Key Insights:

- Stablecoin inflows continue to rise, signaling growing strength in the digital asset market and setting the stage for potential Altcoin movement.

- USDC deposits surged on Solana, pushing its total value locked to $8.57 billion and strengthening its role in altcoin development.

- Tron recorded $824.5 million in USDT inflows within one week. This reinforces its position in emerging markets and supports Altcoin ecosystem growth.

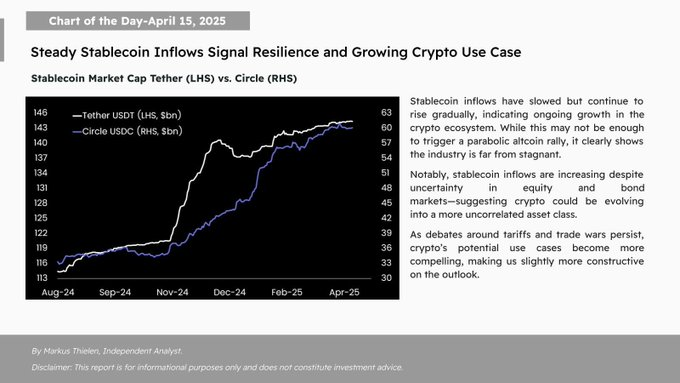

The stablecoin market has recorded consistent inflows, pointing to growing momentum across the broader digital asset sector. Matrixport data showed that stablecoin deposits are increasing despite volatility in traditional financial systems.

This development signals a potential shift as the crypto market shows signs of maturing and gaining independence.

USDC Gains Momentum with Solana as Primary Beneficiary

USDC has recorded strong growth recently, with Solana emerging as a key network driving stablecoin adoption. In December 2024, Solana processed over $1 billion worth of USDC deposits while witnessing substantial network growth.

Solana recorded a significant growth in total value locked (TVL). It reached $8.57 billion in January 2025 through the new inflow.

The surge reflects growing confidence in the network’s low fees and speed, especially for stablecoin-based applications. The performance upgrades at Solana established faster transaction times, driving users from other slow blockchains into the platform.

Solana has earned a favorable status within the developer and financial application market. Improving regulatory standards directs more on-chain operations toward efficient, compliant platforms.

USDC transactions on Solana’s chain have substantially increased because of its focus on industry trends. Users opt for Solana because it provides an environment suitable for transactions and long-term usage through the growing deposit activity.

USDT Sees Uptick with Tron Leading Emerging Market Activity

USDT inflows grew sharply in February 2025, with Tron receiving weekly $824.5 million in stablecoin reserves. The Tron network leads through its market dominance across new economies, where its USDT transaction volumes remain very high.

The network stands out because of its low fees and dependable performance. It is suitable for commercial activities and remittance transactions.

Tron’s payment infrastructure developments continue to grow in Latin America, Africa, and Southeast Asia. The instability of local currency in these areas makes USDT a trustworthy alternative for conducting regular transactions.

Financial access has become possible through the network in locations lacking standard banking institutions. This trend has elevated Tron’s position in the stablecoin ecosystem, boosting its relevance for real-world use cases.

The adoption of USDT through financial platforms created an additional path for global users to be attracted to it. Tron blockchain depends heavily on USDT since it is its pivotal token for all blockchain activities that generate traffic and usage statistics.

SUI Gains Ground in Stablecoin Market

Ethereum recorded a $208 million stablecoin outflow in early 2025 despite its core role in decentralized finance (DeFi). This movement points to a shift in user preferences toward faster and more cost-effective chains.

Numerous platforms now attract liquidity because they deliver better scalability and higher efficiency. In contrast, SUI is emerging as the leading blockchain this month in terms of stablecoin growth.

The chain has attracted attention for its speed and growing ecosystem, making it attractive for stablecoin use. SUI attracts more users who want to leave high-fee networks because of its growing utility.

