Key Insights:

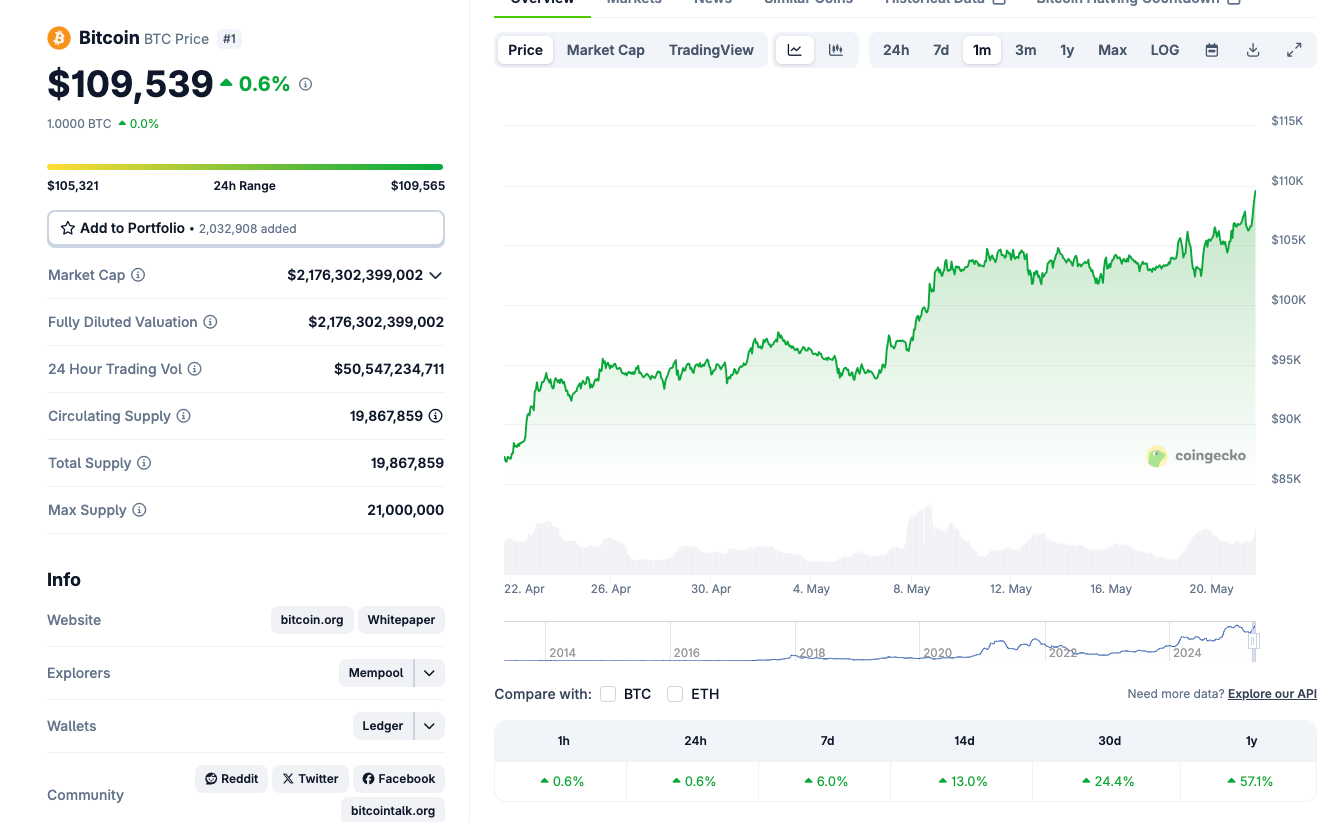

- Bitcoin reached a new all-time high of $109,565 on May 21 after weeks of consolidation above $100,000.

- The rally followed Texas’ approval for holding Bitcoin in its strategic reserve, boosting institutional confidence.

- Trading volume surpassed $44.5 billion, marking the highest level since May 9 and indicating strong market participation.

Bitcoin surged to a new all-time high of $109,565 on Wednesday, May 21, marking a significant milestone. The sharp rise came after weeks of consolidation above $100,000, signaling strong bullish momentum. With macroeconomic shifts and increasing demand from institutions, Bitcoin now targets the $150,000 level as the next potential stop.

Bitcoin Breaks Records as Capital Rotates From Gold

Bitcoin’s latest price surge reflects aggressive capital inflows as major holders continue accumulating. Whale entities, including Strategy and Bitcoin ETFs, have maintained steady buying pressure since early May. The price reacted sharply to Texas’s legislative approval allowing the state to hold Bitcoin in its reserves.

This new development intensified positive sentiment, pushing Bitcoin to $109,656 before consolidating near $105,000. It confirmed solid market participation as trading volume topped $44.5 billion, the highest since May 9. Contrary to this, on-chain metrics reveal that long-term holders don’t seem bothered, with no major distribution signs.

At the same time, capital is being withdrawn from traditional safe-haven assets to Gold as recession concerns rise. Meanwhile, gold ETFs recorded their largest outflow since 2013, at $2 billion, which was directed to the US, Japan, and offshore. This trend points toward a strategic reallocation of capital into Bitcoin as economic uncertainty increases.

