Key Insights:

- SEI price holds support, setting up for potential bullish continuation.

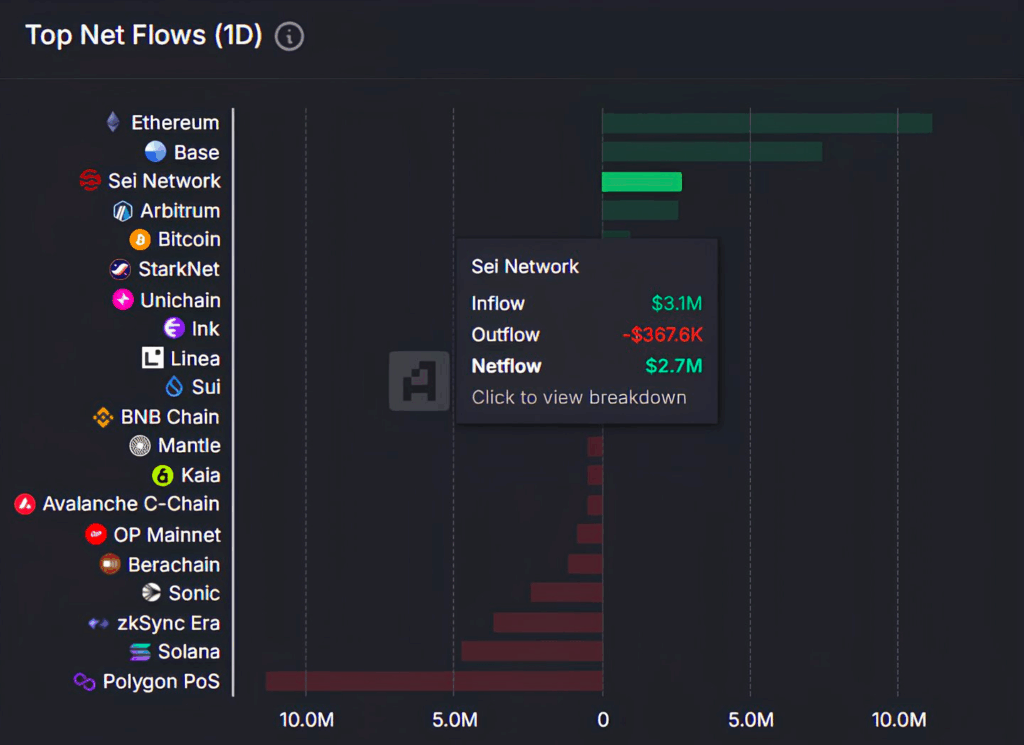

- Net inflows of $2.7M reflect growing interest in SEI.

- Technical patterns signal strength as traders eye a breakout above $0.29.

SEI crypto currently shows relative strength, with nothing to dispute its progression, both on-chain and price-wise. The SEI crypto traded at 0.202 as of press time, 4.22% up over 24 hours. The short-term momentum has been gathering above the key $0.1850 zone. The latest technical observations support this support level as necessary to verify additional upsides. The price remaining above this zone will open the route to the resistance area of $0.30-$0.32, and the $0.2917 level will be a critical trend reversal signal.

The catalyst candle chart shows how SEI gained back the $0.1874 area after a retest and bearish wick. The breakout volume of this zone is massive, which makes it more significant to the structure. In the case of buyer control in the case of nullification of all low-high patterns, the following central sphere of attention could be taken as being close to $0.2917. This is where the local supply zone existed at the end of May. This price is also in line with the previous rejection of price, and it may serve as the next liquidity level.

Bullish Structure Confirmed by Technical Patterns

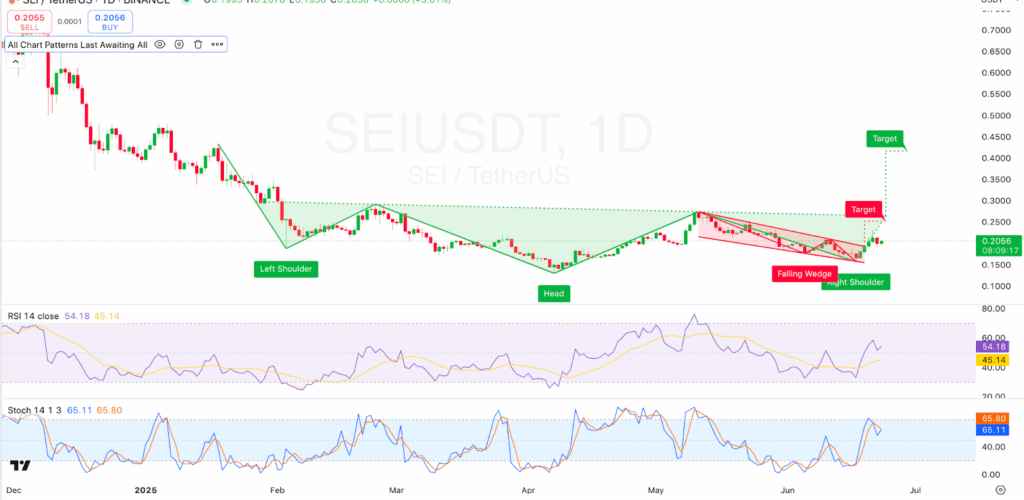

More bullish momentum can be confirmed on the daily chart, which indicates a completed inverse head and shoulders. A neckline breakout value of about 0.12 to a breakout of about 0.20 gives a projected target of about 0.40 or better to 0.30. It is backed by a falling wedge breakout that had merged with the right shoulder. This showed that there was remarkable confluence towards a bigger move on the upside.

Momentum indicators in the daily time frame can support this breakout story. The Relative Strength Index, or RSI, stood at 54.18, which is not overbought and not oversold, so it has further chances to move up. In the meantime, the crossover of Stochastic RSI above 65 signals the presence of upward pressure. The primary resistance levels now are at $0.25 and $0.30, and the strong supports are at $0.1850 and $0.1722 marks. The area is where the time frame breakout started at a lower time frame.

These net capital flows also speak to the strength of SEI. In the 24-hour daily on-chain activity tracker, SEI witnessed total inflow of $3.1 million and outflow of $367.6K, resulting in a net inflow of $2.7 million. This makes it one of the chains with the highest net demand performance, after Ethereum and Base. This demand has no big headlines or announcements, and this means that the organic interest is constant.

SEI Remains Stable Despite General Outflows

Interestingly, the trend of capital inflows expands on the SEI multi-week pattern since it continues to attract liquidity despite other chains recording net outflows. Other projects, such as Solana and Polygon PoS, registered net outflows of well beyond 5 million and 10 million within the same time frame. A steady demand implies that users are investing more resources in the SEI system instead of moving to other options.

The SEI’s market capitalization has increased to 1.12 billion, an increment of 4.63% in the past 24 hours. The 24-hour trading volume has declined 30.94% to $227.5 million. Still, the volume/market cap ratio stands in an encouraging condition, reaching 20.17%. This means that it is actively being traded against its size.

The combination of constant price gains, high support retention, and growing capital flows provides structural strength to SEI’s market position. It has been performing well despite general market volatility and unclear macroeconomic conditions, contributing to diminishing inflows at most other chains.