Key Insights:

- Over $983M in crypto liquidations, with BTC and ETH long positions hit the hardest.

- Musk–Trump feud and China FUD trigger sharp sell-off in Bitcoin markets.

- U.S. Nonfarm Payrolls and ETF flows expected to guide Bitcoin’s next move.

Over $983 million in crypto positions were liquidated in just 24 hours as Bitcoin plunged below $101,000. Rising political tensions, ETF outflows, and market anxiety caused the sell-off. Investors are cautious ahead of Friday’s U.S. Nonfarm Payrolls report.

Massive Liquidations Rock the Crypto Market

One of the sharpest unwinds of the crypto market this year saw over $983 million in liquidations of digital assets.

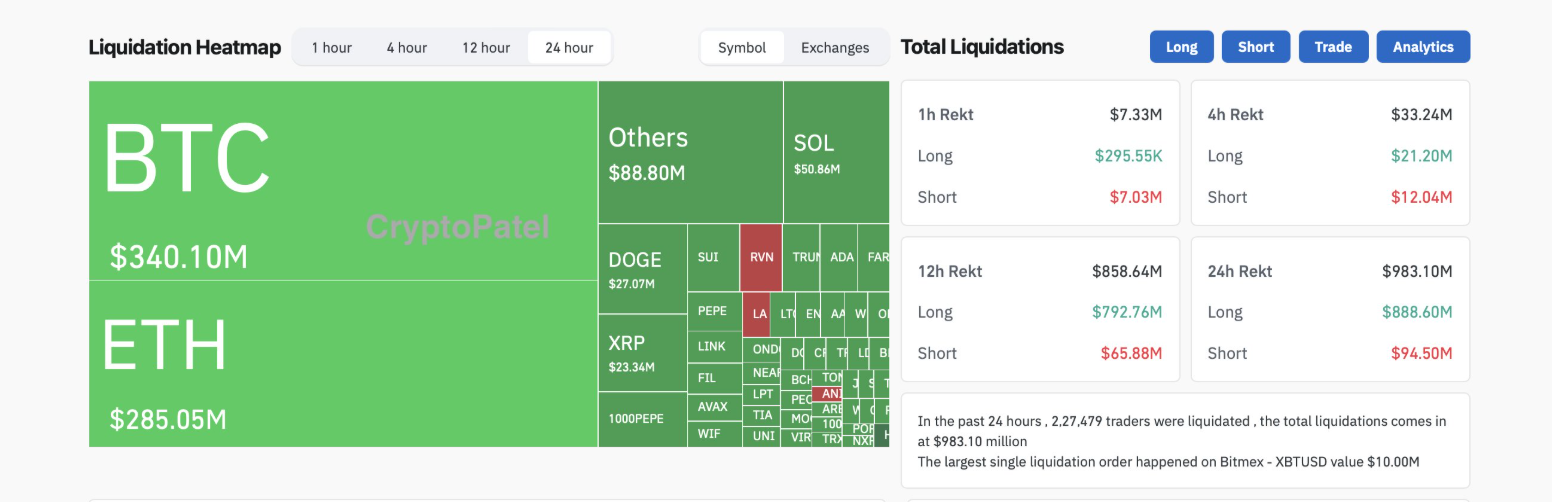

Long liquidations on Bitcoin amounted to $340 million, and Ethereum came in second with $285 million. Data from CoinGlass shows that more than 227,000 traders were liquidated within 24 hours.

One of the biggest single-order wipeouts of the session was a $10 million liquidation on BitMEX’s XBTUSD contract. The total long-side damage was further added by high-leverage trader James Wynn, who lost a position worth over $20 million.

