Key Insights

- Whale short positions drop sharply, signaling reduced sell pressure and a shift in large investor sentiment.

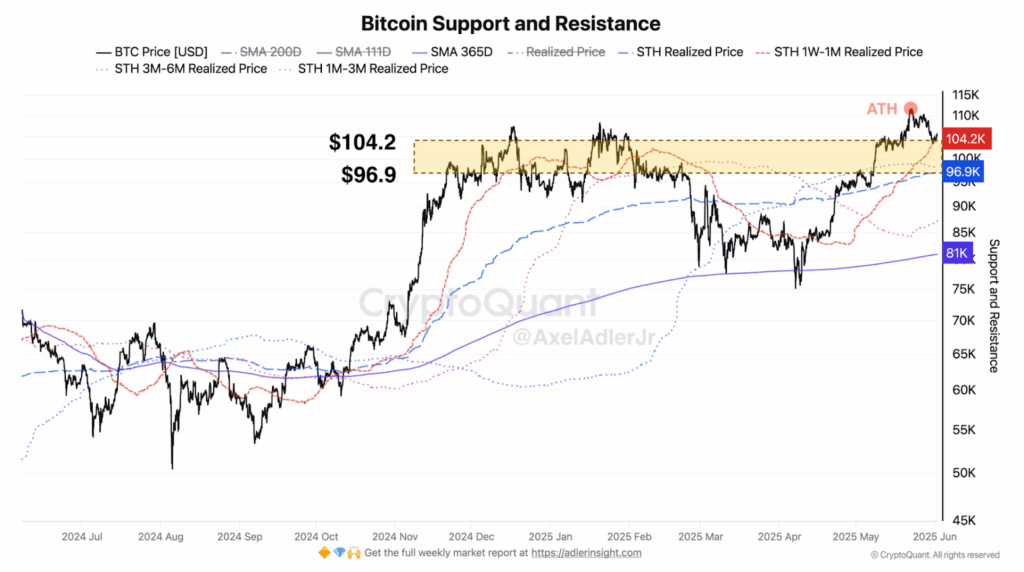

- Bitcoin holds key support between $96.9K and $104.2K, supported by short-term holder realized price data.

- Exchange reserves have fallen by 668K BTC since November 2024. This highlighted continued accumulation across long-term investors.

After a large drop in whale short activity and continued exchange reserve outflows, Bitcoin looks set for a relief rally. On-chain strength continues to support market structure. However, weak retail interest could hold back any aggressive upside.

