Key Insights

- Bitcoin is testing a major support level between $100,000 and $103,000, and a break below could lead to a drop towards $88,000.

- A bullish “cup and handle” pattern shows that a breakout towards $125,000 could be near despite the near-term uncertainty.

- While Bitcoin closed up 11% in May, a bearish divergence in the RSI shows weakening momentum.

Bitcoin is facing one of the biggest technical moments in recent history. The world’s largest cryptocurrency hit record highs earlier this year. It’s testing a crucial support level between $100,000 and $103,000.

If it fails to hold this zone, experts now warn that a massive correction could follow. Could Bitcoin be at risk of crashing to as low as $88,000?

The $100K Support Zone

According to technical analyst Master Ananda, Bitcoin’s most important support right now sits between $100,000 and $103,000.

In a recent TradingView post, the analyst pointed out that this range acts as the market’s line in the sand. If BTC dips below it, a deeper correction could follow and possibly crash prices to as low as $88,000.

Remember that Bitcoin recently pulled back from highs of nearly $112,000. It is now sitting uncomfortably close to that support. “If this level breaks,” Ananda wrote, “we could see Bitcoin enter a period of red candles and sideways consolidation.”

However, despite this risk, the analyst maintained that corrections are normal in an uptrend. If BTC holds this support, it could bounce back stronger and push past $130,000 in the next leg of the bull run.

The “Cup and Handle” Pattern Adds Hope

Despite the near-term uncertainty, not all signals are bearish. Another analyst, Mags, recently pointed out a bullish “cup and handle” pattern on the charts. This setup is often seen right before a breakout and the continuation of an uptrend.

If confirmed, the pattern could end with Bitcoin trading close to or above $125,000 in the coming weeks.

The breakout would also build upon Bitcoin’s earlier move past the $65,000–$70,000 resistance zone. Traders are optimistic about this technical pattern, seeing the recent dip as a temporary pullback. Many believe it’s setting up for a strong price surge ahead.

Bitcoin Posts Highest Monthly Close, But There Are Still Warnings

While May ended on a high note and Bitcoin closed the month up 11%, not everyone is convinced the bullish trend will hold without challenges. In a 2 June report, trader Crypto Tony pointed out that BTC managed to close the weekly candle above $104,500.

Keep in mind that this is an important price level dating back to December of last year. Still, technical indicators are starting to flash caution.

One of the most talked-about among these is the Relative Strength Index (RSI), which is now showing a bearish divergence. This means that while Bitcoin’s price has made higher highs, the RSI has made lower highs. As such, momentum could be weakening.

This type of divergence often signals an upcoming pullback. It becomes even more likely when the price approaches a key resistance or psychological level like $100,000.

Order Book and On-Chain Data Paint a Mixed Picture

Coinglass data reveals a significant liquidity wall above Bitcoin’s current price. Large clusters of orders are concentrated around the $113,000 level. This could mean that traders still expect upward movement, at least in the short term.

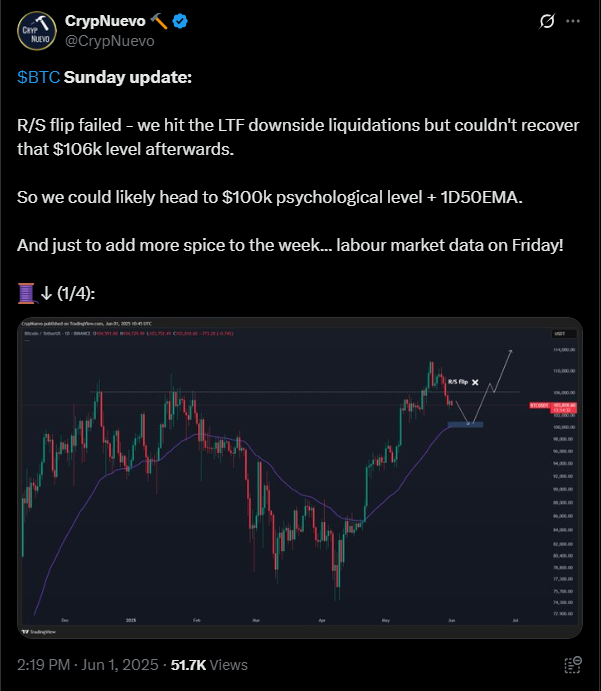

Trader CrypNuevo also noted that if Bitcoin successfully holds the $100K support, a rally to $113,000 seems likely. “Ideally, $100K to $113K,” he said in a recent market update.

Is the Bull Run Still Intact?

So, where does all this leave us? While the $100K support is a fundamental price level, the overall trend is still very bullish, at least for now.

A bullish chart pattern and the ongoing market liquidity all point toward another possible upward leg. However, investors should note that if $100K fails to hold, the next stop could be $88,000. This could lead to panic selling across the market.

It could gain strong momentum if Bitcoin holds its current level and climbs to $113K or beyond. This setup might fuel a surge toward the $130,000 mark.