Other Ethereum-compatible chains such as Polygon, Optimism, and Base also record consistent inflows. This reflected an evolving landscape where users prioritize low-cost environments for stablecoin transactions.

TON and Avalanche have let $506 million and $280 million leave their networks because of varying network activity patterns.

Stablecoins Drive Financial Access Worldwide

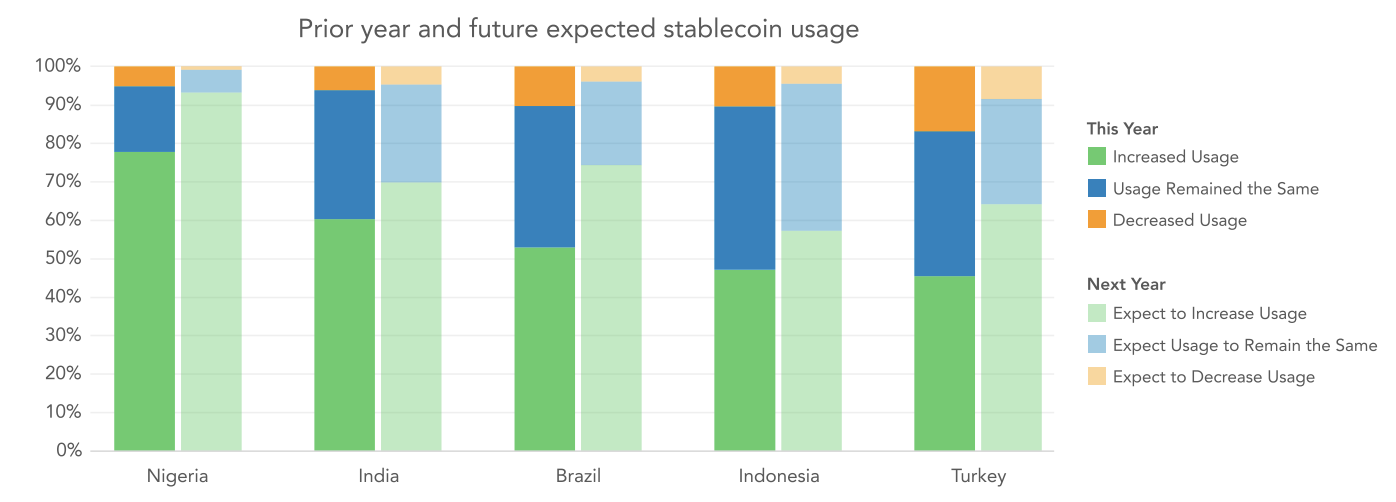

Stablecoins are now more widely used than Bitcoin in Latin America, Southeast Asia, and Africa. The assets provide liquidity support to people who save, transfer money, and conduct business while operating with erratic regional currencies.

Evidence from Nigeria, Turkey, India, Indonesia, and Brazil shows these assets are more commonly used than Bitcoin.

In these countries, stablecoins are a reliable entry point to digital finance. Stablecoins provide users with multiple benefits, including stable prices, international usability, and quick digital transaction options through mobile features.

Such a technology improves financial accessibility, particularly in areas with limited access to traditional banking services. Chainalysis and Visa-backed research show that stablecoin usage is growing faster than expected in these markets.

The data revealed that stablecoins provide an efficient solution for individuals facing economic instability. As adoption rises, stablecoins are integral to daily financial activity in many regions.

STABLE Act Boosts Confidence in Stablecoins

The STABLE Act, recently passed in the United States, established rules for all USD-pegged tokens, including USDC and USDT.

This regulatory clarity has helped solidify stablecoins’ legitimacy within the broader financial system and reassure users that these assets can comply with financial standards.

The November 2024 U.S. election, followed by crypto policy backing, increased users’ involvement in digital asset markets. Under the new government’s direction, various blockchain networks have seen rapid infrastructure development alongside network enhancements.