Key Insights

- LINK’s TD Sequential indicator flashes a buy signal with potential rebound toward $21 or even $23.

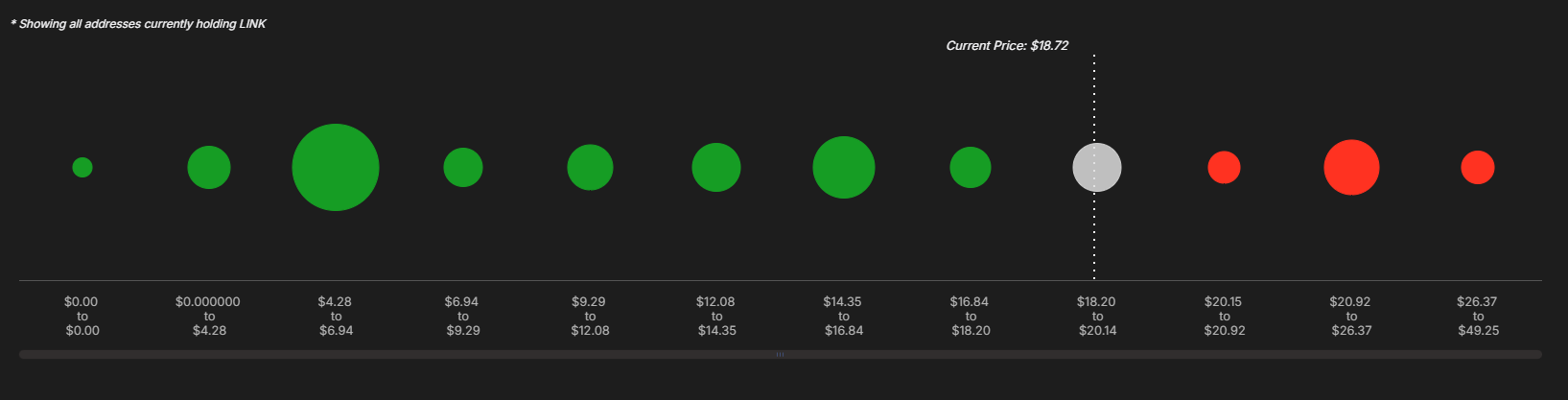

- 78% of holders are in profit, with key resistance at $20 and strong support at $15.

- Technical indicators and on-chain metrics signal a major move ahead.

The crypto market exhibited mixed trends over the past two weeks as sentiment shifted from bullish to bearish warnings. As Bitcoin price continues to struggle around the $96k mark, major altcoins faced volatile swings and stayed in a narrow range.

Despite the market uncertainty, Chainlink price has the potential to rebound and could see a major upswing as evidenced by the buy signal emerging from the TD Sequential indicator.

At press time, LINK price was trading at $18.64, witnessing a rise over 1.20% in the past 24 hours. Its market cap stood at $11.89 Billion, ranked 11th in the overall crypto market.

The trading volume soared over 51% to $417 Million and the total supply stands at 1 Billion.

Buy Signal from TD Sequential: Price Surge Incoming?

A recent post on X by Ali Charts revealed that the technical analysis tool TD Sequential indicator signaled a buy signal on the daily chart.

According to the analyst, Chainlink crypto looks poised for a rebound toward $21 followed by $23. Such signals in the past have often preceded upward price movements, making it a focal point for traders anticipating a rebound.

While its price range fluctuated between $15-$20 in the past week, traders are closely watching a move beyond the $20, where Bollinger band is also squeezing and signals a major move ahead.

On-Chain Data Highlights Key Price Levels

Data from IntotheBlock showed that 78% of PEPE holders are profitable, with strong support established between $14 and $16, where most holders accumulated the token around the 200-day EMA mark.

However, approximately 22% of holders remain unprofitable with potential resistance expected between $20-$22, as these holders may sell to recoup losses.

