Key Insights:

- The worldwide bond market is in the middle of serious stress because of rising yields and increasing national debts across the US and Japan.

- US 30-year Treasury bond yields recently hit 5.15%, a level not seen since before the 2008 financial crisis.

- Japan, the largest foreign holder of US debt, has ended its ultra-loose monetary policy.

The worldwide bond market appears to be cracking under the weight of rising yields and international debt. While this is happening, Bitcoin appears to be breaking free from trad-fi narratives and preparing to surge.

What once seemed like a “speculative gamble” is now becoming more and more recognized as a valid alternative to legacy financial instruments. This convergence of economic stress, sovereign debt and the search for value could just be what Bitcoin needs to grow. Here are the details of this financial wave and what it means for Bitcoin.

The Bond Market Under Siege

The worldwide bond market, which has long been considered the standard of financial safety is facing major issues. At the time of writing, Bond yields in major economies like the United States and Japan are rising at an alarming rate. This trend shows that there are ongoing concerns about fiscal sustainability and inflation.

As an example of this trend, 22 May saw the yield on the US 30-year Treasury bond hit a peak of 5.15%, which is a level unseen since before the 2008 financial crisis. Meanwhile, the yields on shorter-term US debt are still sky-high, with the 10-year at 4.48% and the 2-year at 3.92%.

This increase in yields shows that investors are leaning towards the sentiment that the US is entering a “higher for longer” interest rate environment. The spread between the 5-year and 30-year bond has now widened to 1%, which again, has not been seen since 2021.

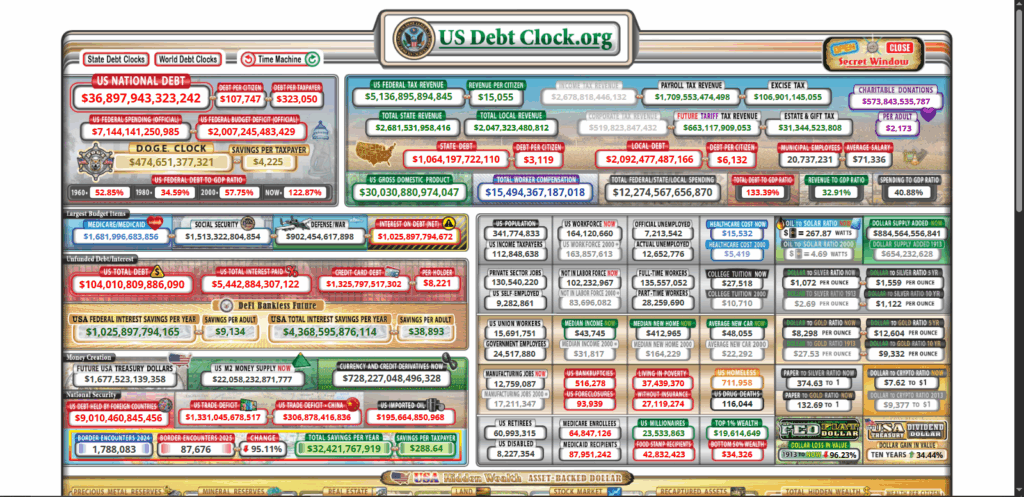

Historically speaking, trends like these tend to point towards persistent inflation and slower economic growth in the future. Adding fuel to the fire is America’s increasing national debt. The country’s national debt has now broken above the $36.8 trillion mark, with interest payments expected to hit $952 billion in 2025 alone.

Investors are already questioning how viable US Treasury securities are likely to be as safe-haven assets.

Japan Joins the Debt Crisis Conversation

It’s not just the United States facing issues. Japan, the largest foreign holder of US debt, has started raising interest rates for the first time in decades.

In March 2024, the Bank of Japan raised its benchmark rate from -0.1% to 0.5% and effectively ended its era of ultra-loose monetary policy. This development has sent long-term Japanese bond yields through the roof, with the 30-year bond reaching an all-time high of 3.1%.

The 20-year yield also jumped to 2.53%, which is a level unseen since 1999. Interestingly, Japanese Prime Minister Shigeru Ishiba described the country’s fiscal condition as “worse than Greece,” especially with the country’s 260% debt-to-GDP ratio.

As the domestic yields rise and the yen strengthens, Japanese institutions (especially traditionally heavy buyers of US Treasurys) may start dumping their positions. This would add even more pressure on the US bond market and make worldwide financial policy harder to deal with.

Bitcoin Is The Answer

Ordinarily, these rising bond yields would spell doom for risk assets like Bitcoin and stocks. However, what we’re seeing now is a major move away from that script.

Bitcoin is not just surviving, it is outperforming almost every major asset class. This trend shows that investor psychology is changing with the times. Instead of investors dumping their positions, institutional and retail investors alike are rushing towards assets outside the fiat debt-based system.

Bitcoin has a fixed supply and decentralized nature, and is therefore a major alternative to fiat. This explains why Bitcoin is no longer the experiment it used to be. It is now both a high-growth asset and the perfect safe haven.

Institutional Confidence on the Rise

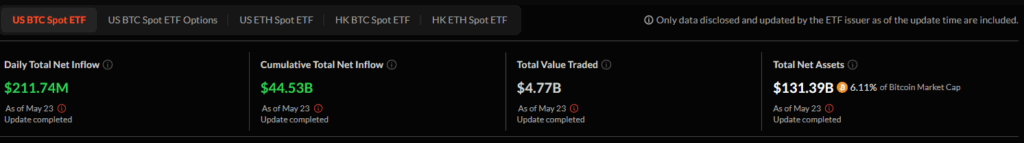

Already, Bitcoin is starting to experience a surge in institutional interest. As of May this year, assets under management in spot Bitcoin ETFs have broken above the $104 billion mark, according to Soso Value. This inflow of capital shows that there is growing trust in Bitcoin as a long-term store of value, just like gold.

According to data from the Bank of America, a net 38% of institutional investors were underweight US equities in early May, which stands as the lowest allocation in a year.

As it stands, the confidence in traditional markets is eroding and many investors are now choosing Bitcoin over stocks and bonds.

Bitwise recently noted in a recent report, that Bitcoin is on track to bring in over $400 billion in inflows by 2026. Ark Invest’s Cathie Wood also noted recently, that BTC will likely grow at a compound annual (CAGR) rate of 58% to $1.5 million per coin before 2030.