Key Insights :

- The latest U.S. Federal Reserve meeting minutes show some major concerns among policymakers about persistent inflation.

- Fears of stagflation complicate the Fed’s path, as officials must balance controlling inflation with avoiding further damage to the labour market.

- Proposed tariffs by President Trump on Chinese and European imports add to the uncertainty.

The U.S. Federal Reserve’s latest meeting minutes have cast a dark shadow over the worldwide financial markets. Concerns about inflation and economic slowdown are growing.

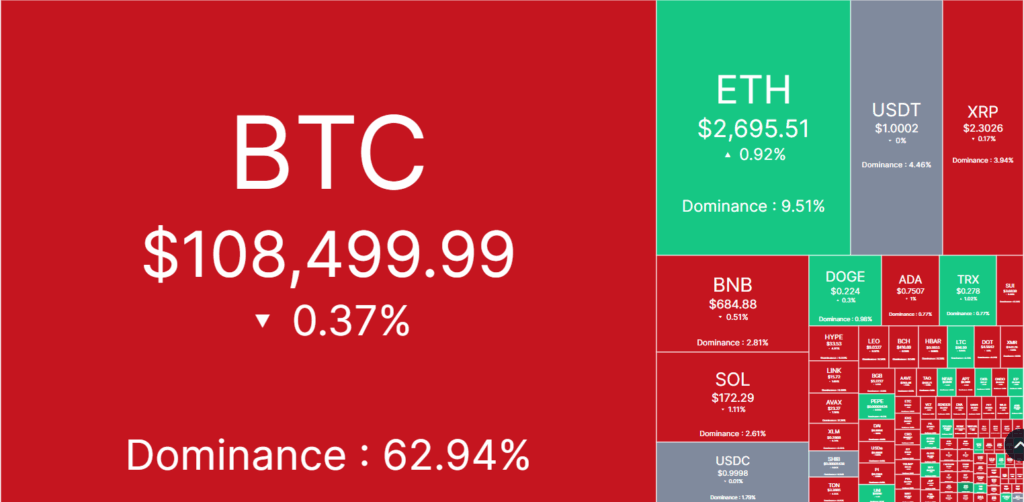

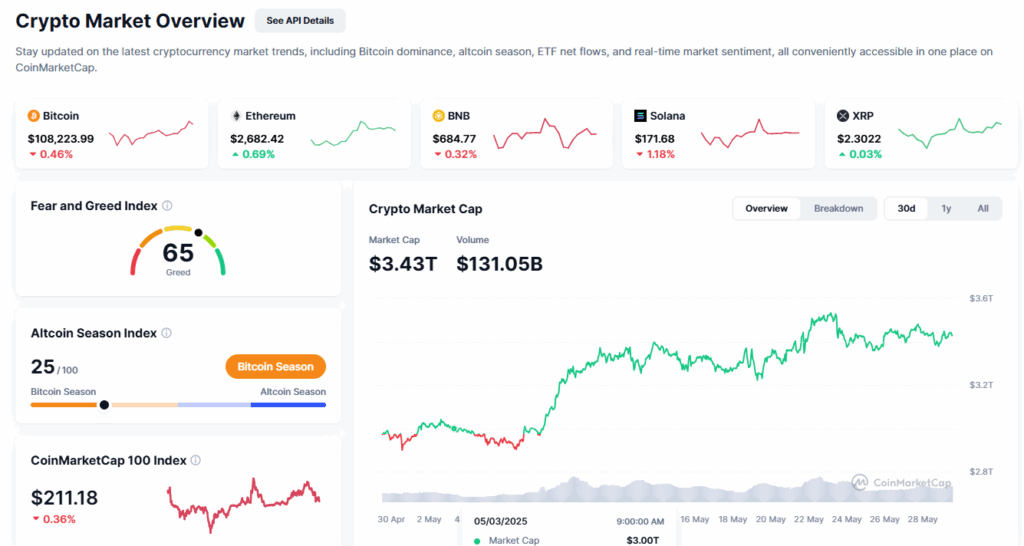

Traders are reevaluating their risk exposure in response. This trend has led to a significant dip in digital assets like Bitcoin, Ethereum, Solana, and XRP.

