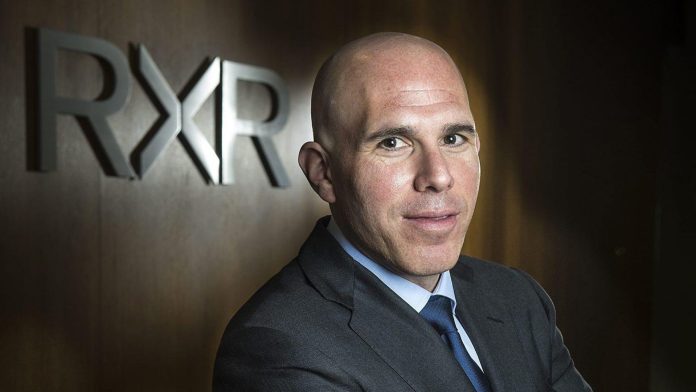

Scott Rechler of RXR has a plan for dealing with the buildings his company owns. He divides them into two groups: “digital” buildings that are worth investing in, and “film” properties that are outdated and not worth it.

RXR has spent a lot on properties like 1285 Sixth Avenue but stopped paying for others like 61 Broadway. However, there’s trouble with one of their “digital” buildings, 340 Madison Avenue. Despite being labeled as a good investment, RXR couldn’t pay back the $315 million mortgage on time, so Massachusetts Mutual Life Insurance Company is taking legal action.

MassMutual is now trying to take over 340 Madison because RXR couldn’t pay back its $315 million mortgage. RXR had asked for more time to figure things out, but it didn’t work out. RXR is still talking to the lender to try to change the loan terms. This shows how hard it is to get money for office buildings these days, with banks being careful, interest rates going up, and lenders asking for more money to extend loans.

Other companies like RXR are also having a tough time in the office market. It’s getting harder to borrow money for office buildings. For example, L&L Holding got a big loan for 425 Park Avenue, which is almost full of tenants like Citadel.

340 Madison Avenue is struggling to find tenants, with about 40% of its space empty, despite being upgraded.

RXR is trying hard to fill up 340 Madison Avenue with tenants that lenders like. They’ve rented space to finance and investment companies, which banks see as good tenants. They’ve also renewed leases with some companies and got new ones with others.

RXR hopes this will make 340 Madison look good to potential tenants in the finance world.

What’s happening with RXR and 340 Madison Avenue shows what’s happening in the office market, especially in Manhattan. The pandemic has made companies rethink how much office space they need.

Older buildings are having difficulty finding tenants, and some are even going bankrupt, like the BankNote building in the Financial District. RXR’s troubles show how important it is for office buildings to be modern and have good tenants to survive in today’s market.