Key Insights

- Bitcoin price predictions remain bullish with a $117K target despite retreating to $109K.

- Funding rates and realized profits remain low, suggesting the rally may still have room to grow.

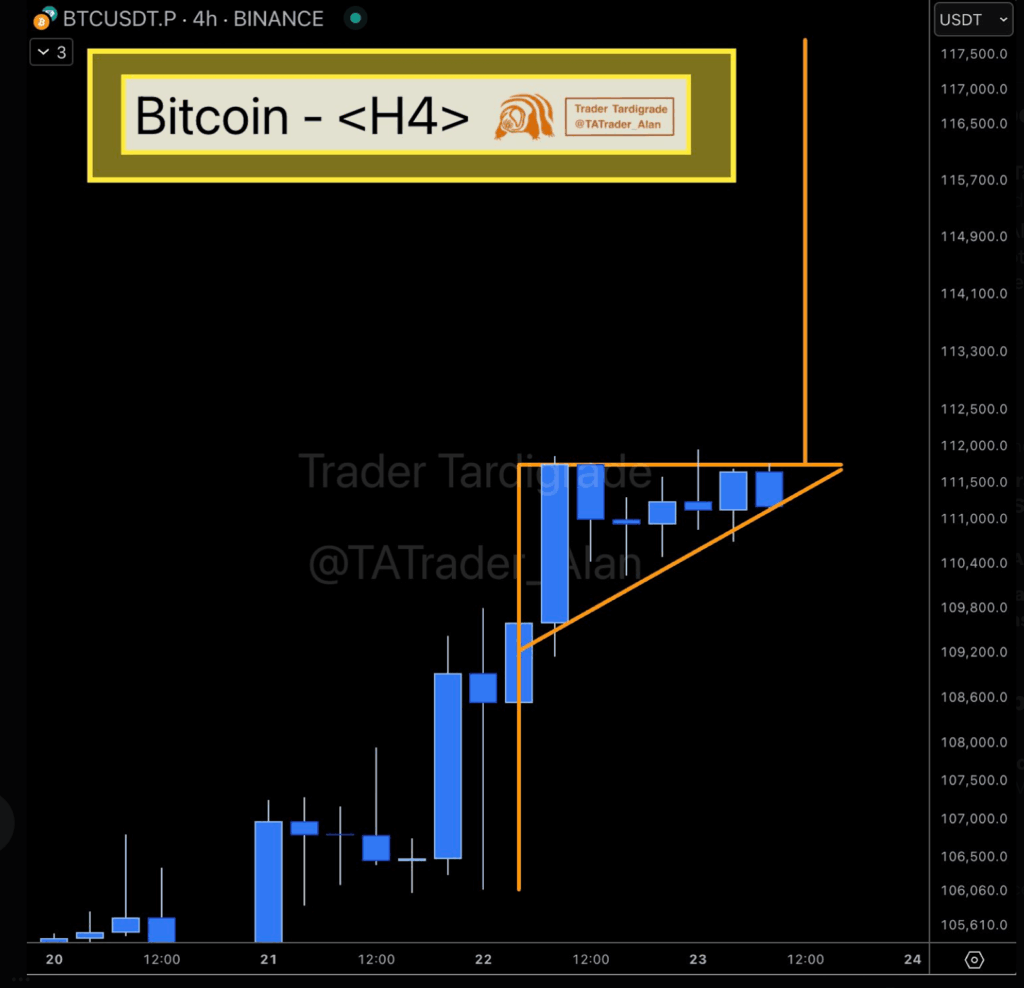

- Bull pennant pattern on the 4-hour chart signals a possible breakout toward the $117K level.

Bitcoin has dropped to $109K after hitting a new high of $ 111.8 K. Still, there is no evidence that the market is overheating. Neutral funding, low realized profits and a rise in U.S. institutional activity make the $117K objective still viable.

So far, the recent drop hasn’t led to major selling, and traders are still waiting for a breakout from the current bull pennant. Bitcoin could be preparing to rise further if it keeps receiving strong backing from institutions.