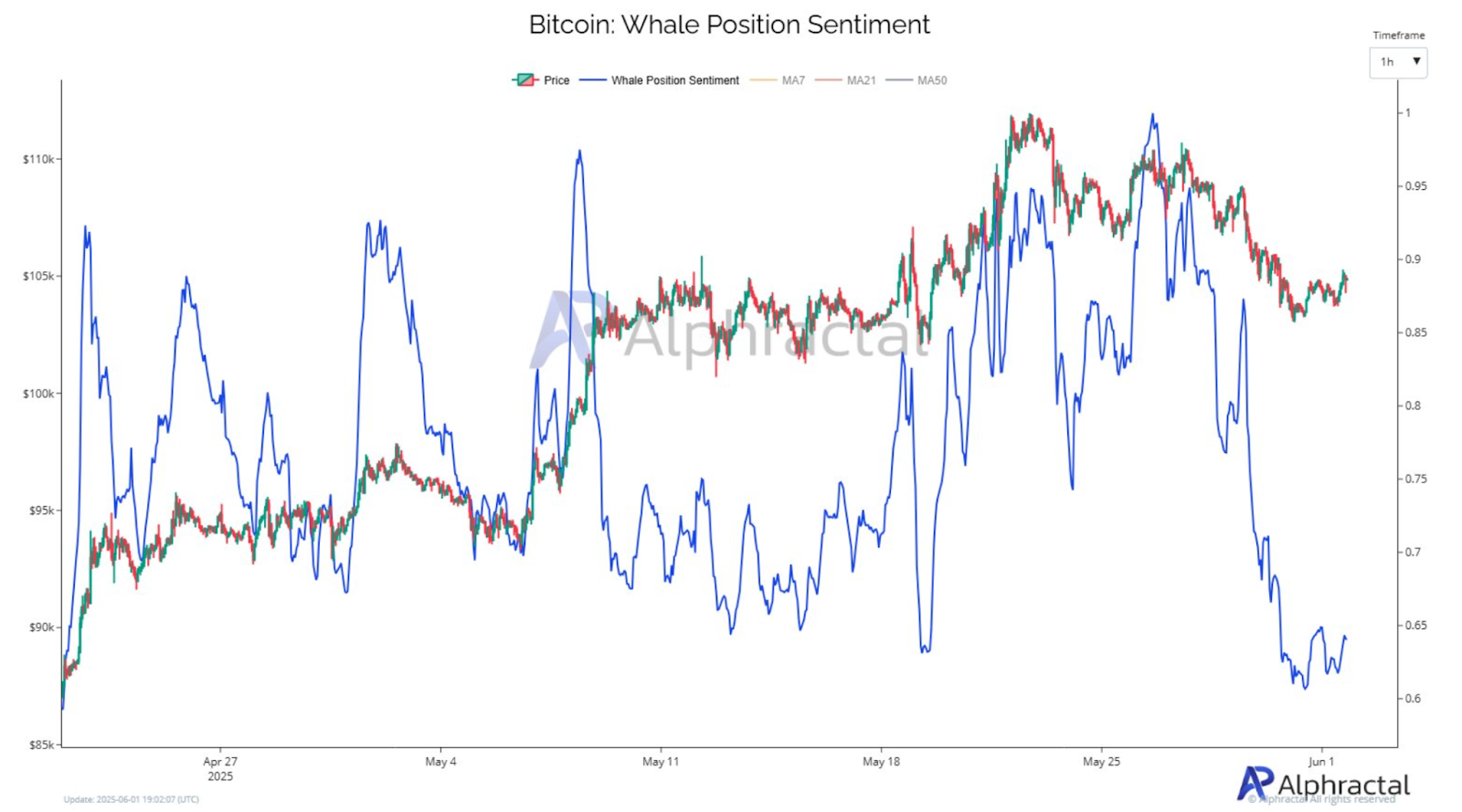

Whale Shorting Declines, Changing Sentiment Dynamics

This week, Bitcoin whales have pulled back from heavy shorting activity, a notable change in market sentiment. This eases off bearish positioning by large holders. It reduces downward pressure and stabilizes price action around current levels.

Whales have a lot of influence on the market, and their early positioning often dictates the direction of the bias. It usually means that their short exposure is weak, and they will likely turn neutral or bullish.

This is a sign of lower conviction in downside continuation, hence room for price consolidation or recovery. Moreover, the market has reacted positively by holding above $104,000 despite the broader uncertainty.

This stabilization above key technical support reflects improved confidence among participants. However, Bitcoin must reclaim the $107,500 resistance level convincingly to confirm a trend change and trigger additional bullish momentum.

On the 4-hour chart, price is consolidating inside a descending channel pattern. Technicals suggest a target of $117,000 if bulls can keep the pressure, break out of the channel, and flip $107,500 into support.

However, a failure to hold above $103,500 would invalidate the setup and could turn control back over to sellers.

