British meal delivery company Deliveroo defied analyst expectations, reporting robust core earnings of 85 million pounds (roughly $109 million) for the 2023 fiscal year.

This news comes as a welcome surprise for investors who have watched the company navigate a competitive and evolving food delivery landscape.

Deliveroo’s strong performance and optimistic outlook for 2024 have injected a dose of confidence into the company’s future.

Deliveroo Beats Estimates, Core Earnings Soar in 2023

Deliveroo’s core earnings for 2023 significantly surpassed analyst predictions. This achievement underscores the company’s ability to streamline operations and drive profitability.

While the specific factors contributing to this growth are not explicitly mentioned, it suggests Deliveroo has made significant strides in optimizing its business model.

This could be due to factors such as an increased customer base, improved delivery efficiency, or strategic partnerships with restaurants.

Deliveroo Expects Positive Cash Flow in 2024, Signaling Financial Maturation

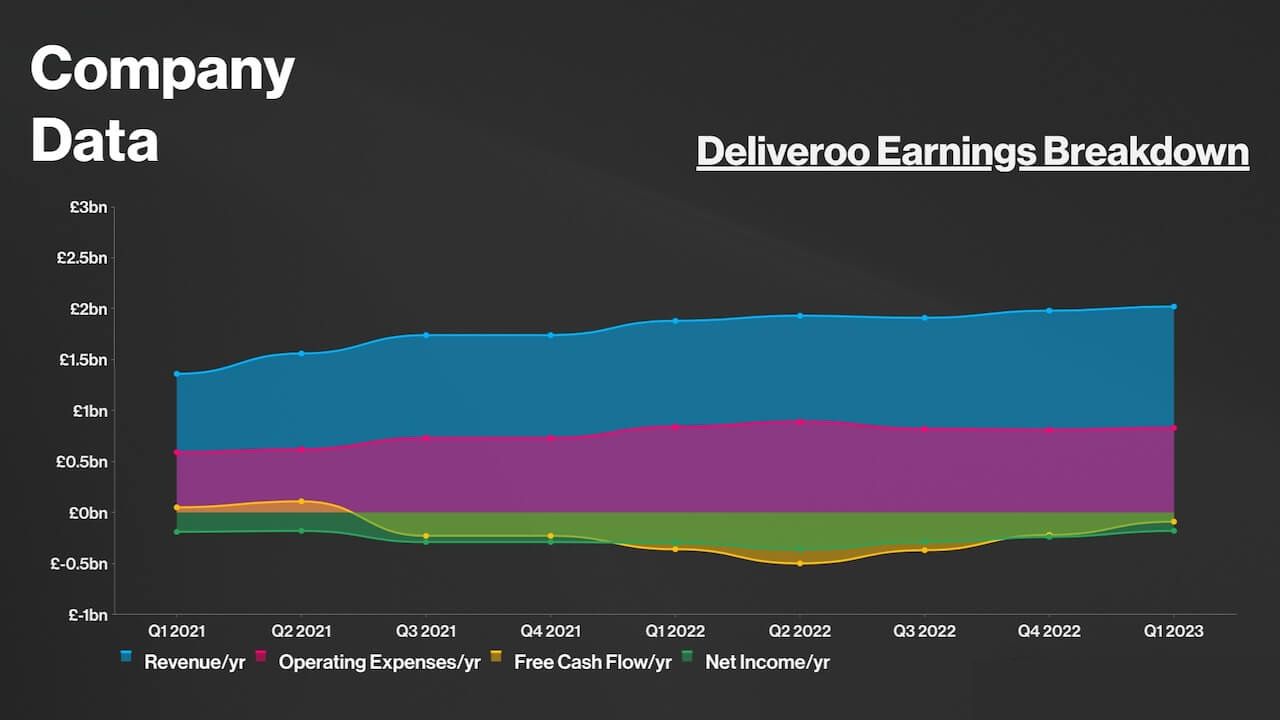

Perhaps the most significant takeaway from Deliveroo’s financial report is the company’s projection of positive cash flow in 2024.

Positive cash flow indicates that Deliveroo’s revenue will exceed its operating expenses, allowing it to invest in future growth and potentially reward shareholders.

This achievement would mark a crucial milestone in Deliveroo’s financial maturity, potentially solidifying its position within the competitive meal delivery market.

Looking Ahead: Deliveroo’s Path to Continued Success

While Deliveroo’s financial performance is undeniably positive, questions remain about the long-term drivers of its growth strategy. Investors will be keen to understand how Deliveroo plans to maintain its profitability and achieve positive cash flow in 2024.

Will the company focus on customer acquisition, forge strategic partnerships, or explore new revenue streams? Deliveroo’s ability to effectively navigate these strategic considerations will be paramount in ensuring its continued success.