Pullback Fails to Break Bullish Bitcoin Price Predictions

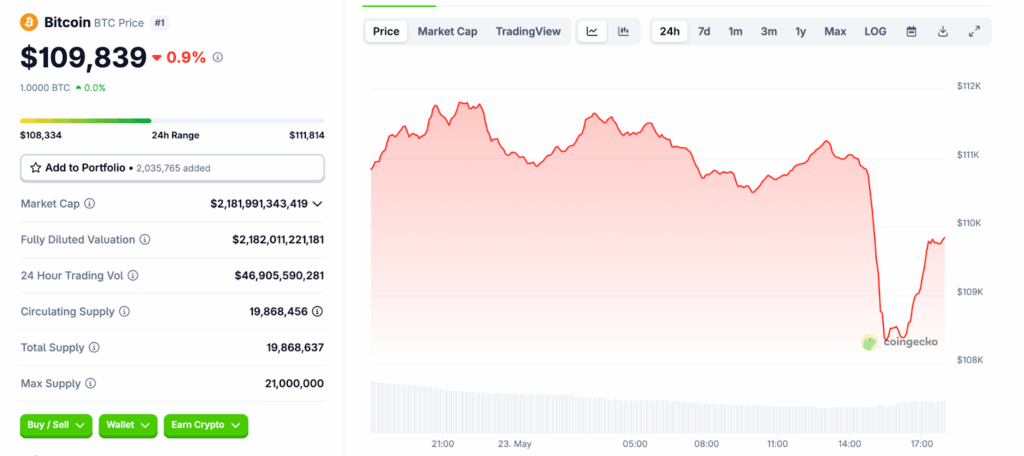

Bitcoin hit a record high of $111,814 and then fell to $109,839, for a 0.9% decrease over the day. Even with the decrease, the price is still within the weekly range of $102,381 to $111,807 which suggests it’s moving forward.

The chart shows that prices fell sharply at 14:00 UTC, but then quickly rebounded. Even during this brief pullback, there is still a lot of buying and selling of Bitcoin, as the 24-hour trading volume is close to $46.9 billion.

Funding Rates and Profit-Taking Remain Low

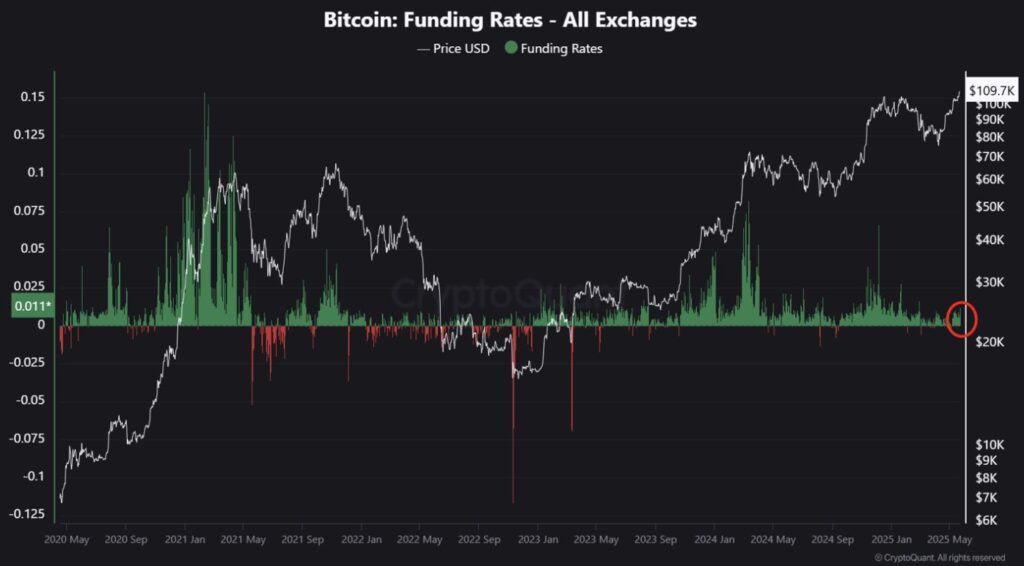

CryptoQuant shows that funding rates on perpetual futures are still neutral at 0.011, despite hitting a new record high. In the past, when markets were overheated, funding rates were much higher, but now they are not.

