OnePlus has fully revealed OxygenOS 15 as the Android 15 update for its supported

OnePlus announced that the Beta program for the OnePlus 12 will launch on October 30, but clarified that this date does not mark the beginning of the stable release, as previously reported.

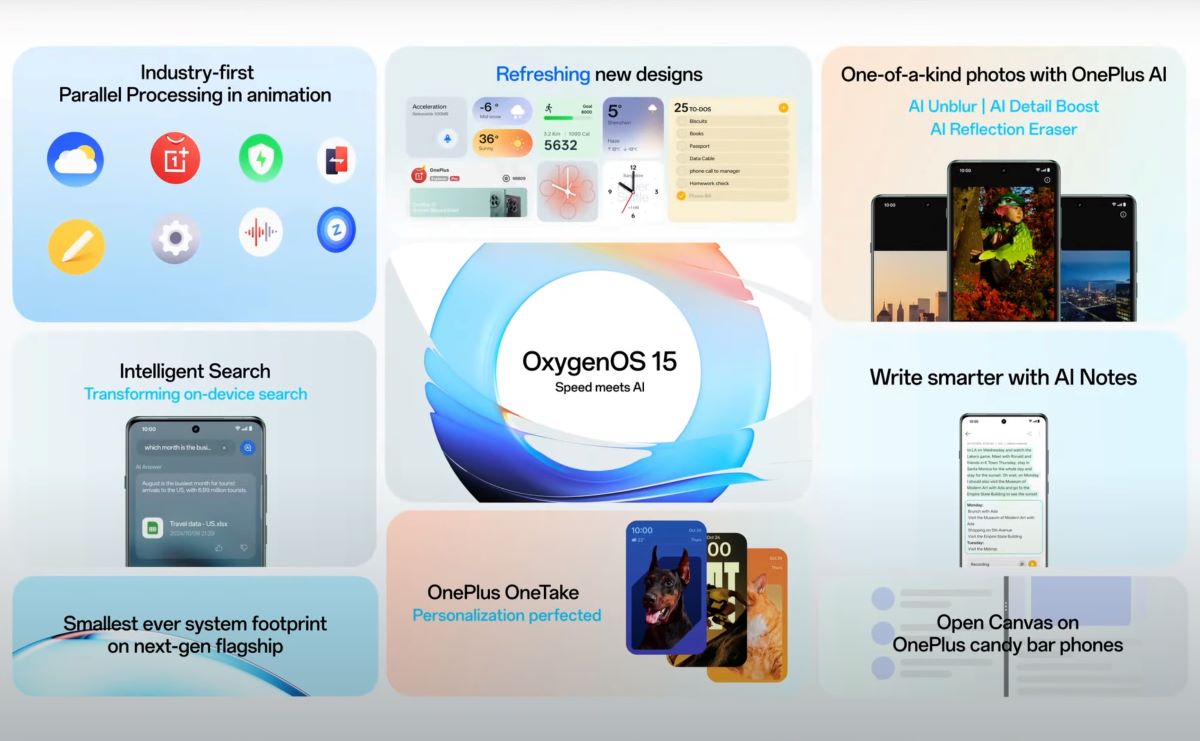

Unlike last year, when OnePlus chose to avoid extensive AI features in favor of refining Android 14 to match its flagship hardware, the BBK-owned brand is now embracing AI with Android 15 and OxygenOS 15. This announcement includes many marketing terms, like “Parallel Processing.”

Parallel Processing enhances the fluidity of animations during rapid app-switching. This addresses situations where users open and close multiple apps back-to-back, as seen in videos demonstrating this.

OnePlus has reworked the animation pipeline so that quick app transitions appear smoother.

Additionally, OxygenOS 15 is reportedly up to 20% smaller than its predecessor. To achieve this, OnePlus removed various “redundant” features, freeing up considerable space.

AI Features in OxygenOS 15

OnePlus is introducing a range of AI-powered camera features. AI Detail Boost, integrated directly into the gallery, automatically identifies and enhances pixelated or blurry images with a single tap, even allowing for upscaling to 4K.

Combined with AI Unblur, this feature provides image clarity similar to the Pixel’s Photo Unblur function. AI Reflection Eraser can eliminate glass reflections from photos without distorting them, and this tool works for various surfaces, not just glass.

Intelligent Search is an on-device tool that enables users to search across system apps, such as Settings, Files, and Notes, for specific files. For example, users can search for “how much did I pay for my hotel stay last month?” and retrieve relevant information quickly.

The Circle to Search feature is also debuting with OxygenOS 15. Powered by Google Lens, it enables contextual searches for anything on the screen by long-pressing the gesture navbar. The update also introduces Theft Protection for added security.

Pass Scan is a key component of OxygenOS 15, allowing users to scan boarding passes, transit tickets, or images from the gallery to save in Google Wallet for easy access later.

Another addition is AI Notes, which uses advanced AI to organize and refine notes. Whether jotting down ideas or drafting reports, AI Notes can summarize key points, adjust tone and formality, and correct grammar for clarity.

The AI Toolbox 2.0 now includes AI Reply, a tool similar to Android’s Smart Reply, providing pre-generated responses. For more in-depth replies, users can use the sidebar to access detailed options.

Updated UI and Interface in OxygenOS 15

OxygenOS 15 also brings several UI enhancements aimed at refining user interaction and improving the experience.

The Shelf Cards feature now offers a broader color palette and more card sizes (such as 1×2, 2×2, and 4×4), allowing users more customization options on their home screen. Popular apps like Zomato and Blinkit are integrated into the Shelf.

Other new UI animations include shimmering effects during interactions such as charging, app installations, or unlocking the device, adding a subtle visual appeal to these actions. For example, when charging with a Super VOOC charger, shimmering effects highlight the charging speed.

The OnePlus OneTake feature is designed to make transitions between the Always-On Display (AOD), lock screen, and main screen smoother and more seamless, providing a natural navigation experience.

The “Depth” option allows users to adjust wallpapers so that the subject in a photo stands out prominently.

Open Canvas, previously only available on the OnePlus Open, is now available for slab-style phones. This multitasking feature allows users to run multiple apps in split-screen mode without shrinking window sizes, making it easier to multitask without feeling restricted.

The update also includes a new “Share with iPhone” app, designed to streamline file sharing between a OnePlus device and an iPhone.

This function requires the “O+ Connect” app on iOS and works similarly to Quick Share, with some additional steps.

OnePlus has confirmed that the OxygenOS 15 Beta rollout will start on October 30 for the OnePlus 12, with details on additional supported devices expected in the coming weeks and months.