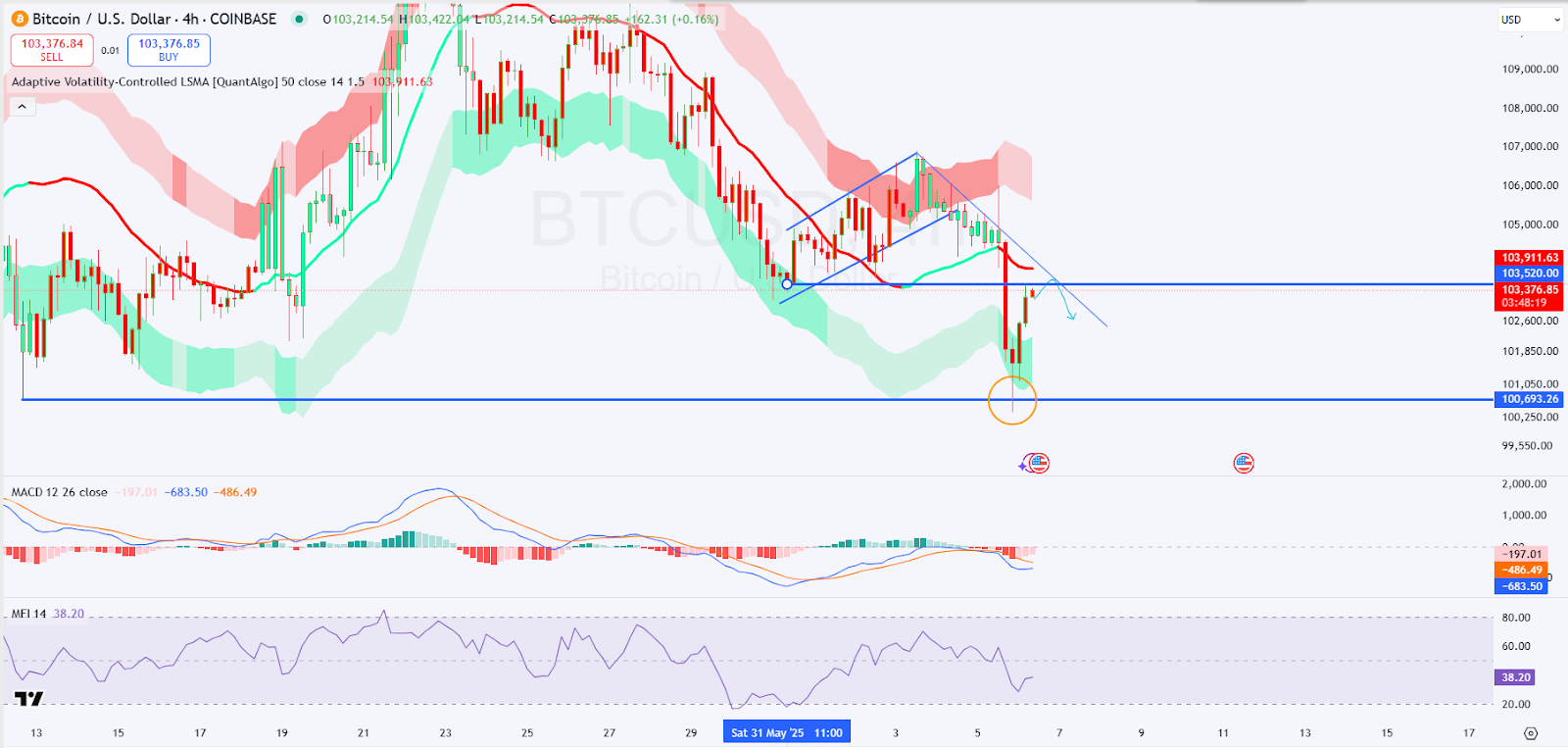

Key support of around $101,000 for Bitcoin was not held. This led to cascading liquidations, with the price dropping as low as $100,436.

Shorts also lost money, but just $94.5 million was wiped off bearish bets, showing the imbalance in market positioning.

Political Tensions and ETF Outflows Amplify Pressure

Tensions between Elon Musk and Donald Trump added to the growing bearish sentiment across crypto markets. Musk criticized Trump’s proposed tariffs, warning they could trigger a recession.

On the other hand, Trump countered by threatening to cut Tesla’s subsidies and federal contracts. The clash fueled broader concerns over policy instability and its impact on innovation-driven sectors.

In response to political threats, Musk also briefly announced that SpaceX would decommission its Dragon spacecraft, before walking that back.

That unsettled markets further, especially since Dragon is America’s only astronaut transport vehicle. This was seen as another sign of instability in the U.S. governance, especially for the tech and crypto sectors.

ETF flows, meanwhile, showed that institutional interest in Bitcoin was waning. On June 5, BTC ETFs saw $278.4 million in net outflows, and ETH ETFs had modest inflows of $11.3 million.

Market stress is leading institutions out of Bitcoin and into Ethereum, which is less volatile. The uncertainty was compounded by renewed fears over China’s stance on Bitcoin on social media.

Speculation about stricter trading or mining ban enforcement was not confirmed, but it triggered memories of previous market crashes. Crypto markets continued to be on edge with no clear positive driver.

All Eyes on Nonfarm Payrolls and BTC Price Structure

The focus now shifts to Friday’s Nonfarm Payrolls (NFP) report that could set the tone for the market going into the weekend. Experts believe the report will display 130,000 new jobs in May, a decline from the 177,000 seen in April.

A weak print may encourage the Fed to lower rates in July and support Bitcoin and other risky assets. As labor market softness is already showing, job openings have fallen to 7.36 million, the lowest since 2021.

The ratio of job openings to unemployed fell to 1.03, indicating a further slowdown. The data could temporarily relieve Bitcoin from selling pressure if the market reacts positively to the data.

Bitcoin technically found support at $100,436 and bounced, trading around $100,700 at press time. Strong resistance lies at $103,500 and $103,900, with momentum indicators like MACD and RSI still in bearish territory.

RSI at 38 shows oversold conditions, but a break above resistance is needed for a trend change. The $100K area is crucial in the run-up to options expiry, as a lot of open interest could guide the price action. The market is uncertain for now until the key economic indicators are released.