Inflation Uncertainty Creates Market Jitters

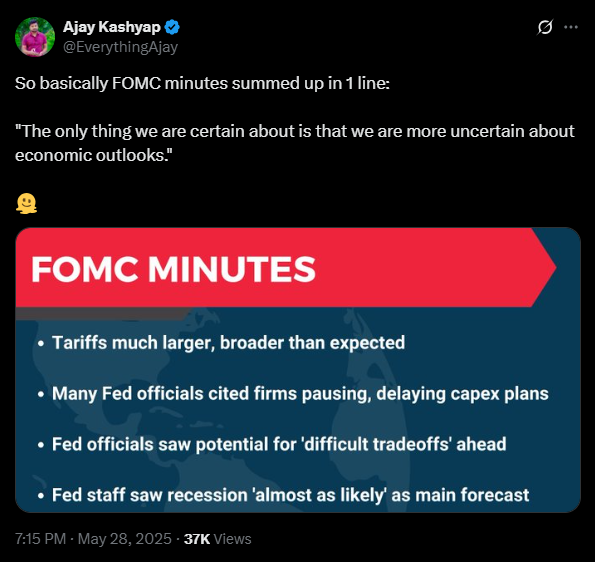

Minutes from the FOMC’s May 6–7 meeting revealed a long-standing debate among policymakers. The discussions were tense and deeply divided.

Officials are becoming increasingly alarmed by the possibility of high inflation and rising unemployment. For context, this combination could force the Fed into making difficult policy choices.

The crypto market responded quickly to this event, considering how Bitcoin and Ethereum dropped around 2% on Tuesday. On the other hand, altcoins like Solana and XRP fell by over 4%.

Per Coinglass, Bullish liquidations on 23 May exceeded $500 million. From 24 to 28 May, daily liquidations were over $150 million. This correction highlights growing unease in financial markets. Traders betting on rate cuts and easier monetary policy is especially concerned.

Stagflation Fears Complicate Fed’s Path

What makes the situation more concerning is the possibility of stagflation. Stagflation is an economic scenario where inflation remains high even as growth slows and joblessness increases. The Fed minutes show officials understand the delicate balance they must maintain.

They need to control inflation effectively. At the same time, they must avoid excessive tightening. Over-tightening could further harm the labor market.

The central bank kept interest rates steady in May and maintained the federal funds rate between 4.25% and 4.5%.

Fed Chair Jerome Powell stated that the bank is not hurrying to change its policy. He emphasized the need to first understand the impact of ongoing trade tensions between the U.S. and other countries.

Trump Tariffs and Trade Tensions Add to the Fire

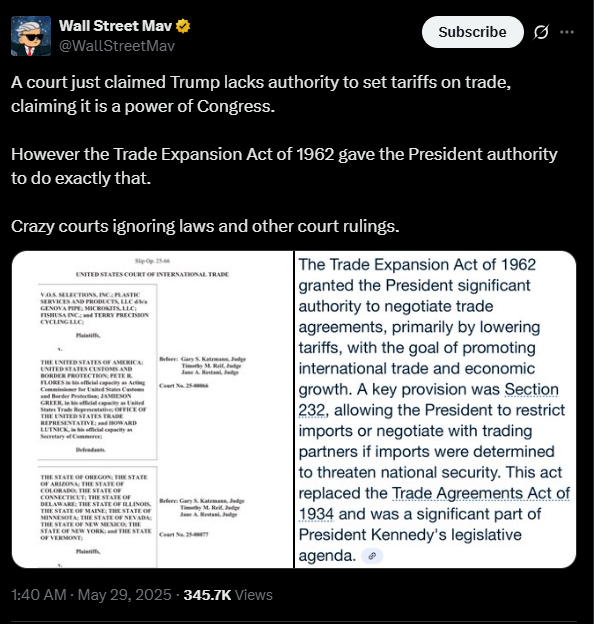

Fresh trade tensions are the main source of ongoing economic uncertainty. President Donald Trump’s proposed tariffs on Chinese and European imports have contributed to these concerns.

Even though the administration postponed the 145% tariff hike on Chinese goods, the threat is still very much in play. In addition, a 50% duty on imports from the European Union has already been imposed. Fed officials flagged these developments as major risks to financial stability.

Several warned that such policies could undermine worldwide confidence in the U.S. dollar and affect the Treasury bond market. This scenario could have even worse consequences for both trad-fi and crypto markets.

So far, there have now been reports of a Federal court flagging Trump’s “Liberation day” tariffs as illegal. Because of this, fears of this tariff issue might be put to rest soon.

Crypto Takes a Hit Amid Policy Ambiguity

So far, the total market cap of the crypto sector slipped more than 2% on Thursday and fell to approximately $3.54 trillion. This metric has slipped further down to $3.43 trillion with Bitcoin. It recently set a record high above $111,000 on 22 May, dipping to just under $108,000.

Traders have started trimming positions and adjusting their funding rates in response to the Fed’s tone. So far, U.S. equities have been feeling the heat as well, with the S&P 500 dipping 0.6%, and the Dow Jones Industrial Average losing 244 points (0.6%).

In this environment, cryptocurrencies are now particularly vulnerable to the market’s ups and downs. Policymakers are considering their next steps amid uncertain economic signals.

Traders in both crypto and traditional markets face ongoing volatility. The coming weeks may bring more unpredictability in financial markets.