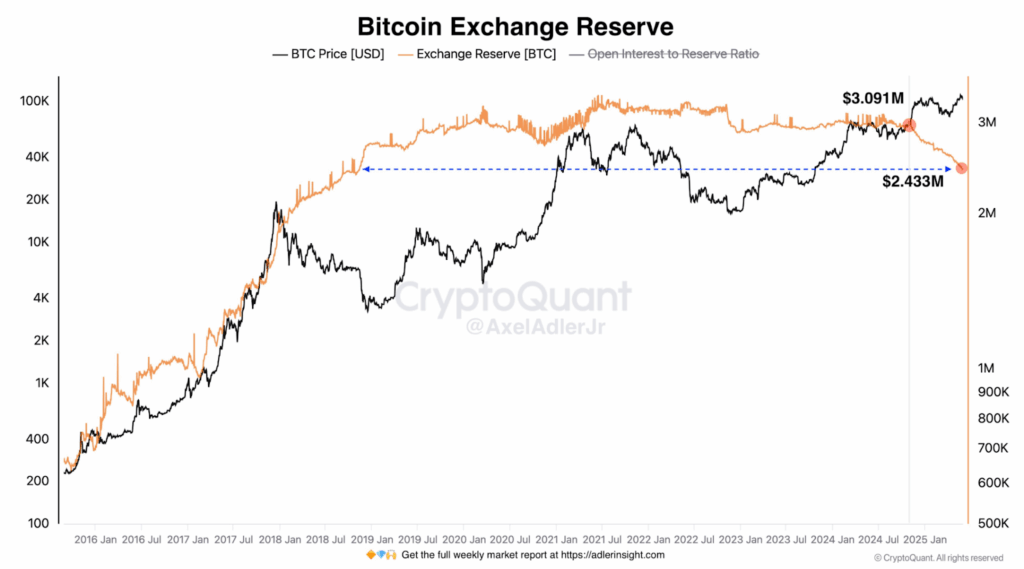

Falling Exchange Reserves Point to Continued Accumulation

Another bullish trend is seen via ongoing accumulation as centralized exchange reserves continue to decline, as on-chain data shows. From November 2024, over 668,000 BTC have been drained from exchange wallets. As a result, the total supply on exchanges is down to just 2.43 million BTC.

Lower reserves mean investors are moving coins to cold storage for long-term holding. At scale, this decreases the size of the available supply to trade, especially when there is little new issuance. This just adds to the scarcity narrative that has often been the case in major Bitcoin bull runs.

This does not mean supply has been exhausted, but it does indicate reduced sell-side liquidity. This means price is more sensitive to demand spikes.

In short, fewer coins on exchanges means less demand is needed to increase prices. At the current price, buying the entire available supply would cost over $253 billion.

Much of this trend is likely driven by institutional participants as ETFs and other vehicles increase Bitcoin exposure. However, retail momentum is still missing, which is holding back any breakout for now.

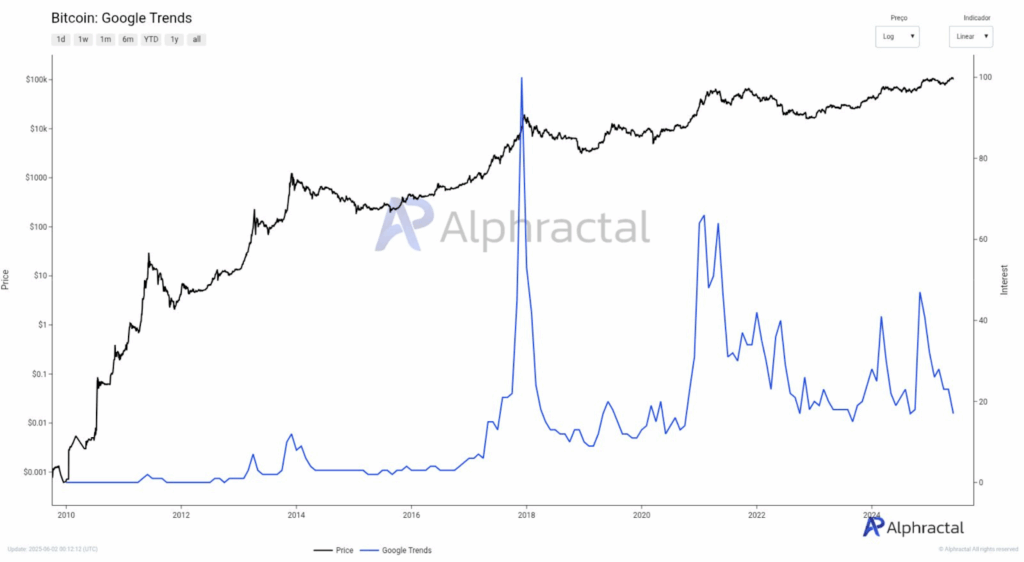

Support Holds Firm, But Public Interest Stays Muted

Bitcoin is trading near all-time highs, but it still doesn’t have strong public engagement. Bitcoin search interest on Google Trends is at just 17 points.

It is the same level seen when the asset was trading at $17K in late 2022. The same interest is seen as during its bear market lows.

The disconnection between price and public interest calls into question the robustness of retail participation. Returning to search volumes and online attention, they have historically spiked ahead of major price tops and retail FOMO phases.

The lack of that now implies the market is not overheated and could still have some room to run. Key on chain levels continue to provide support.

Realized prices for short-term holders (1 week to 6 months) fall into the $96,900 to $104,200 zone. These are psychological benchmarks, as traders are less likely to sell at a loss, reinforcing this area as a cushion against downside.

If Bitcoin can hold this support band and break above $107,500, it could generate new flows and rekindle speculative interest. Search activity has been muted, and volatility, which tends to spark public interest, has remained relatively subdued.