Key Insights:

- Whale interest grows with $8.3M in long positions, boosting optimism for 70% rally to $68 on Hyperliquid crypto.

- HYPE shows strong market volume at $2.92B, indicating active trading despite price fluctuations.

- Price consolidation near key support suggests potential for bullish breakout, targeting $68 if momentum builds.

The price of Hyperliquid crypto (HYPE) has shown significant growth recently, with many traders and investors wondering if it could reach new all-time highs.

At the forefront of the latest developments is the growing interest from large investors, or whales, who are placing substantial bets on HYPE’s future.

With increased market activity and positive sentiment from key market indicators, many are speculating that HYPE could rally by another 70%, potentially reaching $68.

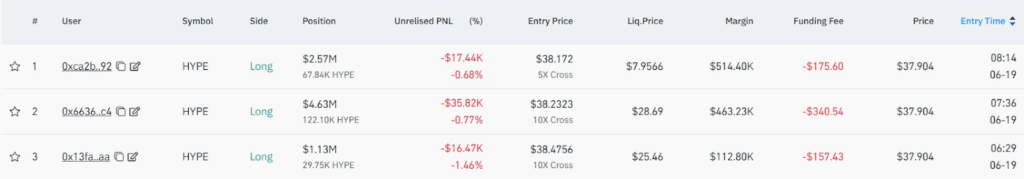

Hyperliquid Crypto Whales Show Strong Interest with $8.3M in Long Positions

Whale activity has played a significant role in the recent bullish sentiment surrounding HYPE. In the past 24 hours, large traders opened $8.33 million in long positions on the Hyperliquid DEX platform, despite the price retracing.

This surge in long positions indicates strong confidence in HYPE’s upward potential, even as the token’s price hovers below $40. Some whales remain at risk of liquidation if the price falls to $25 or $28, but their long-term outlook appears positive.

These whales have made notable profits, with one reportedly earning $34 million from a 4x leverage position. The continued interest from large wallets suggests optimism about HYPE’s future performance.

According to CoinGlass data, this sustained whale involvement points to an expectation of further price appreciation, possibly leading to new record highs.

The current bullish momentum within HYPE’s ascending parallel channel supports the possibility of a 70% rally to $68. Whale positions exceeding $11 million show strong support for this potential price surge.

