Microsoft and OpenAI collaborate on a groundbreaking data centre project, as reported by The Information. The venture, estimated at a staggering $100 billion, aims to introduce an artificial intelligence supercomputer named “Stargate” by 2028.

The surge in demand for advanced AI capabilities fuels the need for specialized data centres, surpassing the capabilities of traditional ones.

Microsoft is expected to spearhead financing for the project, dwarfing the costs of existing data centres by a hundredfold, according to insiders familiar with discussions.

Expansion of Supercomputing Capacities

The proposed U.S.-based supercomputer represents the first of many such endeavours by Microsoft and OpenAI over the next six years. With plans spread across five phases, Stargate marks the pinnacle of this progression.

Microsoft is currently developing a smaller, fourth-phase supercomputer slated for launch around 2026.

Procuring AI chips, crucial for enhancing computational power, constitutes a significant portion of the project’s costs.

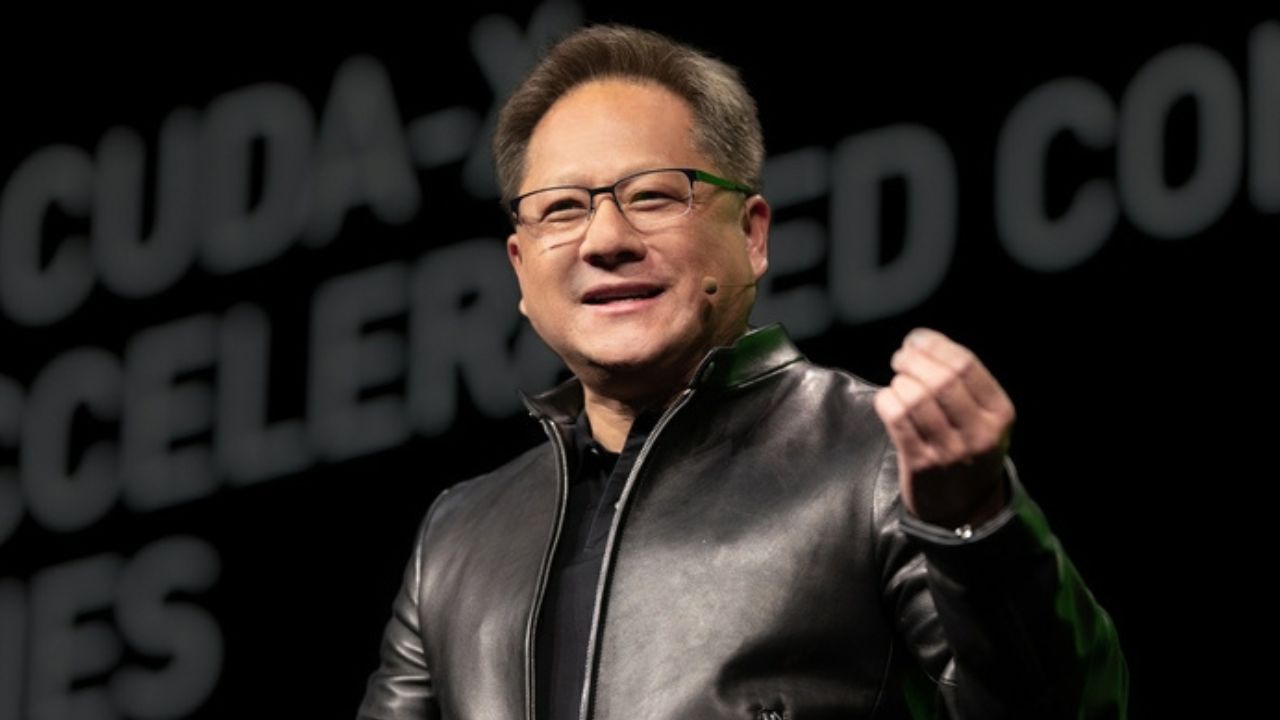

The high prices of these chips, as acknowledged by Nvidia’s CEO, underscore the substantial financial commitment required for advancing AI infrastructure.

Financial Implications and Infrastructure Innovation

Microsoft’s ambitious project signals a paradigm shift in AI infrastructure investment, with expenses potentially exceeding $115 billion.

This outlay far surpasses the company’s previous capital expenditures, emphasizing its commitment to driving innovation in AI technology.

Despite the substantial financial burden, Microsoft remains dedicated to advancing AI capabilities through cutting-edge infrastructure.

The project underscores Microsoft’s forward-looking approach to infrastructure innovation, ensuring its ability to push the boundaries of AI capabilities.

While exact details of the Stargate supercomputer’s launch remain undisclosed, Microsoft reaffirms its commitment to pioneering the next generation of AI infrastructure.