Key Insights:

- Bakkt files S-3 registration to raise $1 billion in capital.

- Form allows equity, debt, or warrants for flexible fundraising.

- Filing supports direct Bitcoin purchases under the updated June 2025 policy.

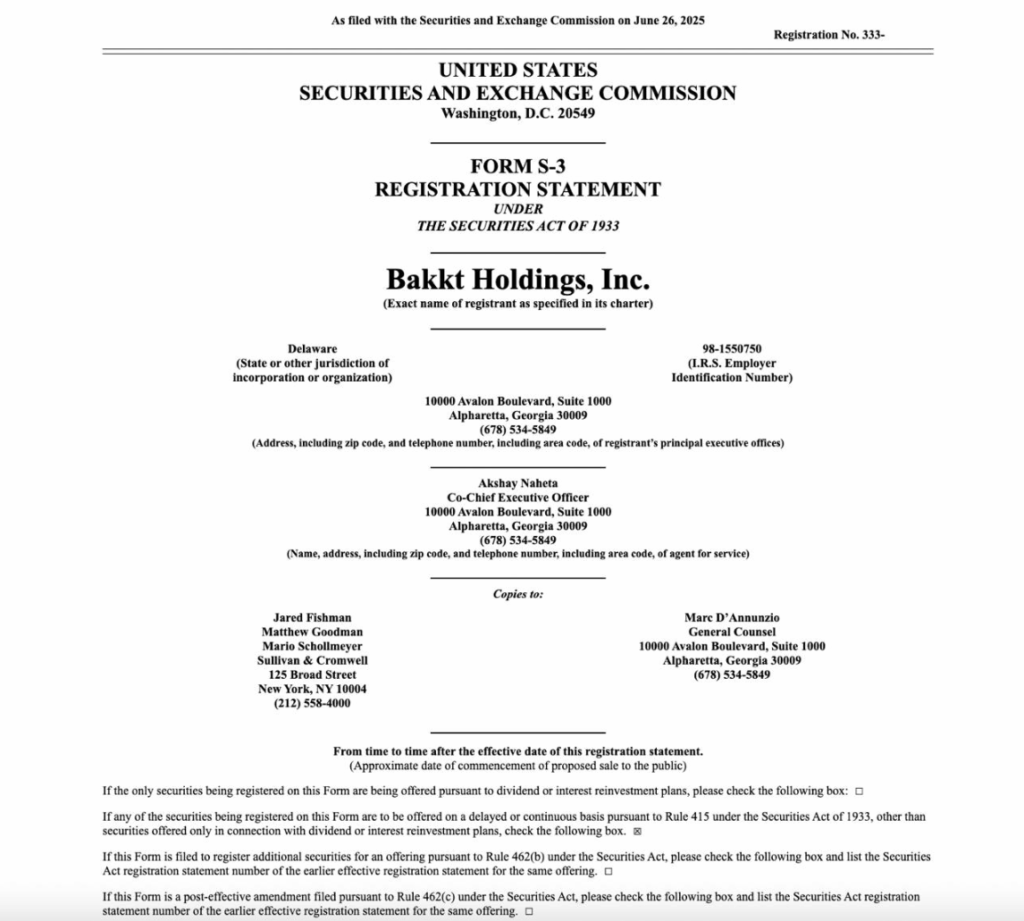

Bakkt Crypto Holdings, Inc. has now lodged a Form S-3 registration statement with the U.S. Securities and Exchange Commission (SEC), which will allow it to issue as much as $1 billion in the mix of equity, debt, and warrants.

The filing dataed June 26, 2025, under the Securities Act of 1933 could mark a turning point for the company.

In the registration, which was filed in Delaware and registered in the office of the Secretary of State of Alpharetta, Georgia, the company indicated that it could issue common stock, preferred stock, and other types of debt or warrants.

The flexibility inherent in a shelf registration allows Bakkt access to capital markets on a step-by-step basis as it sees fit and in a manner that supports otherwise advantageous strategic priorities.

Regulatory Signal and Corporate Intent

The document notes Bakkt’s formal processes for adhering to the SEC and tickets to collect capital, fixedly ascertained as per time after the effective date of this registration statement.

The name of the co-Chief Executive Officer Akshay Naheta was noted in the listing, and legal counsel and regulatory representatives’ contact details are also given, which makes the corporate action even more serious.

This official attraction highlights Bakkt’s determination to follow aggressive digital coin policies and points towards regulatory conformity in case of possible Bitcoin acquisitions.

The filing does not provide specific timings or offering schedules, but it has been set up to enable quick mobilization when opportunities arise.

Although the company is yet to unveil the exact fundraising phases, the complete discharge of the $1 billion registration may place Bakkt on the list of the most prominent publicly traded crypto collectors of Bitcoin.

At the press time BTC price (about 106,800 USD), the company would be able to purchase approximately 9,364 BTC if it constructively applied the funds raised all toward digital asset purchases.

That implies that Bakkt would surpass Coinbase and that it would be slightly behind large institutional investors likeTesla and MicroStrategy.

The filing outlines a broad spectrum of fund applications, listing possible acquisitions of Bitcoins, crypto treasury diversification, expansion of operations, and other corporate requirements.

The organizational record of the shelf registration enables Bakkt to be flexible as it readies to have more exposure to Bitcoin markets.

Initially, Intercontinental Exchange (ICE) launched them in 2018, and therefore, Bakkt was in the news because it pioneered regulated Bitcoin futures.

The company has since developed over the years to include custody solutions, merchant payment, and consumer rewards programs. Yet, a new era is on the horizon when Bakkt will take efforts to become a full-stack Digital asset infrastructure provider in 2025.

The co-CEO of the company, Akshay Naheta, stressed that this move aims to turn Bakkt into a pure-play crypto infrastructure company. This shift reflects the general trend of movement around the entire financial sector, with companies combining traditional financial tools with on-chain technologies.

Bakkt’s Crypto Holdings: Comparison with Institutional Peers

Imagine that Bakkt crypto holding adopts the strategy to acquire Bitcoin on a large scale. Then, it will become a member of the group of institutional innovators who employ their balance sheets to expose them to the largest digital coin worldwide.

Previous actions by Strategy, Marathon Digital, Tesla, and Galaxy Digital have resulted in increased interest among investors, a reputation on the market, and integration with digital asset environments.

Bakkt’s strategy is distinguished by time and organization. The shelf registration process implies that the company is not committed to one capital raise event or a one-time crypto purchase. Instead, it can gradually roll out products or services as the market situation changes, which is an opportunity in the inherently unstable crypto space.

Although the company’s move to file the filing does not imply direct purchase of Bitcoin, it provides a regulatory framework for these ventures. By so doing, it may have been a vote of confidence in Bitcoin on the part of another of the big U.S.-based institutions.

Moreover, the June novelty of 2025 of the policy stated in the registration of Bakkt permits direct investment in Bitcoin, which reflects the availability of the corporation treasury options to the current regulatory clarity.

In the event that Bakkt continues to buy large amounts of BTC, it would stimulate additional activity among the institutions and, possibly, have an impact on the supply side of Bitcoin exchanges.

The Form S-3 filing is not just a formality, but it will mark a new step in Bakkt’s move towards integrating digital assets.

Additionally, the filing suggests the Holding can ramp up its crypto operations through direct purchase of objects.