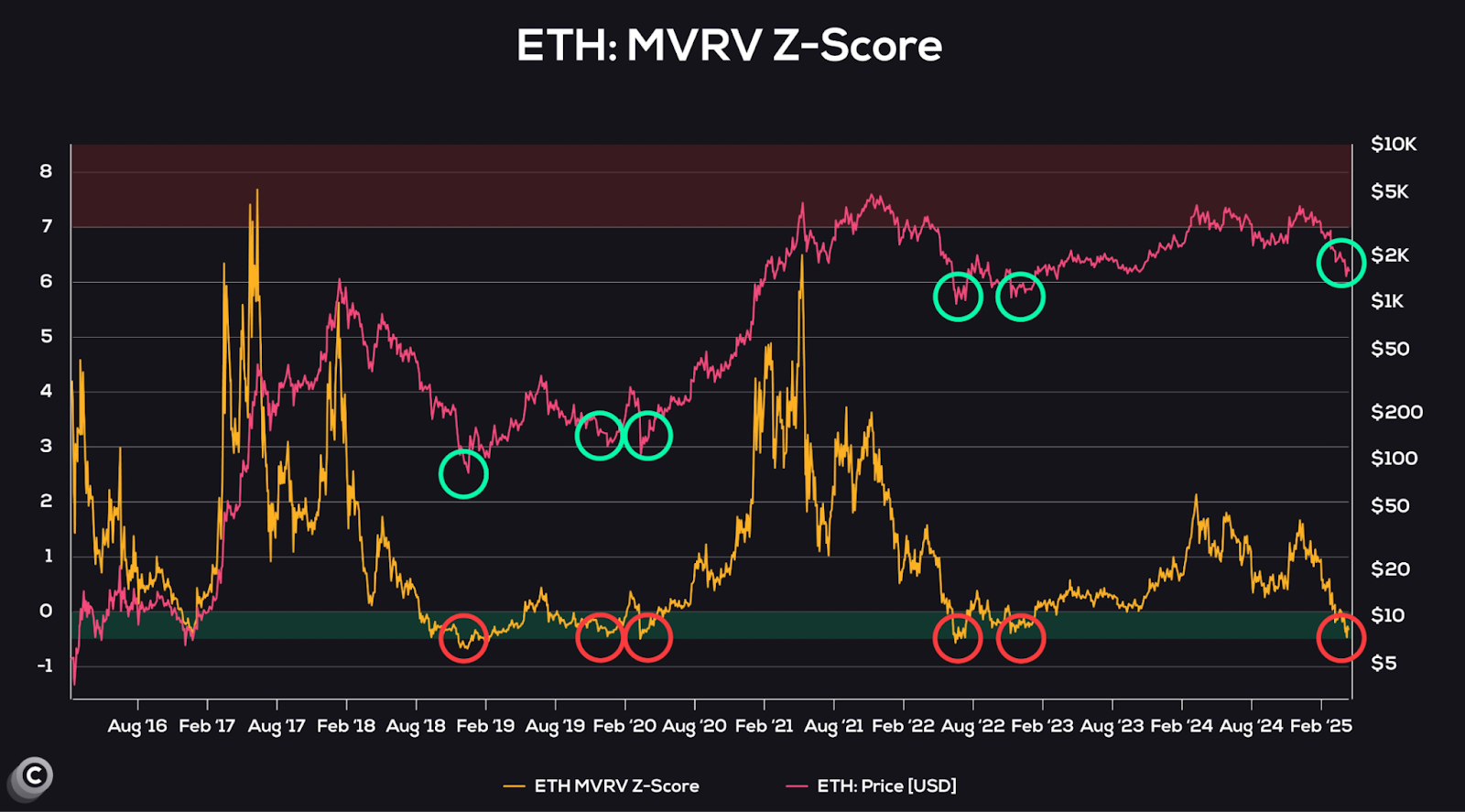

- MVRV Z-Score nears historic bottom zone, hinting at undervaluation and reaccumulation.

Ethereum holders are stacking more ETH while lowering their cost basis, a sign of long term conviction. In parallel, key valuation metrics indicate ETH is trading close to historical bottom zones, which could present an accumulation driven price recovery setup.

Ethereum Holders Increase Accumulation in 2025

According to CryptoQuant, Ethereum accumulation has risen significantly over the last two months. From March 10 to May 3, 2025, the quantity of ETH held by accumulation addresses increased by 22.54% from 15.5356 million to 19.0378 million. This is a consistent inflow into wallets that have historically not sold often.

Meanwhile, Ethereum’s price ranged between $1,866 and $1,833, indicating relatively stable price. The fact that buyers are not reacting to short-term volatility is the reason for this behavior. Rather, they seem to be gradually acquiring positions while decreasing their average entry price, or realized price.

Addresses With Lower Cost Basis Accumulate

Investors are averaging into the market, as the realized price by accumulating addresses has decreased.

The realized price for these addresses was $2,026 on March 10, when Ethereum’s market price was $1,866. By May 3, the market price was around $1,834 and the realized price was $1,980.

This movement demonstrates that accumulation is happening at lower levels and that holders are lowering their average cost basis. The lower the risk of a strong selloff, the closer the realized price is to the current market price.

However, when market prices are below the average entry of large holders, pressure to sell usually rises. But, in this case, holders seem happy to keep on purchasing.

Accumulating addresses reduce any potential losses in the short term as they reduce their cost basis. This is a common behavior when there is confidence in a longer-term move.

