Key Insights:

- Chainlink whales accumulated over $36 Million of LINK in the past week from Binance.

- A total of 2.52 million LINK coins were moved into at least 15 new large wallets.

- LINK price increased by nearly 13% during the same period before falling 4% intraday.

Large-scale Chainlink holders have recently acquired over $36 Million worth of LINK, boosting market sentiment.

The spike in activity coincided with a noticeable price uptick and increasing trading volume.

While the broader market shows signs of instability, LINK’s whale-driven momentum has brought renewed focus on the altcoin’s trajectory.

Chainlink Whales Drive Accumulation Wave

This past week, 2.52 million LINK coins, worth about $36.43 Million, moved from Binance into new large wallets.

According to blockchain tracker Lookonchain, at least 15 previously unused wallets participated in the LINK coin collection. These transfers occurred steadily, contributing to intensified LINK buying pressure.

Chainlink’s price has risen nearly 13% over the last seven days, aligning with the whale accumulation surge.

The investment activities by these large-scale wallet owners signal their growing trust in LINK despite general market instabilities.

The continuous purchases demonstrate rising market acceptance of LINK prices at their current values.

Whale activity typically leads to shifts in market sentiment, and LINK has now become a prime candidate for short-term upside.

The surge in demand for buying has caused traders to anticipate outstanding market performance in the future.

However, intraday volatility has tempered enthusiasm slightly, with LINK slipping 4% to $14.20.

LINK Pulls Back Amid Market Volatility

Despite whale activity, LINK saw a pullback from $15.23 to $14.20 in the past 24 hours. The market volatility caused a 2% decrease in Bitcoin, leading to a $91,000 settlement price.

Most prominent cryptocurrencies reacted to this trend by demonstrating wider cautious behaviors in the market.

LINK’s brief rally failed to hold due to market-wide corrections impacting all digital assets.

As the sentiment weakened, short-term traders began to secure profits, causing a drop in LINK’s momentum, even with positive accumulation data.

LINK’s fundamentals remain strong, and many expect the token to recover quickly. Long-term commitment to an investment overrides market speculations in high-level purchasing behavior.

The market is transitioning towards conditions that may significantly change prices during upcoming market sessions.

Market Experts Expect LINK Price Rise

Market analyst Michaël van de Poppe maintains a bullish forecast on LINK despite recent intraday losses.

He believes utility and DeFi-focused coins, like Chainlink, could outperform in the next crypto cycle. His assessment reveals the token’s solid core components and practical implementation trends.

The Chainlink team continues forming partnerships across the U.S. to strengthen its data-sharing network.

These strategic partnerships aim to develop both the project’s short-term success and long-term adoption.

Professional analysts predict that the token price will eventually match its current development advancements.

Positive momentum also stems from Chainlink’s increased relevance in decentralized finance and smart contract solutions.

The ongoing project developments point toward a sustainable upward movement. With improved infrastructure and growing integrations, LINK may soon revisit previous highs.

Short Positions Rise as LINK Dips

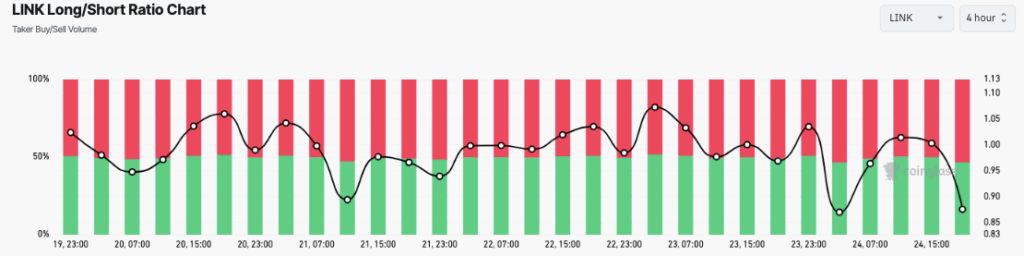

LINK’s long/short ratio has fluctuated significantly over the past five days, reflecting changing trader sentiment.

Between April 22 and 23, the long ratio reached above 1.10, yet it fell beneath 0.90 on April 24. Changes in price evolution demonstrate the impact of short-term market betting activities.

Short and long position trades exchanged rapidly based on daily market price fluctuations during this period.

The combination of uncertain conduct brought about heightened market volatility. If this disrupts the market’s current pattern, it could achieve better clarity throughout the following days.

On April 24, the long/short ratio declined to 0.85, which indicated intensifying short positions during an overall market decline.

However, this decline may be temporary if LINK resumes upward movement. The market suggests an upcoming bull market by whale buy actions complementing positive business indicators.