Key Insights:

- BNB trades just 10% below ATH, showing a stronger recovery than most major altcoins.

- BNB Chain leads with over $8.5B daily trading volume, topping Solana and Ethereum.

- Weekly transactions on BNB Chain surpass 80 million, marking 49% growth in one week.

Binance Coin (BNB) was currently consolidating around $689, preparing for a possible break above that level. According to current technical and on-chain data, the market is getting ready to challenge the $730 resistance level.

While crypto volumes have gone down on many chains, BNB Chain is still seeing strong transaction numbers and regular trading. Because of this, the price has stayed strong and close to its highest level ever.

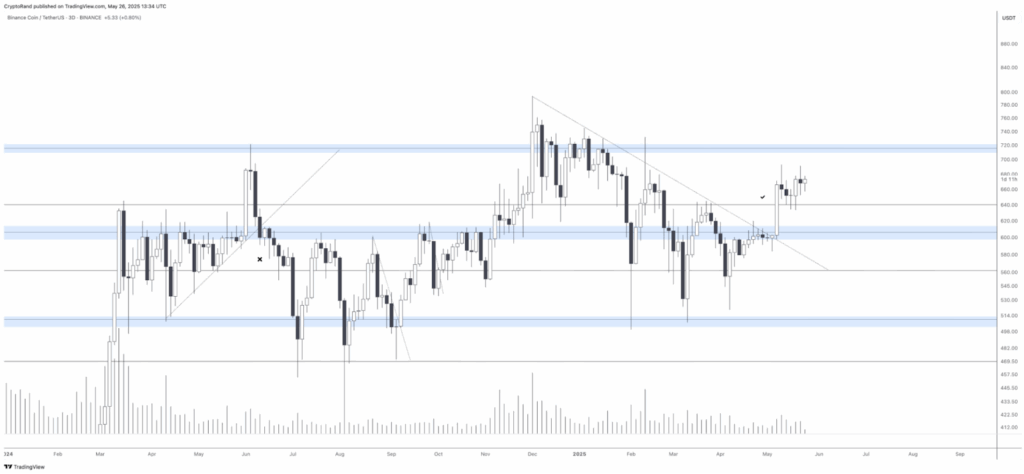

Price Structure Builds Toward Key Resistance

BNB has been trading below $730 after it recently broke through $620. The trend is currently bullish, as confirmed by repeated visits to the $660–$680 range.

If the token can clear $730 and maintain the momentum, it could open the door for further price growth.

Price is in a rising range with higher lows and a descending resistance trendline already broken. The token is now in a new accumulation phase following this breakout. As volume creeps up, a continuation move toward the next resistance band is on the cards.