Ethereum Valuation Metrics Signal Undervaluation

The chart of MVRV Z-Score indicates that Ethereum is currently trading in a zone that has historically marked market bottoms. This is a metric of market value to realized value. It tends to reflect undervaluation when it enters the green band. Again the score is near zero in the current chart.

Dips in the past have occurred in early 2019, mid 2020 and mid 2022. These levels were always followed by strong rebounds each time. In those periods, price also traded sideways before going higher. Both the Z-Score and ETH price have been stable recently with no sharp deviation which usually precedes reaccumulation.

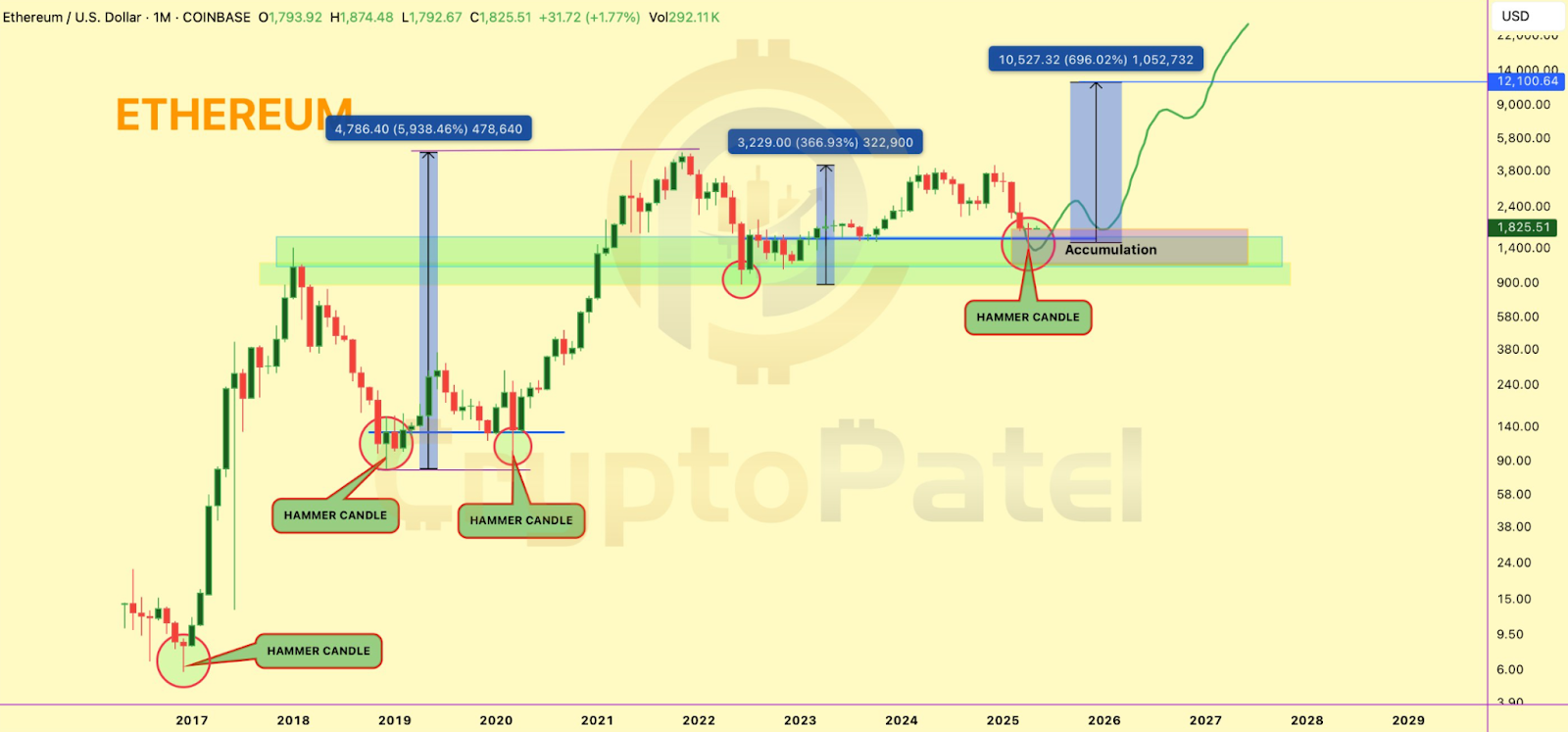

Technical Structure and Candlestick Pattern Support Bullish Setup

Meanwhile, hammer candlestick has formed in April 2025 in monthly charts. It occurs after a downtrend and usually implies a reversal. In the current configuration, the hammer is in an accumulation zone, as was the case in 2019 and 2020.

The price was near the green accumulation band, and in all previous examples shown, price had moved up strongly from past cycle lows.

Ethereum rose over 5,900% after 2020 to an all-time high. Past returns may not repeat, but these structures generally show strong support from buyers.

According to the chart, the current price is $1,825 and the accumulation zone is near $1,400 to $1,800. The setup is also supported by volume, as buying activity rises on the chart.

ETH Holders Show Structural Confidence

Even with market consolidation, Ethereum’s base is still growing. The total balance on accumulation addresses reached 19.0378 million ETH on May 3, compared to 15.5356 million ETH in March. This is a rapid buildup in just two months.

This added ETH was not a reaction to rising prices, as market price remained stable during this time. It was proactive.

These addresses are usually linked to long-term investors. Even if near-term price action remains subdued, their behavior shows increasing confidence in future price movement.

This is a trend of more ETH entering long-term wallets as the realized price moves closer to market price, and this is a reduction in speculative pressure. Ethereum may have stronger price support in the months ahead as long as accumulation continues and realized prices remain near current levels.