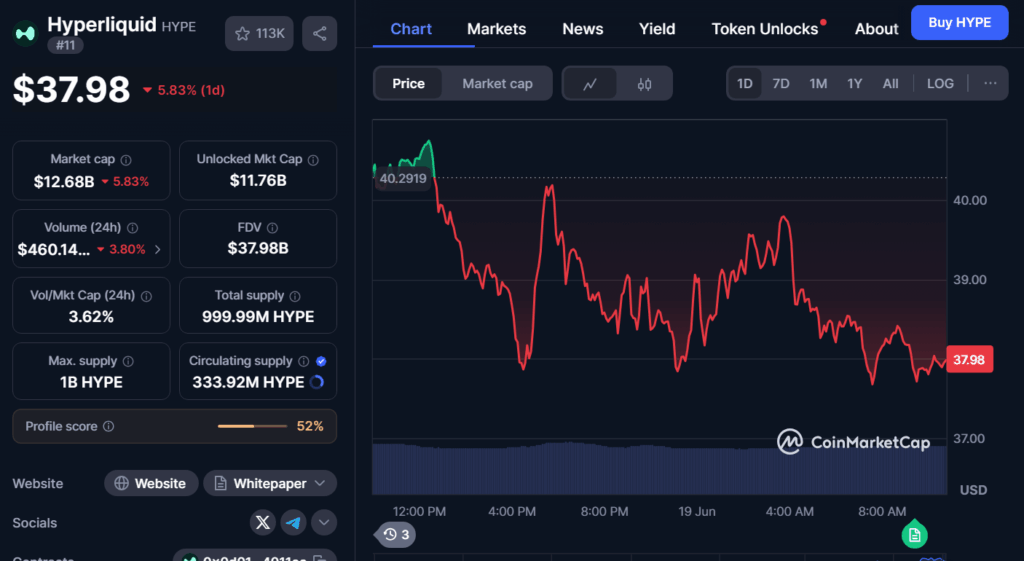

Market Volume and Sentiment Show Positive Trends

Hyperliquid crypto, while writing, had clocked a 24-h trading volume of $2.92 billion, marking a 1.58% increase from the previous day. This uptick in volume indicates growing market participation and liquidity, which may lead to significant price fluctuations.

Despite a price decline of 5.83% to $37.98, the volume remains strong, suggesting active trading and potential volatility in both directions.

The open interest, however, decreased by 2.54% to $1.82 billion, signaling reduced speculative trading and a possible lack of conviction in the current trend.

The mixed long/short ratios across platforms like Binance and OKX further highlight a divergence in market sentiment, with Binance showing a slight bullish bias, while OKX has a more bearish outlook.

Despite the recent volatility and liquidations, with $1.33 million in total liquidations over 24 hours, the market sentiment remains cautiously bullish.

Whales continue to position themselves with long bets, indicating optimism for a potential rally, with the possibility of a 70% price surge to $68.

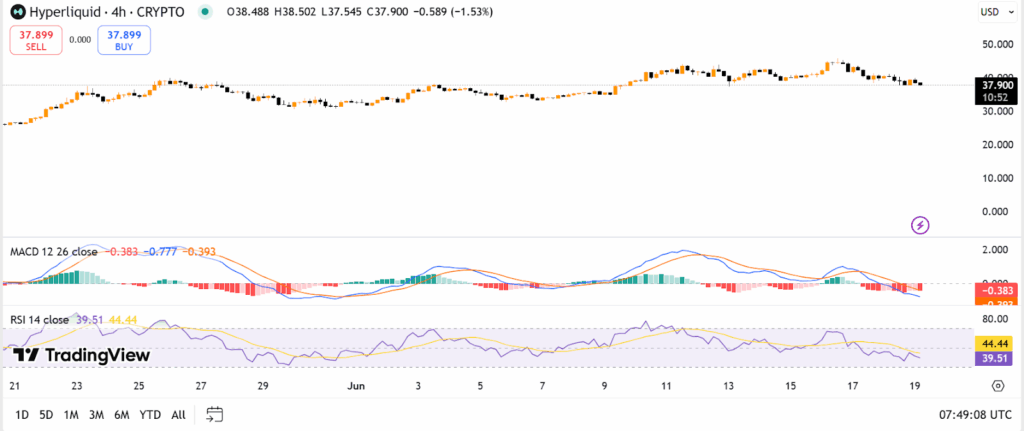

Hyperliquid Crypto Price Shows Signs of Consolidation Amid Market Indecision

The price of Hyperliquid crypto is still consolidating near $37.90 after a modest decline after hitting 38.50. Presently, the market is indecisive, which is reflected at $37.50 to the $38.50.

The Relative Strength Index (RSI) stands at 39.51 — a somewhat bearish depiction. Meanwhile, the Moving Average Convergence Divergence (MACD) histogram depicts rising selling force and is therefore, indicative of a bearish short-term forecast.

However, HYPE is currently testing a crucial support level in an upward sloping parallel channel that has formed since April. The direction is still bullish and RSI is 53, gauging the possibility of an upside move.

When the price settles within the support level and has high volume on buy side, it might create a rally and take HYPE to new all-time highs, possibly to the value of $68 with an increment of 70 percent on its current price.

However, it is advisable to proceed slowly as there is weaker bullish momentum indicated on the Awesome Oscillator (AO).

Short term, a rise above 38.50 would have caused a bullish reversal whilst a decline below 37.50 may have caused selling pressure, hence the price might have taken a hit to 35.