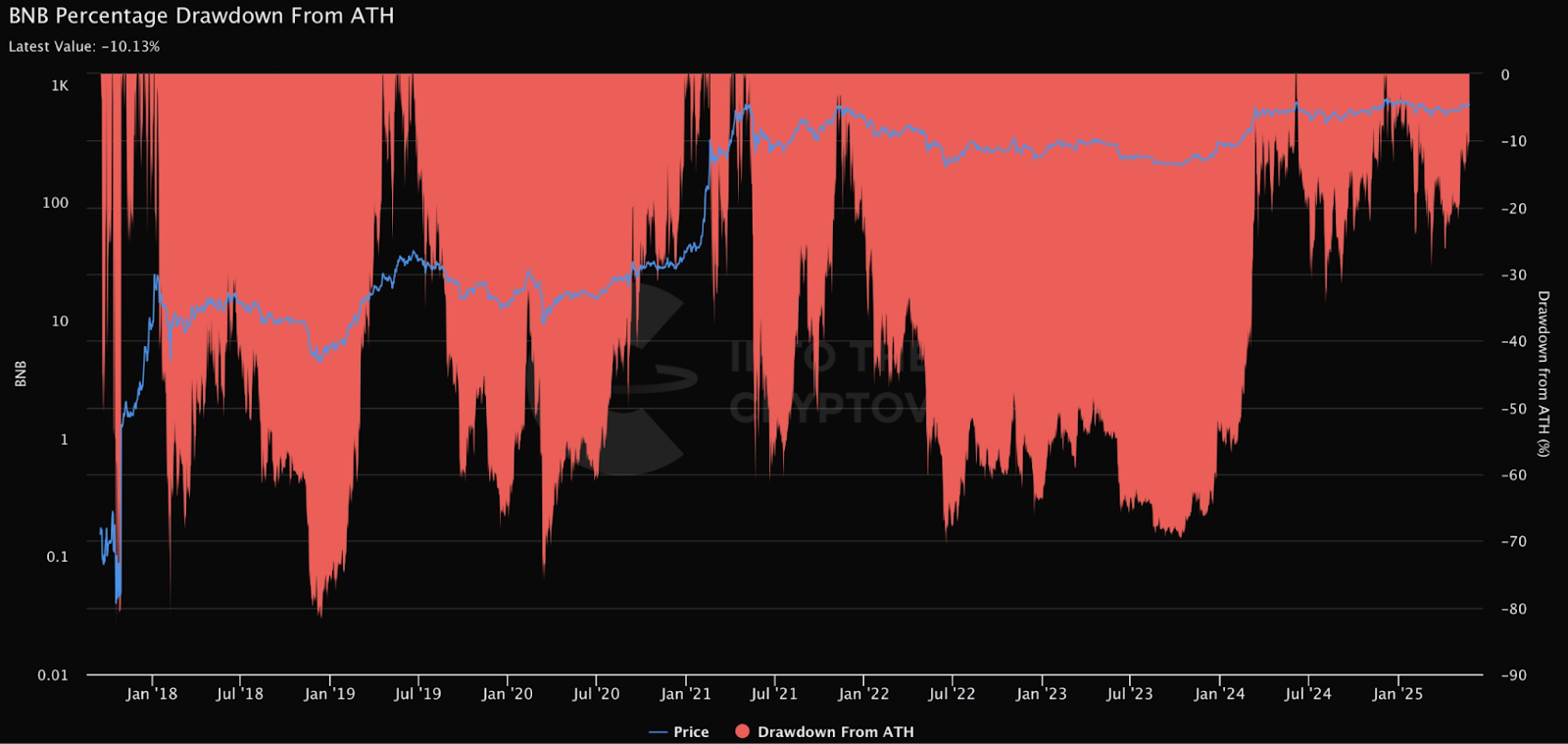

In addition, IntoTheCryptoverse reports that the current percentage drawdown from the all-time high is only -10.13%. That makes BNB one of the best-performing major assets from its peak.

Because the drawdown is so small, the price is more stable than that of many other large-cap coins, which are still far from their previous highs.

