Key insights:

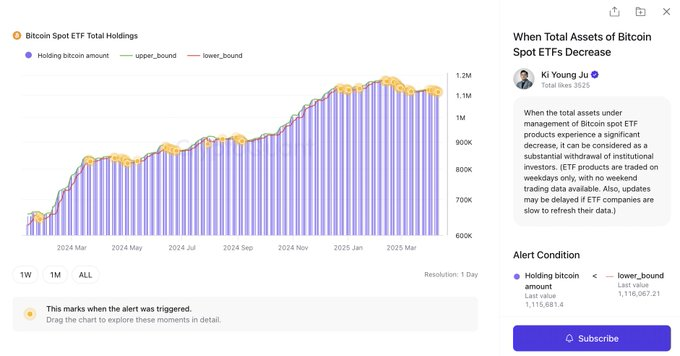

- Spot Bitcoin ETFs saw total outflows of $713 million between April 7 and April 12.

- BlackRock’s iShares Bitcoin Trust faced weekly outflows of $343 Million, even with the Bitcoin price surpassing $84,000 recently.

- Other major funds, including Fidelity, Invesco Galaxy, and Grayscale, also recorded significant Bitcoin withdrawals during the same period.

Spot Bitcoin exchange-traded funds (ETFs) faced major capital outflows over the past week. This signaled a potential cooling in demand. Data from CryptoQuant and ETF issuers showed that $713 Million exited these financial products between April 7 and April 12.

Steep withdrawals from major funds like BlackRock and Fidelity highlighted a declining trend. This signaled reduced engagement despite the recent price gains of BTC.

BlackRock Leads Bitcoin ETF Capital Outflows

BlackRock’s iShares Bitcoin Trust (IBIT) saw the biggest weekly outflow. Between April 7 and April 12, $343 million exited the fund. This occurred even though Bitcoin surged more than 11% within days, pushing prices above $84,000 by midweek.

The high price gains failed to attract continuous fund deposits because institutions remained reluctant to invest. Even though BlackRock did not lose BTC for the week, its operations resulted in the overall decline of BTC capital.

On that specific day, all total Bitcoin withdrawals from Fidelity Invesco Galaxy and Grayscale surpassed hundreds of Bitcoin units. The withdrawals significantly reduced the overall ETF outflows for the week, which degraded expectations about fund growth.

Analysts cite macroeconomic instability and tightening monetary conditions as key reasons behind the recent sell-off in Bitcoin ETF shares.

Organizations have adjusted their risk portfolio allocations due to growing concerns about inflation rates. These adjustments also reflect fears of potential recession scenarios.

Bitcoin ETFs See Sharp Weekly Outflows

Spot Bitcoin ETFs, launched with much anticipation last year, initially attracted billions in inflows from institutions and asset managers. Market participants have reduced their inflows for Bitcoin since global economic changes made them rethink their investment plans.

Fund assets experienced such substantial loss that several large funds now demonstrate net withdrawals. On April 11, $200 Million exited the spot ETF products through multiple issuer platforms by removing 2,359 BTC from their funds.

BTC withdrawal from Fidelity reached 938, while Invesco Galaxy lost 578 coins, and Grayscale suffered 419 coins flowing out. The established figures indicate a sudden change in trend for the week, contrasting past accumulation stages.

Despite these losses, Bitcoin prices remained resilient throughout the week, showing little immediate impact from ETF capital movements. Market sentiment around Bitcoin remained optimistic, even with the ETF movement.

Investors sustain their bullish stance through various alternative demand channels. The continuous withdrawals indicate that substantial investors are reluctant to participate in short-term markets.

