Key Insights:

- Public interest in Pi Network according to Google Trends, has fallen to its lowest point in 2025 despite the upcoming Pi2Day.

- Unofficial trading volume for Pi Coin IOU tokens has collapsed by 97% in less than a month, from over $2 billion to $56 million.

- Despite rumors of a Binance listing/Tesla partnership, there have been no confirmations from either company yet.

With Pi2Day just around the corner on June 28, excitement within the Pi Network community is running high. Yet outside that bubble, the reality is a lot more troubling.

Interest in the project has sunk to its lowest point in 2025, despite the fanfare around the upcoming celebration. As it stands, without any major updates or major partnerships, Pi Network risks losing both visibility and credibility very soon.

Here’s what’s at stake:

Public Interest in Freefall

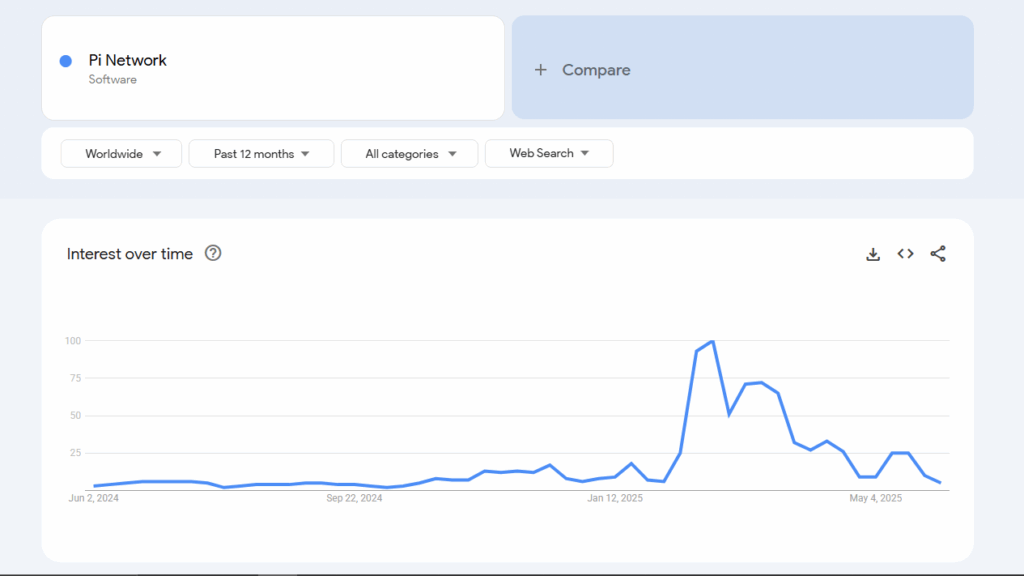

According to Google Trends, global search interest in “Pi Network” recently dropped to a score of 5. For context, this is the lowest it has been all year. This score is even below pre-mainnet levels, which means that general public curiosity has all but dried up.

Search volume is an important metric when it comes to measuring relevance in the crypto space.

When fewer people search for a project, fewer new users are discovering it.

This is a problem for Pi under any circumstance. For a network that heavily relies on grassroots adoption, this downward trend is alarming. This decline isn’t just limited to search metrics.

Trading activity on unofficial markets, where IOU tokens representing Pi Coin are bought and sold has also taken a nosedive.

Daily trading volume has collapsed from over $2 billion in mid-May to just $56 million as of June 4.This stands as a staggering 97% drop in less than a month.

Hope or Hype?

Despite these grim numbers, many in the Pi community are still hopeful that Pi2Day will turn things around.

The annual event, which coincides with Elon Musk’s birthday, has become symbolic for Pi believers. Major community influencers are stoking speculation, often without evidence and one popular rumor making the rounds is that Binance might list Pi Coin on June 28.

Another major speculation that has been making the rounds is that of a partnership with Tesla, where Pi users could pay for car charging with their tokens.

However, these ideas are still heavily speculative and neither Binance nor Tesla has made any official announcement.

Technical Issues Continue to Hold Pi Network Back

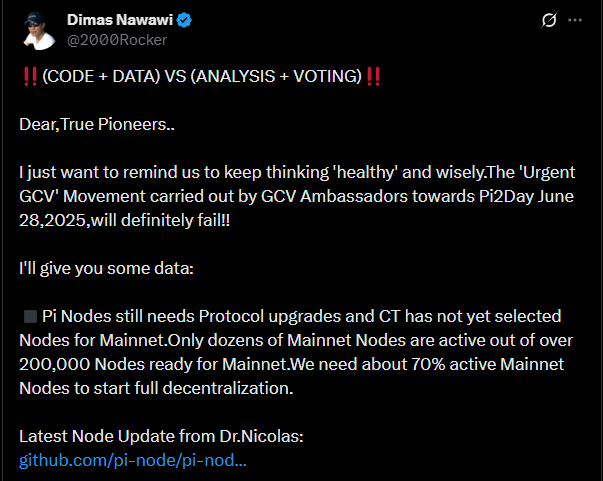

While community members are waiting on an unconfirmed Tesla tie-in and exchange listing, developers are urging investors to return to reality. Dimas Nawawi, a Pi Network developer, recently laid out an interesting technical assessment.

According to Nawawi, Pi’s infrastructure simply isn’t ready to support many of the promises being made. Out of more than 200,000 nodes registered for the mainnet, only a few dozen are currently active.

More importantly, the protocol is still running on version 19.6.1, while version 20 is needed to deploy smart contracts.

“Smart contract deployment is impossible without a protocol upgrade,” Nawawi stressed. In short, without the technical foundation in place, major efforts are doomed to fail.

What’s at Stake on June 28?

The upcoming celebration could still help Pi coin rally. If the main Team can deliver tangible updates like a finalized open mainnet timeline, a protocol upgrade, or meaningful partnerships and more, it could boost investor confidence in the project.

However, without that progress, June 28 may become yet another missed opportunity for everyone.

Public interest is waning, market activity has dried up, and technical limitations remain unresolved. If Pi fails to deliver, it could further cement the idea that the Network is more about wishful thinking than actual innovation.