Key Insights

- Cardano price prediction turns cautious after ADA fails to hold gains above $0.84.

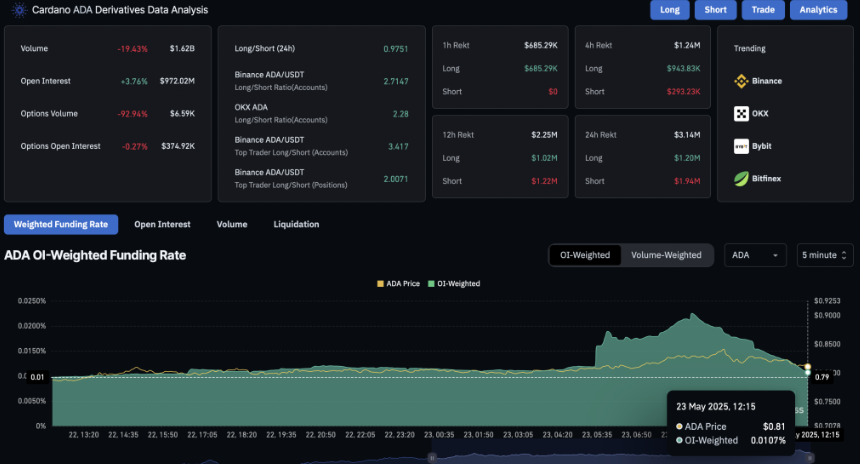

- $943K in Cardano long positions were liquidated in 4 hours as funding rates fell and resistance held.

- Cardano’s stablecoin market cap grew 30% QoQ, increasing treasury and DeFi diversity.

After a 15% bullish breakout, Cardano price fell below $0.84, setting off renewed selling. The outlook for the ADA has improved. However, technical indicators suggest a possible correction when traders resume short trading.

Cardano Price Prediction Weakens Below Fibonacci Resistance

The bullish setup met resistance at $0.84, with the price now trading near $0.78. The 4-hour chart shows a bearish engulfing candle after the initial breakout, and the Relative Strength Index (RSI) has dropped sharply. This signals declining momentum despite MACD remaining positive.

The rejection at the 50% Fibonacci retracement level ($0.8253) further weakens the cardano price prediction. If the price loses support at $0.7745, ADA could revisit $0.7225—a previous support zone aligned with the double-bottom breakout.

Lack of strong support between these levels leaves the market vulnerable to further downside unless bulls regain control.

More so, failure to break above $0.8253, the 50% Fibonacci level, gives more reason to expect a decline. Such a technical threshold sometimes marks when the trend starts to take hold. A decline below this point shows the bullish phase could be weakening.

There is minimal support at $0.7745 at press time, although a stronger historic level lies at $0.7225. A rise in bear pressure could cause the Cardano price to fall toward these lower points.

Liquidations and Funding Rates Reflect Declining Sentiment

Derivatives data suggests that in the last four hours, $943,000 worth of long positions have been liquidated in ADA. It happened when the price fell more than 4% once it reached the resistance zone. The liquidations are a strong reaction by traders who expected the breakout trend to continue.

At the same time, the funding rate has fallen from 0.0212% to 0.0107%. This means that traders in derivatives show less optimism.

Open interest is around $972 million, and trading volume over the past 24 hours has only increased by 3.76%. These signals show that traders are still involved but show greater caution after the price rejection.

On-Chain Metrics Show Broader Network Growth

While the rapid price swings are short-lived, the Cardano ecosystem keeps developing. Messari revealed a 30% rise in stablecoin market capitalization for Cardano during the last quarter.

These numbers indicate that DeFi is seeing more use and activity within the network. Moreover, a rise in Delegation Representatives (DReps) has helped increase the network’s DeFi diversity score by 13%.

They point to the protocol growing further, with increased user involvement and robust infrastructure. Besides, the platform’s treasury has also seen a 5% increase in balance, measured in ADA tokens.

This adds more flexibility to operations and supports Cardano’s mission to encourage community initiatives. Even though these numbers do not instantly move prices, they show the market’s larger adoption pattern.

Cardano Price Support Levels and Trading Volume

Going forward, cardano price prediction hinges on ADA maintaining support at $0.7745 and $0.7225. A breakdown below these levels would likely open the door for further selling and a revisit of previous consolidation zones.

Conversely, if buyers return and ADA reclaims $0.8253, a short-term recovery could begin. For now, indicators suggest a cautious stance, with market participants monitoring price structure near key technical thresholds.