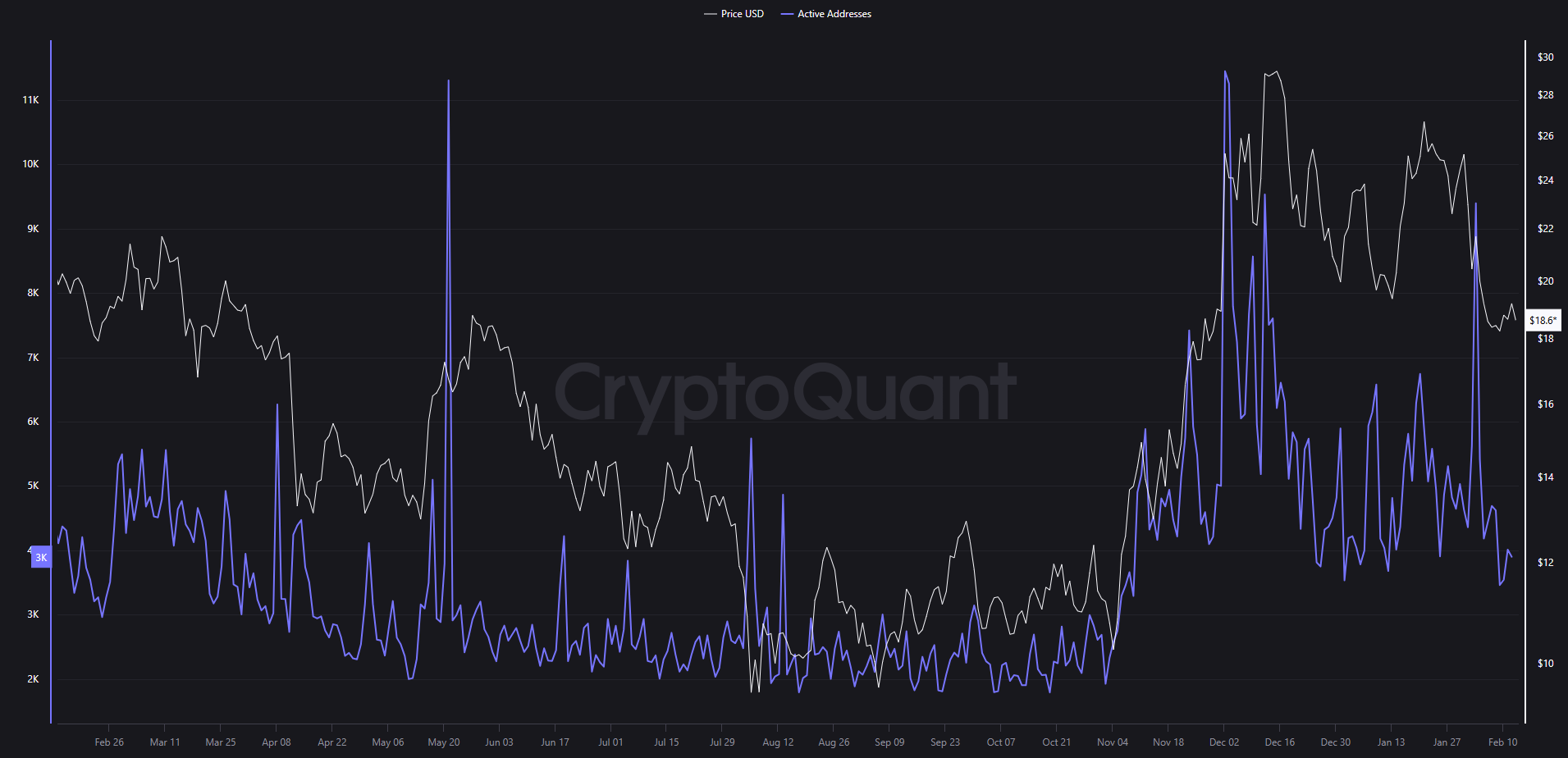

Furthermore, the daily active addresses have surged over 1.18% to 3900, replicating rising investors interest and broader usage of the network.

As the market sentiment stabilizes, the combination of TD sequential buy signal coupled with holders’ bullish sentiment, could fuel a bullish rally.

Chainlink Price Prediction: Factoring in Indicator Signals

LINK is consolidating around the $20 mark. This signals mixed sentiments regarding its next move. While the TD Sequential indicator pointed toward a buy signal, the ongoing sentiment in the market still revealed uncertainty among the investors.

Until the Chainlink price breaks past the $22 mark, the token may continue to hover around its 200-day EMA support zone.

The next LINK price movement may result from whale participation because these whales control 67% of all LINK units in circulation.

The Relative Strength Index (RSI) line was at 38, representing oversold signals. It showed that bears continue to dominate, while bulls are trying hard for a potential reversal.