Key Insights:

- Analysts predict a potential 5% short-term dip, others foresee a bullish wave count with up to 38x long-term upside.

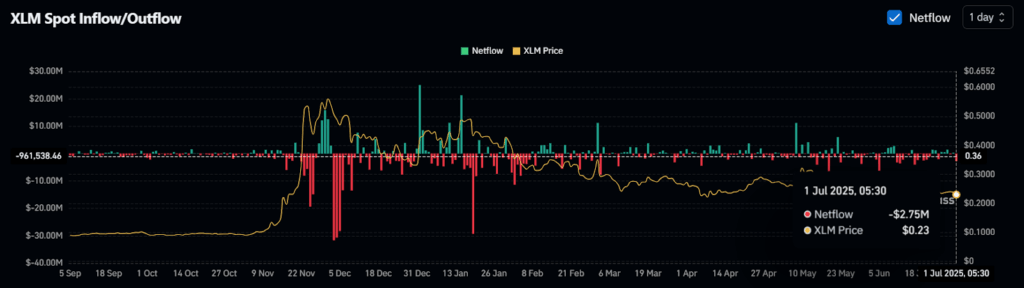

- Exchanges witnessed a $2.75 million outflow of XLM, indicating possible long-term accumulation.

The XLM crypto price appears to be in a bearish trend and is currently consolidating within a tight range, raising the question of whether the price is preparing for another dip or an upward rally.

The daily chart reveals that the asset has been in a downtrend, hovering within a descending channel pattern since May 2025.

Experts Bullish Outlook

Given the current market sentiment, experts and analysts appear to be showing strong interest in the token, as several posts have surfaced on X (formerly Twitter). On X, some appear optimistic, while others are making bold predictions.

In a post on X, the expert noted that the XLM crypto price has completed waves 1 and 2 off the lows. It took 22 days to move off the lows and has the potential for a 38x gain to reach the full target.

Meanwhile, another expert stated that XLM might already be in its 5th wave up. However, the April low needs to hold for this bullish scenario to remain valid.

A break above $0.335 would signal that the bulls are back in control. Dropping below $0.17 would weaken the setup, but the key invalidation level is at $0.076—so there is still plenty of room if needed.

Current Price Momentum

Besides this, XLM crypto price is currently trading at $0.2317 and has experienced a 2.25% price decline in the past 24 hours. During this period, traders and investors have shown strong interest in the asset, resulting in a 25% surge in trading volume.

This surge in trading volume, along with the price decline, hints at strong downside momentum and suggests that sellers are gaining control, potentially leading to further price depreciation in the near term.

XLM Crypto Price Action and Key Technical Analysis

According to expert technical analysis, XLM crypto price appears bearish and is poised for a potential decline. As per the daily chart, the asset has been moving within a descending channel pattern, fluctuating between the upper and lower boundaries.

XLM Crypto Price Prediction

Based on recent price action, if XLM fails to gain upside momentum, there is a strong possibility of a 5% price dip in the coming days.

On the other hand, if market sentiment shifts, XLM could experience upward momentum. The overall trend may reverse if the asset breaks out of the descending channel pattern.

At press time, XLM crypto price is trading below the 50-day Exponential Moving Average (EMA) on the daily time frame, which hints at prevailing bearish sentiment and a lack of strong buying pressure, potentially indicating further downside in the short term.

Whereas, its Relative Strength Index (RSI) stands at 35, indicating that the asset is approaching the oversold zone, which may signal weakening selling pressure and the potential for a short-term rebound or consolidation.

$2.75 Million Worth of XLM Leave Exchanges

Despite the bearish outlook, investors and long-term holders appear to be seizing the opportunity presented by the price dip, as they have been actively accumulating tokens.

Data from spot inflow/outflow reveals that exchanges across the crypto landscape have witnessed an outflow of $2.75 million worth of XLM coins.

This substantial outflow from exchanges suggests potential accumulation, which could reduce selling pressure.