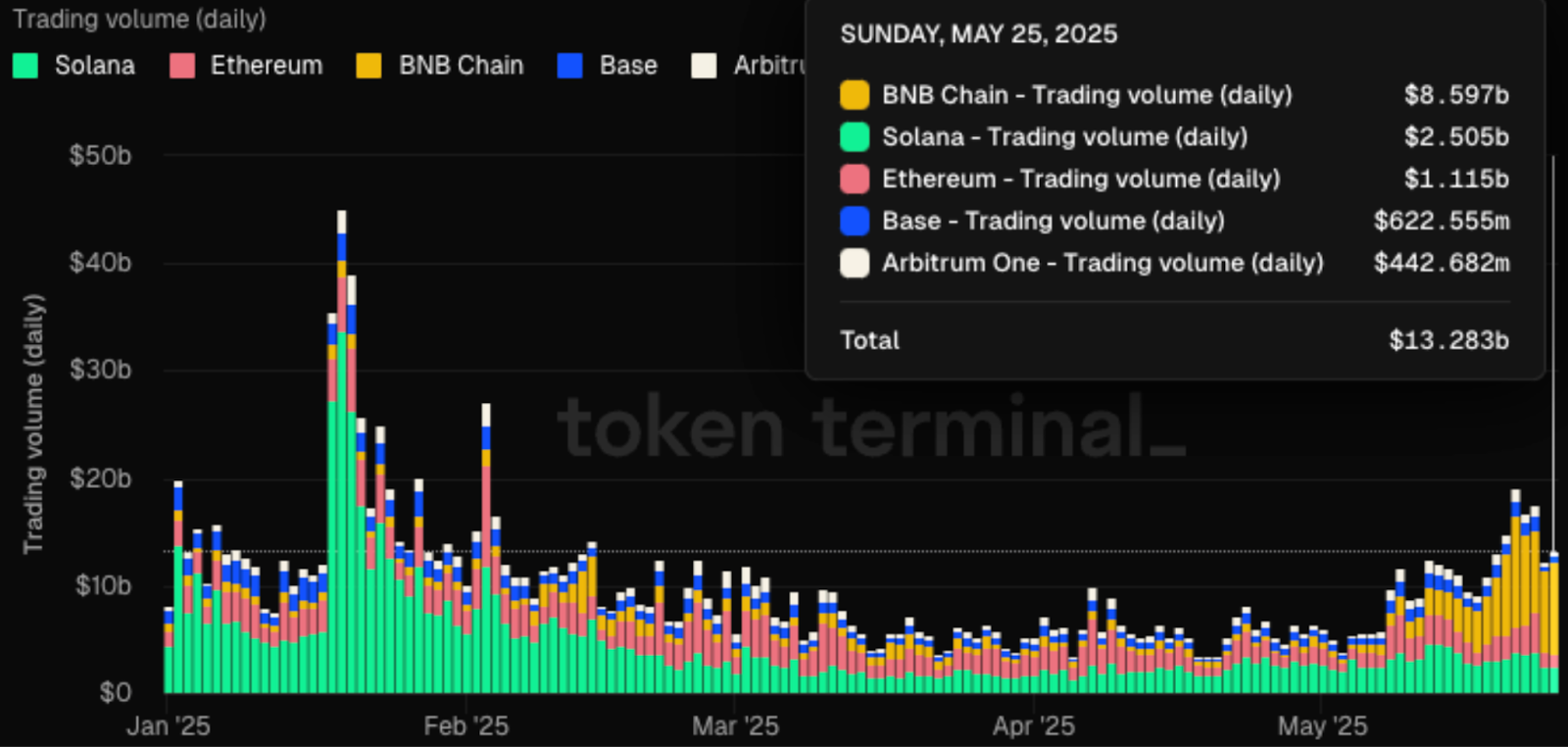

Trading Activity on BNB Chain Remains High

Although the wider market is slow, BNB Chain is still seeing a lot of activity. According to Token Terminal, $8.597 billion worth of assets were traded on the BNB Chain on May 25.

It is more than twice the size of Solana’s $2.5 billion and almost eight times bigger than Ethereum’s $1.1 billion.

Even though trading volumes on major blockchains have decreased by 75% since January 2025, this high activity is still present.

Although Solana is more popular among developers and gets more attention, BNB Chain handles more transactions each day. The fact that it holds the top position in daily trading volume points to strong liquidity and a lot of user demand.

Also, this week, BNB Chain processed more than 80 million transactions, setting a new weekly record. This week’s figure is up by 49% compared to the week before.

In addition, weekly DEX volume hit $61 billion, a new record for the chain. These figures highlight the ongoing utility of the network and strengthen the resilience of BNB’s current price.

BNB Chain is doing well in various areas, especially in terms of active addresses and transaction growth.

During the past week, there were 7.86 million active addresses, up by 1.5%, and the number of transactions grew by 49% to reach 80.2 million.

During the same period, BNB Chain collected $3.24 million in fees, which is a 2% increase. Despite quieter trading in crypto markets, the increasing address count, throughput, and fees indicate that demand for block space is high.

While other chains like Sonic and Sei v2 have also seen growth in some areas, BNB is still miles ahead in total transaction numbers. By contrast, address activity and fee generation on Scroll and Optimism decreased. This divergence indicates that BNB is more consistently used.

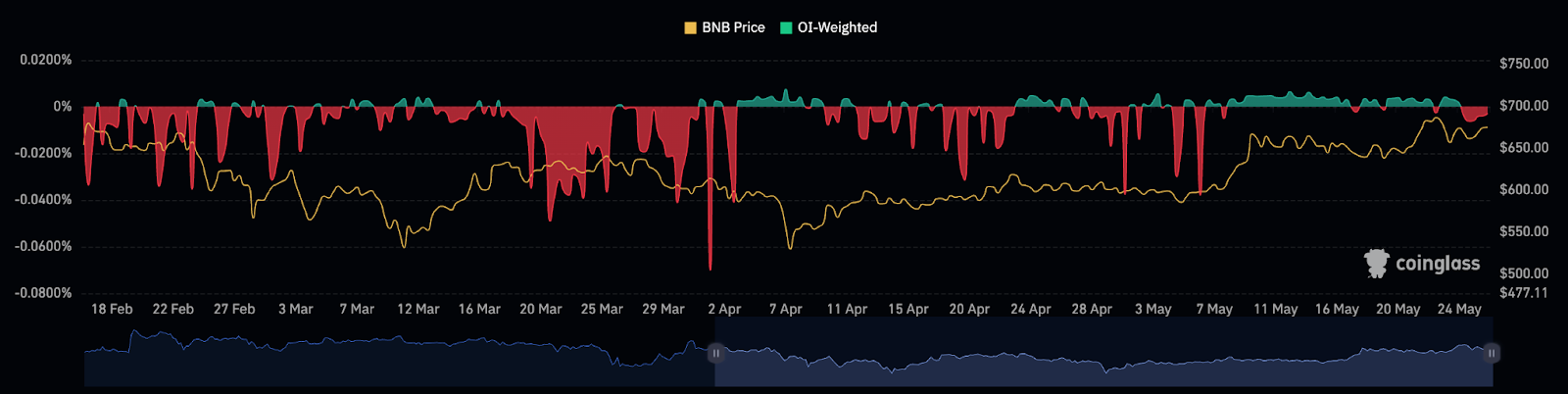

Funding Rates Remain Flat While Price Holds

Meanwhile, funding rates indicate that BNB open interest-weighted rates have not moved far from neutral.

Coinglass reports that mid-May saw brief rises above zero, coinciding with the recent rise in price to $680. Nonetheless, the majority of the rates have stayed close to or below neutral since February.

Because funding is stable, it indicates that there aren’t too many leveraged long positions in the market. If momentum stays and volume expands, BNB could enter a new rally.

For now, the current price structure and the strong on-chain metrics indicate an active and liquid network, which continues to support a stable trading environment.