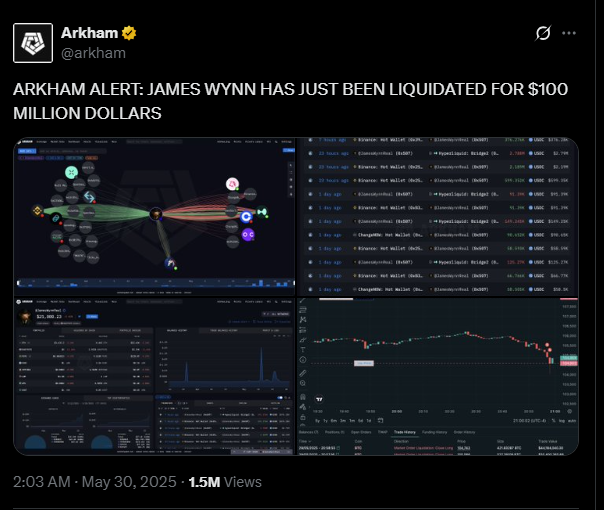

- Crypto trader James Wynn lost nearly $100 million on Hyperliquid via a 40x leveraged Bitcoin long position liquidated on 30 May.

- The massive liquidation happened despite Bitcoin only dipping by less than 2%.

- Wynn opened his over $1 billion leveraged position with just $3 million in collateral.

Something drastic happened in the hours between Thursday and Friday this week.

According to reports, a crypto trader known online as James Wynn lost close to $100 million after making a series of risky Bitcoin trades on Hyperliquid.

Considering Bitcoin’s relatively calm price movement, Wynn opened a 40x leveraged long position, which ended up getting liquidated on 30 May. Here are the details of how a single trader lost a staggering $100 million on the edge of crypto leverage trading.

A $1 Billion Bet on Borrowed Money

It all started with Wynn depositing $3 million in stablecoins into the Arbitrum-based trading platform, Hyperliquid. He used this capital as collateral to open a 40x leveraged position on Bitcoin worth more than $1 billion.

Keep in mind that at 40x leverage, any small move in the wrong direction can result in immediate liquidation, and that’s exactly what happened.

According to blockchain analytics from Hypurrscan, Wynn first entered his leveraged Bitcoin long position at an average price of $107,993. As Bitcoin prices fluctuated in a tight 2% range, Wynn’s position came under fire, especially as he continued to pump funds into the trade rather than reduce exposure.

Death by a Thousand Cuts

While most liquidation events come after strong price drops, Wynn’s position took a different approach. Bitcoin never crashed. Instead, it slipped just under 2% to around $106,000.

However, because of the extreme leverage Wynn had used, this dip was enough to wipe out the margin.

In total, Wynn had three major positions liquidated, including 527.29 BTC (~$55.3M) at $104,950, 421.8 BTC (~$43.9M) at $104,150, and 94 BTC (~$10M) at $106,330

In total, 949 BTC worth roughly $99.3 million were liquidated in just over 24 hours.

Interestingly, on-chain records showed Wynn had increased his position to $1.25 billion on 24 May, only days before the losses started to mount.

Big Risks and Big Mouth

James Wynn is no stranger to risky gambling in crypto. He first became popular in 2023 after successfully predicting PEPE’s price explosion before it hit a market cap of over $11 billion by late 2024. This call earned him tens of millions in profits along with thousands of followers on Twitter (now X).

However, Wynn is also known for boasting about his wins and defending his losses with cryptic posts and memes sometimes. After the liquidation, he posted a still from the 1999 movie, The Matrix, which showed Neo stopping bullets in mid-air.

Earlier in the week, Wynn even described himself as an “extreme degenerate” gambler and openly admitted that he doesn’t follow any sort of risk management strategy.

“I stand to lose everything,” he wrote. “I strongly advise people against what I’m doing.”

Community Reactions To Wynn’s Loss

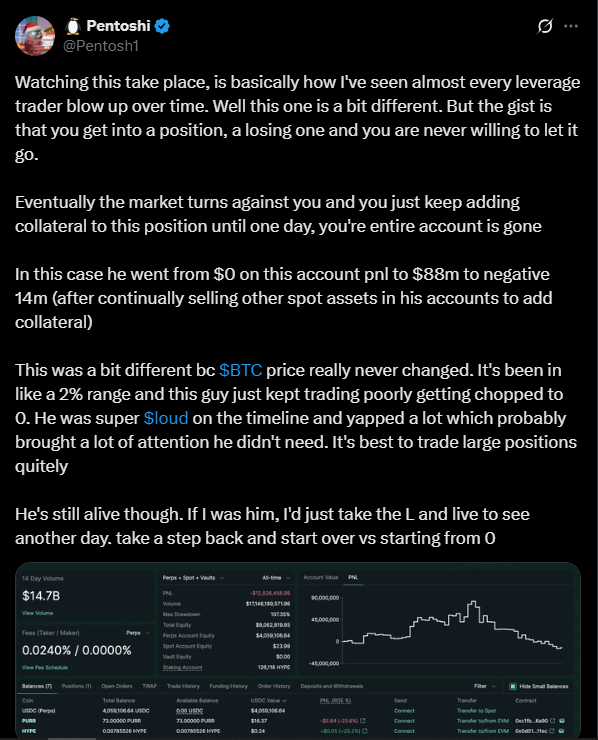

News of Wynn’s misfortune spread quickly across the crypto space, with another trader, “Pentoshi,” commenting that this liquidation was unlike others he had seen.

He also criticized Wynn’s online behavior, saying,

According to Hypurrscan, he still holds an open 40x leveraged position, which is sitting at an unrealized loss of $3.4 million. This means that after losing nearly $100 million, Wynn is still rolling the gambling dice.

Overall, it is worth noting that crypto will always attract risk-takers, and some will win big while most might lose. Wynn’s loss stands as a major example of how dangerous high-leverage bets can be, even in relatively stable markets.