Bitcoin Futures Surge as ETFs Decline

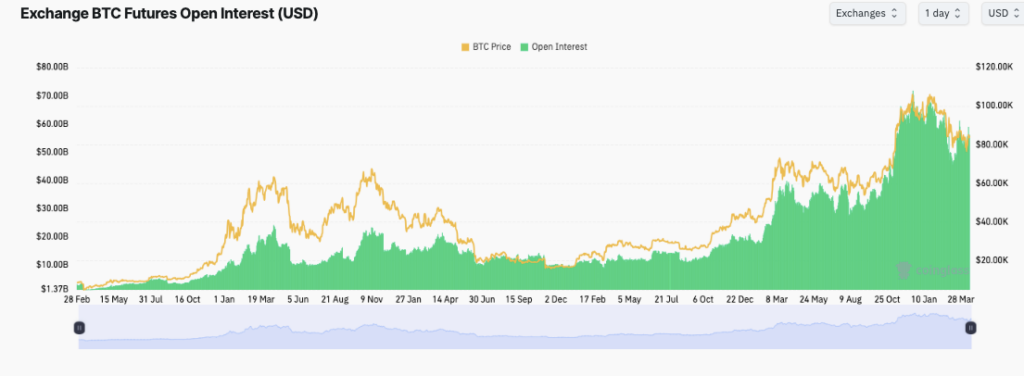

While spot ETF activity cooled, the BTC futures market saw renewed strength, with Open Interest (OI) climbing above $80 Billion. The rise highlighted that more investors are turning to leveraged products.

This shift reflected a growing preference for short-term trading over long-term asset management. The market data suggested investors are earning profit from price shifts instead of holding onto ETFs for extended periods.

Bitcoin upward trend in the fourth quarter of 2024 caused futures Open Interest to align with the price increases. This movement also contributed to improved market liquidity and higher volatility.

The market momentum continues to be shaped by derivatives instruments into April 2025. Futures market activity growth will counterbalance the lower popularity of ETFs.

Market experts identify macroeconomic situations and policy expectations as fundamental factors driving the spot-to-futures movement. Traders prefer flexible exposure because of the ongoing uncertainties regarding inflation rates, interest rates, and geopolitical risks.

Bitcoin Supply Drops as Cold Storage Rises

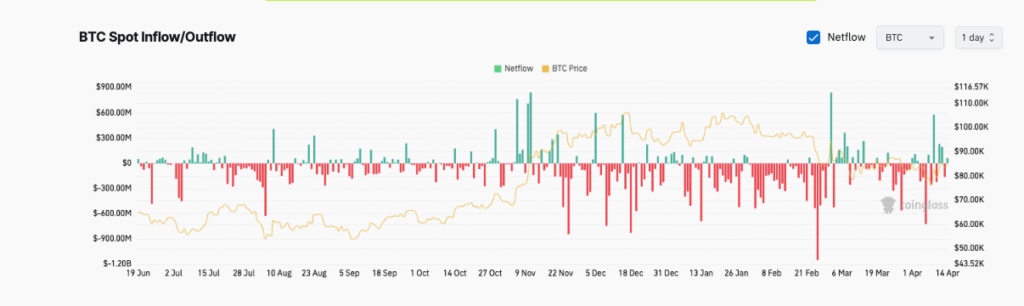

On-chain spot market data reveals that large BTC holders are continuing their buying activities when ETFs experience outflows.

Exchange cryptocurrency transfers have shifted from positive netflow to negative. This change is driven by investor withdrawals exceeding $600 million in consecutive transactions. The established pattern signifies that BTC owners transfer their coins to offline cold storage for extended periods.

Since February 2025, Bitcoin holders have consistently moved funds away from trading platforms. This reflects their growing confidence in the cryptocurrency’s long-term value.

The reduction in supply due to these trading platform movements generally leads to market price increases. Core market participants demonstrate their confidence through ongoing BTC withdrawals.

ETF transactions indicate that institutional investors are decreasing their interest. Still, market activity signaled asset acquisitions alongside market protection measures.

ETF activity differs from spot market behavior because the market tends to show short-term uncertainty and long-term optimism. Bitcoin might show its dual nature in the upcoming months.