Key Insights:

- Bitcoin surged past $94,000 this week after a month-long period of bearish and range-bound trading.

- The cryptocurrency gained over 9 percent between April 21 and 22, peaking at $94,700 before a slight dip.

- Despite the rally, CryptoQuant CEO Ki Young Ju maintains that a break above $100,000 is needed to confirm a trend reversal.

Bitcoin surged past $94,000 this week, marking a strong comeback after weeks of downward movement and range-bound performance. The recent uptrend has prompted mixed responses from market analysts, as some maintain a bullish outlook while others remain unconvinced.

Despite strong momentum, CryptoQuant’s CEO emphasizes the need for a breakout above $100,000. He believes this level is crucial to confirming a true trend reversal.

Bitcoin Breaks $94K After Month-Long Struggle

Bitcoin gained over 9% between April 21 and 22, bouncing back from its mid-April low of $74,000. This recovery has pushed Bitcoin to its highest level in seven weeks, with the price above $93,000.

The latest rally developed during a two-month price drop, where market activities remained sluggish and progress slowed. On April 21, Bitcoin climbed 2.71%, followed by a 6.83% increase on April 22, pushing the asset past $90,000.

The token peaked at $94,700 on its way down by 0.43% today and stabilizes around $93,085. Market leaders oppose continuing a bull trend following this latest price rally.

The crypto market shows signs of recovery, yet its long-term signals do not verify that a complete bull cycle will continue. Bitcoin’s ability to hold current levels will likely influence short-term sentiment.

Bullish momentum faces a significant hurdle because of powerful resistance barriers above the present trading level.

Bitcoin Rise Not Enough for Confirmation

Ki Young Ju, CEO of CryptoQuant, shifted his stance to neutral after Bitcoin struggled near $83,000 in March. He stated that his stance was a key reason for declining ETF inflows and lower market liquidity.

This, in turn, contributed to the inability to maintain higher price levels. Despite Bitcoin’s latest move upward, he has not changed his view unless the price breaks $100,000.

Following his remarks in March, Bitcoin fell to $74,000 by April 7, confirming short-term weakness in market structure. The cryptocurrency surpassed $82,000 after its initial recovery. However, it stayed within the defined range before the latest market surge lifted its value to $94,700.

The surge did not meet Ju’s criteria for confirming a bull market. Despite this, it contradicted his earlier forecasts, adding uncertainty to the trend analysis. According to him, the present market awaits further clarity from outside events and spontaneous changes in investor sentiment.

Ju relies on examining on-chain supply and demand data while abstaining from using short-term price movements. He uses extended-period patterns to check whether the cycle demonstrated an authentic reversal.

Analysts See Strength in Bitcoin Recovery

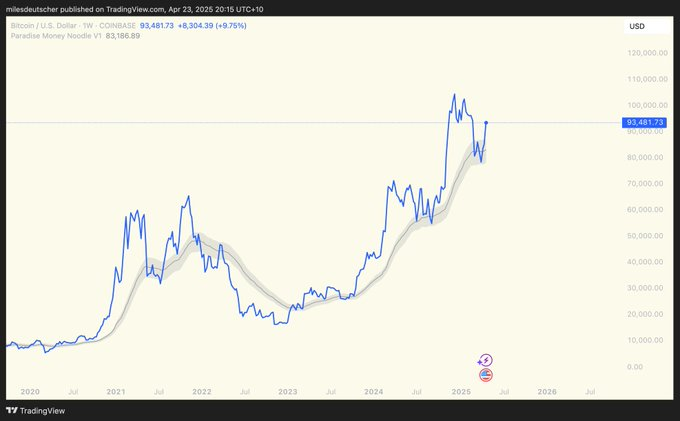

Several analysts interpret the market’s recovery as evidence of lasting market strength because long-term uptrend lines remain intact. Market analyst Miles Deutscher endorsed the longevity of the “Paradise Money Noodle” support area, which has persisted for two years.

His analysis indicates that the recent price declines align with past market reactions at support zones. This pattern suggests a continuation of expected price behaviors in similar conditions.

Following the recent rally, veteran trader Peter Brandt revised his analysis, now predicting Bitcoin could extend its upward trend. His updated outlook signals growing optimism about the cryptocurrency’s price movement.

The price structure convinced him to abandon his earlier warning about hasty optimism because it indicates future market growth potential. Brandt says the existing trend will continue only if deeper market corrections do not take place.

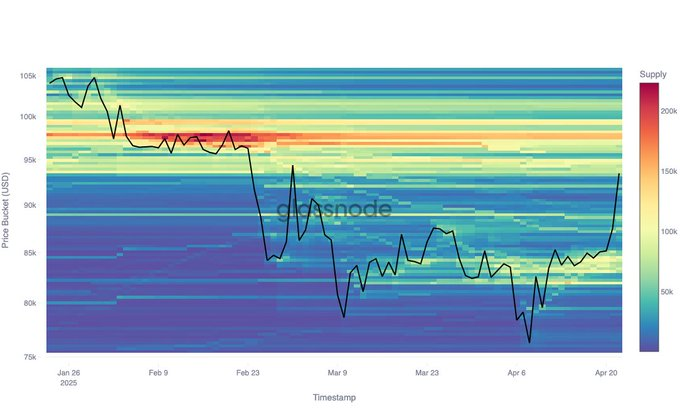

Analytics firm Glassnode reported high engagement from new Bitcoin buyers throughout April, signaling renewed interest. The Relative Strength Index (RSI) consistently stayed above 50 throughout April.

It peaked at 100 last week before settling at 80 on April 23, reflecting strong market momentum. An uptrend is evident through the levels Glassnode detected, yet the platform pointed out forming resistance at approximately $97,000.

$97K Barrier Could Delay $100K Breakout

Glassnode’s Cost Basis Distribution reveals that institutional investors own approximately 392,000 BTC. It was acquired when Bitcoin reached $97,000.

The ownership value of $97,000 could generate substantial selling pressure from holders wishing to restore their position to zero. If Bitcoin approaches this point, profit-taking could slow the current upward trend.

If Ethereum surpasses $97,000, reaching $100,000 could become feasible due to low seller density in that range. This lack of resistance may support further upward momentum.

CryptoQuant’s CEO designated the benchmark for establishing bullish momentum. Market participants face price indecision because they need to see a definitive market movement before taking a clear direction.

BTC now trades at $93,085, holding firm but facing resistance just ahead. A final confirmation about the market trend depends on Bitcoin reaching above $100,000 despite the present positive momentum.