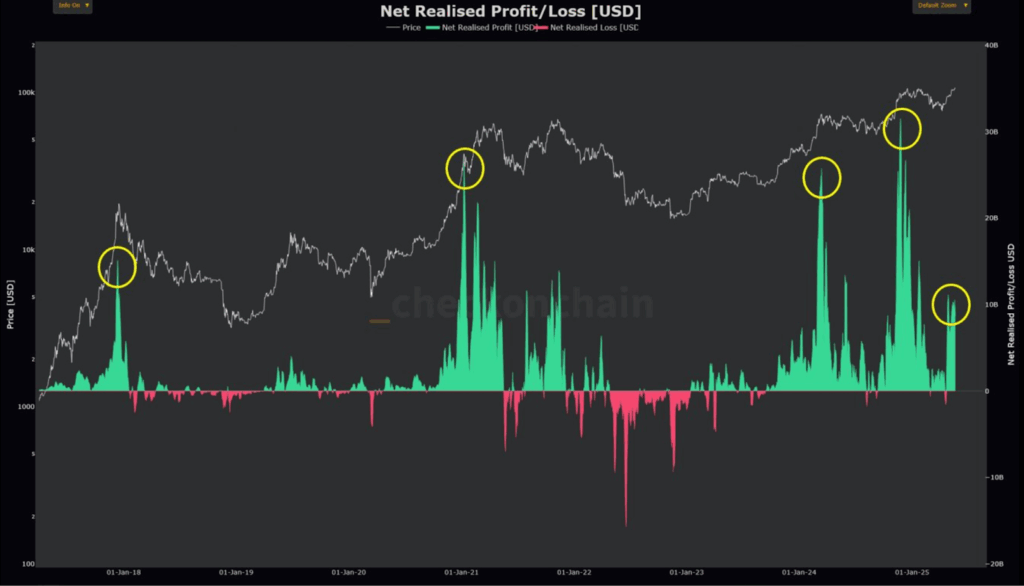

Additionally, the profits shown on the net realized profit/loss chart are still far below the highest points reached in early 2021 and late 2023.

So, it seems that short-term holders are not dumping their coins, and the rally could be driven by institutions or long-term investors.

As CryptoQuant reported, the funding rate and short-term capital inflow are currently lower than they were at previous highs.

This situation could lead to higher prices because, in the past, high funding rates and realized profits have often led to record highs.

U.S. Institutional Inflows Continue to Support Price

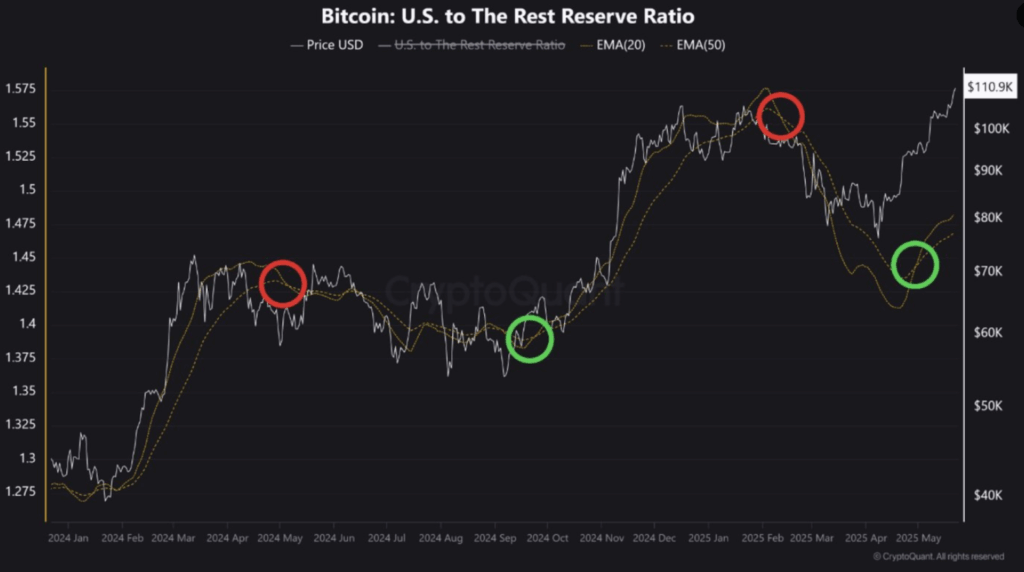

Meanwhile, there is a clear upward movement in the reserve ratio chart for U.S. exchange holdings compared to the rest of the world.

The ratio has now moved above its 20-day and 50-day EMAs, which has often been followed by strong price increases in the past.

Data from CryptoQuant shows Bitcoin price soared last year when U.S. entities started to accumulate more Bitcoin.

Since October 2024, it has risen above $70,000, in large part because of U.S. institutions buying more.

The chart also displays two recent green circles, one for October 2024 and the other for May 2025, which both mark the point where the EMAs cross.

In the past, these patterns signaled the start of multi-month bullish trends, so another could be on the horizon.

Technical Setup Confirms $117K Bitcoin Price Predictions

A bull pennant has formed on the 4-hour chart, and the price is now consolidating just below the resistance line at $111,000. According to Trader Tardigrade, if the token continues to rise, it could reach $117,000.

From the point the pattern broke out at $105,000 to its top at $111,000, the flagpole totals almost $7,000. Should Bitcoin break above the resistance line, it could see a measured move taking it to around $117,000, in line with positive market predictions.

But if the support at $108,334 is broken again, traders could see the price retest the $105,000 zone, which was resistance before the breakout.

Overall, bitcoin price predictions remain tilted upward as long as BTC holds its current range. With on-chain metrics still neutral and U.S. accumulation rising, the path toward $117,000 remains open.