Key Insights:

- Bitcoin whale wallets add over 79K BTC in a single week during price consolidation.

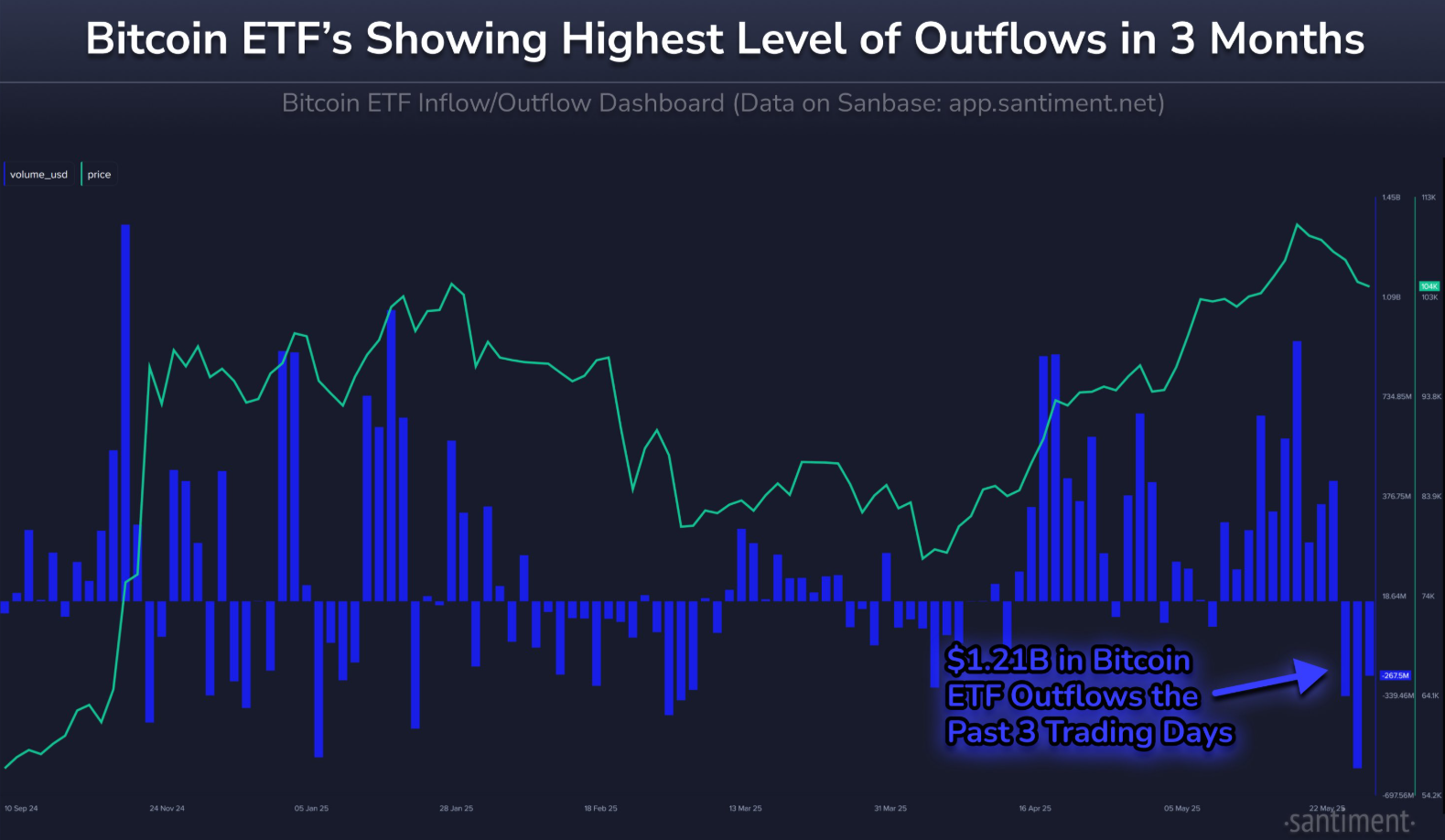

- ETF investors withdraw $1.21B in 3 days, marking largest outflow in 3 months.

- BTC hovers at $105.5K with key resistance at $106.8K and critical support near $103.4K.

Bitcoin price is stuck under a key resistance zone at $106.8K with little price action but growing on-chain activity. Despite a flat market, whales added 79,244 BTC over the last seven days, adding to confidence.

Meanwhile, institutional ETF flows saw $1.21B in outflows over three trading sessions. The sharp divergence in behaviour between spot whales and ETF holders has split short-term sentiment.

Whale Wallets Accelerate Accumulation as Supply Tightens

Large wallet holders are accumulating Bitcoin. Santiment data showed that wallets holding 10 to 10,000 BTC added a total of 79,244 BTC over seven days. This now includes 151,820 wallets, which shows a broad and steady accumulation of holdings.

Moreover, analyst Ali reported that large holders added more than 30,000 BTC in just 96 hours. This kind of behaviour is often associated with high conviction among long-term investors, even if there is muted price action. Whales usually accumulate when they expect higher prices or think that current prices are fair entry points.

With this rise in holdings, there is also less supply on exchanges, which could lead to price volatility. The massive buying volume Bitcoin is seeing currently is not resulting in any price movement, and the trading zone around $105,500 is stable, which could mean sell pressure is being suppressed.

Any spike in demand, with supply continuing to tighten, could lead to strong upward momentum in the near term.

ETF Redemptions Raise Short-Term Concerns Despite Spot Demand

Spot whales continue to pile up, but institutional investment vehicles are seeing big outflows. The largest drawdown in three months, Bitcoin ETFs saw $1.21 billion in outflows over three consecutive trading days. It is a change from earlier months, which saw steady inflows.

These outflows may be profit-taking, broader macro risk or short-term fund managers losing conviction.

Whale wallets that hold Bitcoin directly are different than ETF investors who manage positions based on macro cycles and fund mandates. The difference may be why ETF behaviour is so different from whale accumulation trends.

The withdrawal activity also injects short term uncertainty, especially if ETF selling continues in a low volume trading environment.

Some institutional buyers, however such as Fidelity and ARK Invest, bought $275 million worth of Bitcoin, demonstrating a mixed interest among institutional buyers.

Bitcoin Remains in Tight Range Between Supply and Demand Zones

Bitcoin is still consolidating below the $106.8K resistance zone, despite strong underlying wallet activity. Recent rejection from the $106.8K supply level is a clear CHoCH → BOS → Retest structure according to technical charts. At press time BTC is trading at $105,329 with 24 hour volume at $46.1 billion.

Bitcoin must break above the $106.8K level, which is a major supply barrier, for a bullish continuation. If price breaks above this resistance, targets could be at the $111K zone. However, if price drops below $103.4K, a deeper pullback to sub $100K becomes more likely.

In recent sessions, support at $104.2K has held firm and is a clear short-term range. Near-term direction will depend on breakout confirmation on either side of the market.

Meanwhile, the put/call open interest ratio in the options market is down, indicating that traders are less convinced.

The confluence of technical, on chain and derivatives data is in agreement that Bitcoin is on the cusp of a major move, either towards a continuation of the momentum or a further downside correction.