Key Insights:

- With historical price momentum, DOGE price prediction appears bearish and is on the verge of downside momentum.

- Dogecoin’s large transactions soared by 41%, indicating rising interest from traders and investors. What does this mean for traders?

- 78% of Binance traders are taking long positions on DOGE, while the remaining 80% are betting on short positions.

Amid the ongoing market correction, DOGE price prediction appears bearish and is on the verge of a crash. This bearish speculation arises as the meme coin repeats its historical pattern.

The last time this pattern formed, the Dogecoin price dropped by over 40%. Now, traders wonder if history will repeat itself.

Current Market Sentiment and DOGE Price Momentum

At press time, DOGE price was trading at nearly $0.219. It had recorded a price decline of over 6.50%, seemingly following its historical pattern.

The recent price drop and previous momentum have sparked increased activity among traders and investors. Interest in the meme coin is surging as more participants enter the market. According to the latest data, DOGE’s trading volume during the same period has jumped by 15%.

A sharp increase in trading volume while the price declines show strong bearish momentum. This is generally seen as a negative signal for the market.

Dogecoin (DOGE) Price Action and Technical Analysis

According to expert technical analysis, DOGE price prediction appears bearish and is poised for massive downside momentum.

Per the daily chart, the meme coin was rejected from a strong resistance level of $0.242. It has begun heading toward the next support level. The last time the meme coin reached this level, it recorded a price decline of 40%, and now it is repeating its history.

If Dogecoin stays below $0.24, its price may drop by more than 15%. The next support level could be the key to stabilizing its decline.

However, DOGE price prediction could turn bullish only if it breaches the $0.245 level and closes a daily candle above it. If this happens, Dogecoin could see a price surge of over 20% until it reaches the $0.31 level.

DOGE’s RSI is currently at 61, suggesting it is approaching overbought territory. However, it still has some potential to rise further. However, this would only be possible if market sentiment shifts.

Bullish On-Chain Metrics

Whales and traders are taking advantage of the recent market dip by accumulating assets. On-chain analytics tools, Coinglass and IntoTheBlock, are also betting on the bearish side.

Despite the bearish outlook, IntoTheBlock recently flashed a bullish signal for the meme coin. Large transaction volume, often linked to whales and institutions, has jumped by 42%.

This surge reflects growing interest and confidence in the asset. Meanwhile, daily active addresses have increased by 41.12% in the past 24 hours.

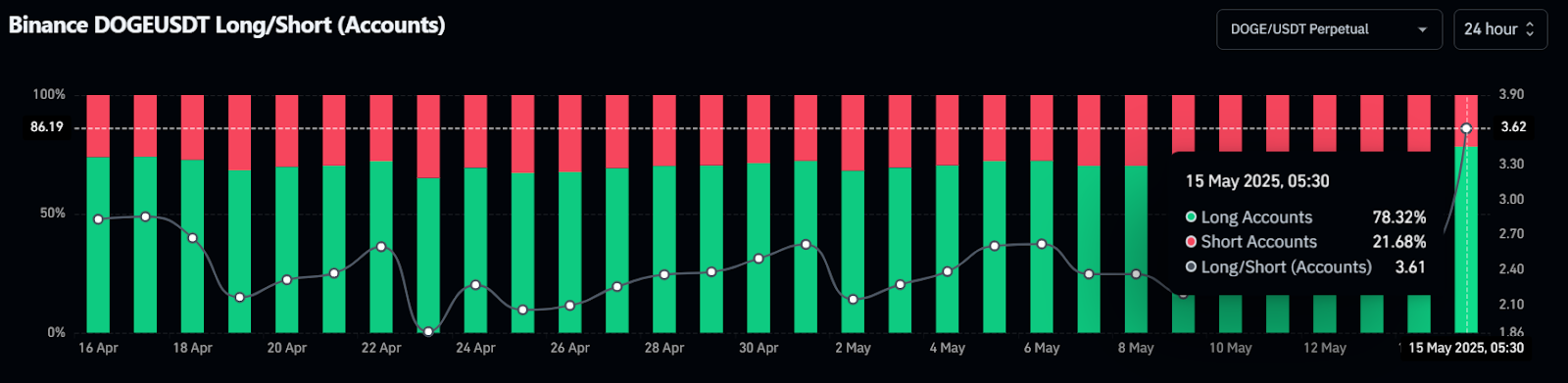

Besides this, traders strongly bet on the bullish side and dominate the meme coin. The Binance DOGEUSDT Long/Short ratio at press time stands at 3.61.

This indicated strong bullish sentiment among traders. This metric suggests that for every 3.61 long positions, there is a single short position.

As of now, 78.32% of Binance traders are betting on DOGE long positions, whereas 21.68% are on the bearish side.