Key Price Levels and Technical Signals Indicate Uptrend

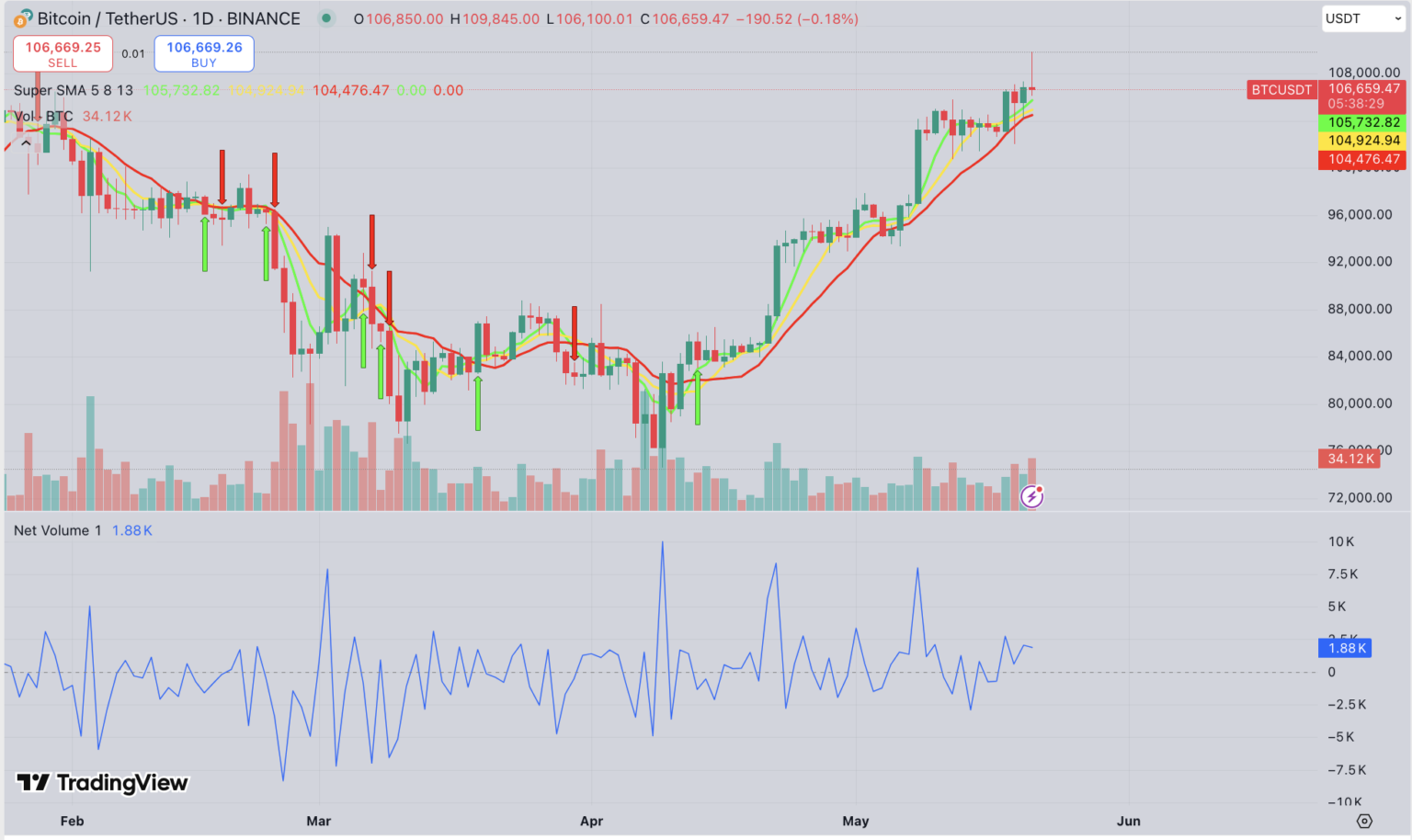

Bitcoin trades above key short-term moving averages, supporting a strong technical structure. The 5, 8, and 13-period SMAs—at $105,767, $104,946, and $104,489—remain aligned beneath current price levels. This alignment confirms continued upward momentum within a rising channel formation.

Bitcoin must clear $110,000 to confirm the next leg of the rally toward $125,000 and beyond. If price breaks and holds above this psychological barrier, increased volume could propel it toward $150,000. The latest wick to $109,845 and strong closing support at $106,834 suggest a resilient trend.

However, failure to hold above $105,000 could trigger a decline toward the $100,000 zone. The 13-period SMA remains critical support; a close below may indicate short-term weakness. Yet, sustained net positive volume of 1.69K suggests that buying pressure remains dominant.

Macroeconomic Signals Strengthen the Bullish Case

According to the data, the Consumer Sentiment Index fell to 50.80, a historically recessionary level. This development has pushed major funds to reduce exposure to US equities and increase positions in Bitcoin. Several leading hedge funds now hold long positions in Bitcoin while shorting traditional markets.

Market analysts say weakening stock performance and declining confidence are signs of a broader capital shift. With the US Fed expected to discuss rate cuts in June, monetary policy could further accelerate Bitcoin demand. The weakening dollar and de-dollarization efforts in global markets also enhance Bitcoin’s appeal.

At the same time, long-term support is furthered by government state-level adoption and strategic reserve planning. Institutional demand continues to grow as Bitcoin crosses $2.4 trillion in market capitalization. The data also shows entities with over 1,000 BTC sitting in accumulation mode, a sign the coins won’t be selling anytime soon, further supporting a sustained upside.

Bullish Outlook Ahead of Q3 as Bitcoin Maintains Strength

Bitcoin’s recent breakout has created a strong setup heading into Q3. However, top firms’ financial analysts say things will continue to rally if economic instability worsens. To date, good technical and macro signals still lead us to believe that $150,000 is a reachable target.

We show price action clearly, with higher lows as volume continues to rise. Consistent buying patterns tell us a story of a market controlled by the bulls. As profit taking occurs intermittently, traders push the price higher, with daily candle patterns forming long upper shadows. Bitcoin’s structural support between $104,000 and $106,000 remains intact, preventing deeper pullbacks.